- United States

- /

- Mortgage REITs

- /

- NYSE:ABR

Arbor Realty Trust (ABR): Exploring Current Valuation After Recent Share Price Movements

Reviewed by Kshitija Bhandaru

Arbor Realty Trust (ABR) shares have seen some movement recently, drawing attention from investors who are watching for any fresh developments that could impact the value of the stock. With a history of volatile returns, it offers an interesting case for those tracking income-focused real estate plays.

See our latest analysis for Arbor Realty Trust.

While Arbor Realty Trust’s share price hasn’t posted strong momentum this year, its long-term total shareholder returns tell a more balanced story. Over the past five years, investors have seen a total shareholder return of nearly 77%, even as the recent 1-year total return edged slightly negative. Lately, price movement has been relatively muted, but investor interest remains steady in anticipation of potential shifts in real estate sentiment and income opportunities.

If you’re tracking income-focused names like this, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

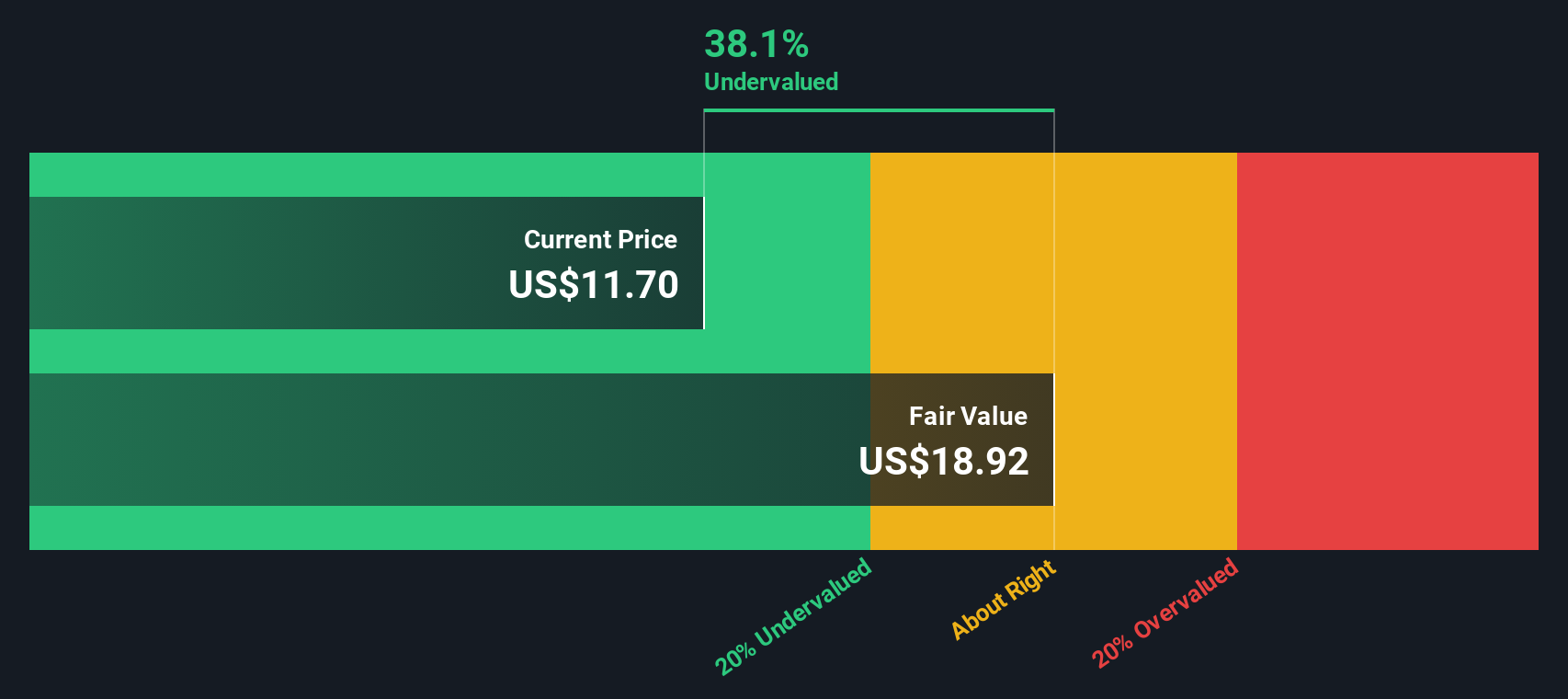

The real question now is whether Arbor Realty Trust's recent price action signals that shares are undervalued compared to their intrinsic worth, or if the market has already factored in any future growth and left little room for upside.

Most Popular Narrative: 7% Overvalued

With Arbor Realty Trust closing at $12.43 and the prevailing fair value estimate sitting slightly lower, many investors are questioning whether the share price already reflects the company's future prospects. This has led to a robust debate around what truly drives valuation in today's high-interest environment.

The company has a large cushion between earnings and dividends and has maintained its dividend, unlike its peers, which contributes to shareholder confidence and supports earnings. The management has successfully modified and repositioned a significant portion of its loan book, improving collateral values, which could safeguard future revenues and earnings.

Think rising rates and tightened margins spell disaster? The narrative hinges on a bold outlook, with unexpected moves by management and surprising underlying earnings power hiding beneath the headline numbers. Want to see what really sets this fair value call apart? Discover the quantitative pivots that could change how you see Arbor’s trajectory.

Result: Fair Value of $11.62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Arbor Realty Trust’s management continues to outperform peers or if agency volumes hold steadier than forecast, the outlook could shift quickly.

Find out about the key risks to this Arbor Realty Trust narrative.

Another View: DCF Suggests a Different Story

Taking a broader approach, the SWS DCF model paints a more optimistic picture for Arbor Realty Trust. According to this method, shares appear significantly undervalued compared to recent prices. This suggests there could be unrealized upside. However, how reliable is the DCF in these uncertain market conditions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arbor Realty Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arbor Realty Trust Narrative

If you have your own perspective or want to dig into the numbers personally, you can shape your own Arbor Realty Trust story in just minutes. Do it your way

A great starting point for your Arbor Realty Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities never wait for those on the sidelines. Strengthen your portfolio by jumping into high-potential sectors and finding stocks with real momentum before the crowd takes notice.

- Spot under-the-radar growth stories by focusing on these 3568 penny stocks with strong financials that are making waves with strong financials and game-changing potential.

- Capitalize on the tech revolution by searching out these 24 AI penny stocks positioned to lead in artificial intelligence breakthroughs and future profitability.

- Amplify your passive income by targeting these 19 dividend stocks with yields > 3% offering reliable yields above 3%, which can be helpful for building steady cash flow into your investment mix.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABR

Arbor Realty Trust

Invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives