- United States

- /

- Capital Markets

- /

- NYSE:AB

Will AllianceBernstein’s (AB) New California ETF Shift the Dynamics of Its Active Management Strategy?

Reviewed by Sasha Jovanovic

- AllianceBernstein Holding L.P. and AllianceBernstein L.P. recently announced the launch of the AB California Intermediate Municipal ETF (CAM), an actively managed fund now trading on the New York Stock Exchange with Jane Street as the Lead Market Maker.

- This specialized fund aims to offer California residents tax-efficient income and broadens AllianceBernstein's footprint in actively managed ETF offerings.

- We'll explore how the CAM fund launch could influence AllianceBernstein's efforts to diversify its product range and appeal to new investors.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

AllianceBernstein Holding Investment Narrative Recap

To feel confident as a shareholder in AllianceBernstein, you need to view its drive for product expansion, like the new California Intermediate Municipal ETF, as support for revenue diversification and a broader client reach. While this launch spotlights the firm's ability to innovate in fixed income offerings, it likely won't be a material short-term catalyst or mitigate the biggest current risk: competition-driven fee compression across major investment channels, particularly in fixed income and investment-grade alternatives.

The recent announcement that AllianceBernstein will report its third quarter 2025 results on October 23 is relevant, providing an opportunity to hear how management frames the CAM fund launch within the broader context of revenues and current client inflows. Financial updates and commentary from leadership may help investors assess how new products could impact the company's positioning amid persistent margin pressures and revenue headwinds in some channels.

However, against these product rollouts, investors should also consider the rising fee compression risk...

Read the full narrative on AllianceBernstein Holding (it's free!)

AllianceBernstein Holding's narrative projects $5.5 billion in revenue and $431.8 million in earnings by 2028. This requires a 245.2% yearly revenue growth and a $34.7 million earnings increase from $397.1 million today.

Uncover how AllianceBernstein Holding's forecasts yield a $40.43 fair value, a 5% upside to its current price.

Exploring Other Perspectives

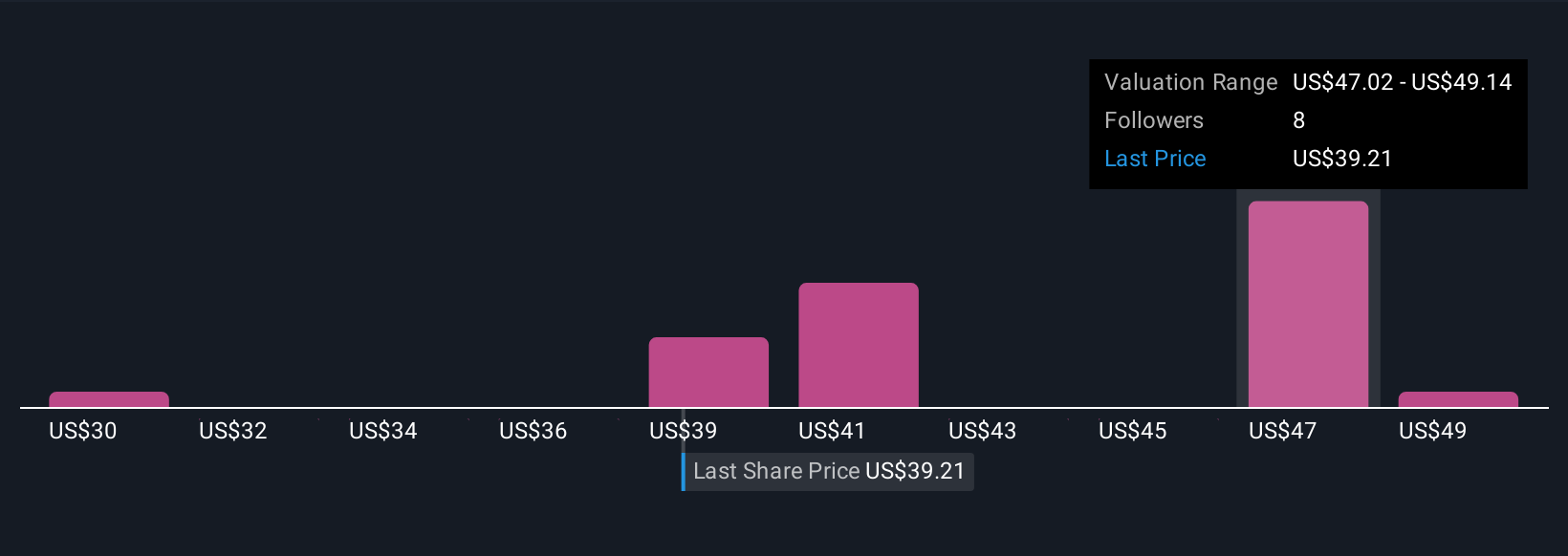

Five private investors in the Simply Wall St Community estimated fair values for AllianceBernstein ranging from US$30 to US$51.27 per unit, suggesting a wide spectrum of expectations. With competition and fee compression posing a real risk to future revenue, you might find it helpful to compare these varied viewpoints as you weigh your own outlook.

Explore 5 other fair value estimates on AllianceBernstein Holding - why the stock might be worth 22% less than the current price!

Build Your Own AllianceBernstein Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AllianceBernstein Holding research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AllianceBernstein Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AllianceBernstein Holding's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AB

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives