- United States

- /

- Capital Markets

- /

- NYSE:AB

How AllianceBernstein's New Municipal Bond ETF and Secure Income Portfolio Are Shaping Its Story (AB)

Reviewed by Sasha Jovanovic

- Earlier this month, AllianceBernstein Holding L.P. announced the launch of the AB California Intermediate Municipal ETF (CAM) on the NYSE, with Jane Street as lead market maker, and also unveiled a new Secure Income Portfolio for defined contribution plan participants featuring guaranteed income and principal protection.

- These initiatives underscore the firm's focus on expanding its offerings in the retirement income and municipal bond spaces, potentially increasing its appeal to investors seeking tax-efficient and stable income solutions.

- We'll now examine how the addition of an actively managed municipal bond ETF could influence AllianceBernstein's broader investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

AllianceBernstein Holding Investment Narrative Recap

To be a shareholder in AllianceBernstein Holding, you need to believe in the company’s ability to expand its investment offerings and drive inflows, especially in fixed income and retirement solutions, despite competitive and margin pressures. The recent launch of the AB California Intermediate Municipal ETF adds to its product suite, but is unlikely to materially impact near-term results since the key catalysts and risks remain driven by fee compression, active equity outflows, and alternative platform growth.

Among the latest announcements, the Secure Income Portfolio for defined contribution plans stands out as highly relevant. This initiative aligns with demand for guaranteed income products and could reinforce AB’s growth prospects in the retirement solutions space, a central theme behind recent catalysts tied to margin expansion and broadening revenue streams.

Yet, despite product innovation, the persistence of active equity outflows remains a risk investors should be aware of, especially as...

Read the full narrative on AllianceBernstein Holding (it's free!)

AllianceBernstein Holding's narrative projects $5.5 billion in revenue and $431.8 million in earnings by 2028. This requires 245.2% annual revenue growth and a $34.7 million increase in earnings from the current $397.1 million.

Uncover how AllianceBernstein Holding's forecasts yield a $40.43 fair value, in line with its current price.

Exploring Other Perspectives

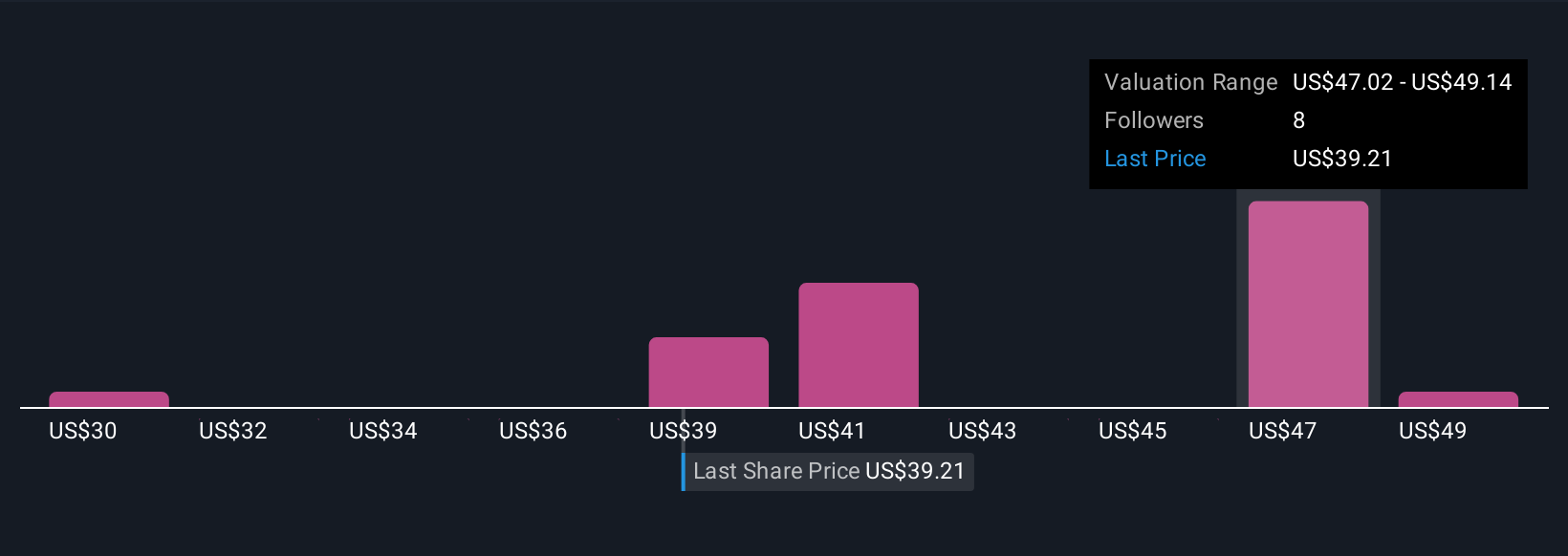

Fair value opinions for AllianceBernstein Holding from five Simply Wall St Community contributors range from US$30.00 up to US$51.27 per share. With ongoing pressure on active equity flows highlighted above, you can see just how differently investors are sizing up future performance and risk, explore several viewpoints to inform your own assessment.

Explore 5 other fair value estimates on AllianceBernstein Holding - why the stock might be worth 24% less than the current price!

Build Your Own AllianceBernstein Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AllianceBernstein Holding research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AllianceBernstein Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AllianceBernstein Holding's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AB

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives