- United States

- /

- Capital Markets

- /

- NYSE:AAMI

How Investors Are Reacting To Acadian Asset Management (AAMI) Surge in Confidence and Valuation Debate

Reviewed by Sasha Jovanovic

- Earlier this year, Acadian Asset Management experienced a surge in investor interest as news highlighted heightened confidence in the company's strategies and leadership, setting it apart from peers.

- This wave of attention has sparked ongoing debate among analysts regarding the stock's valuation, fueling diverse opinions about its future prospects.

- We'll explore how rising investor confidence in Acadian's management and strategy continues to shape its overall investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Acadian Asset Management's Investment Narrative?

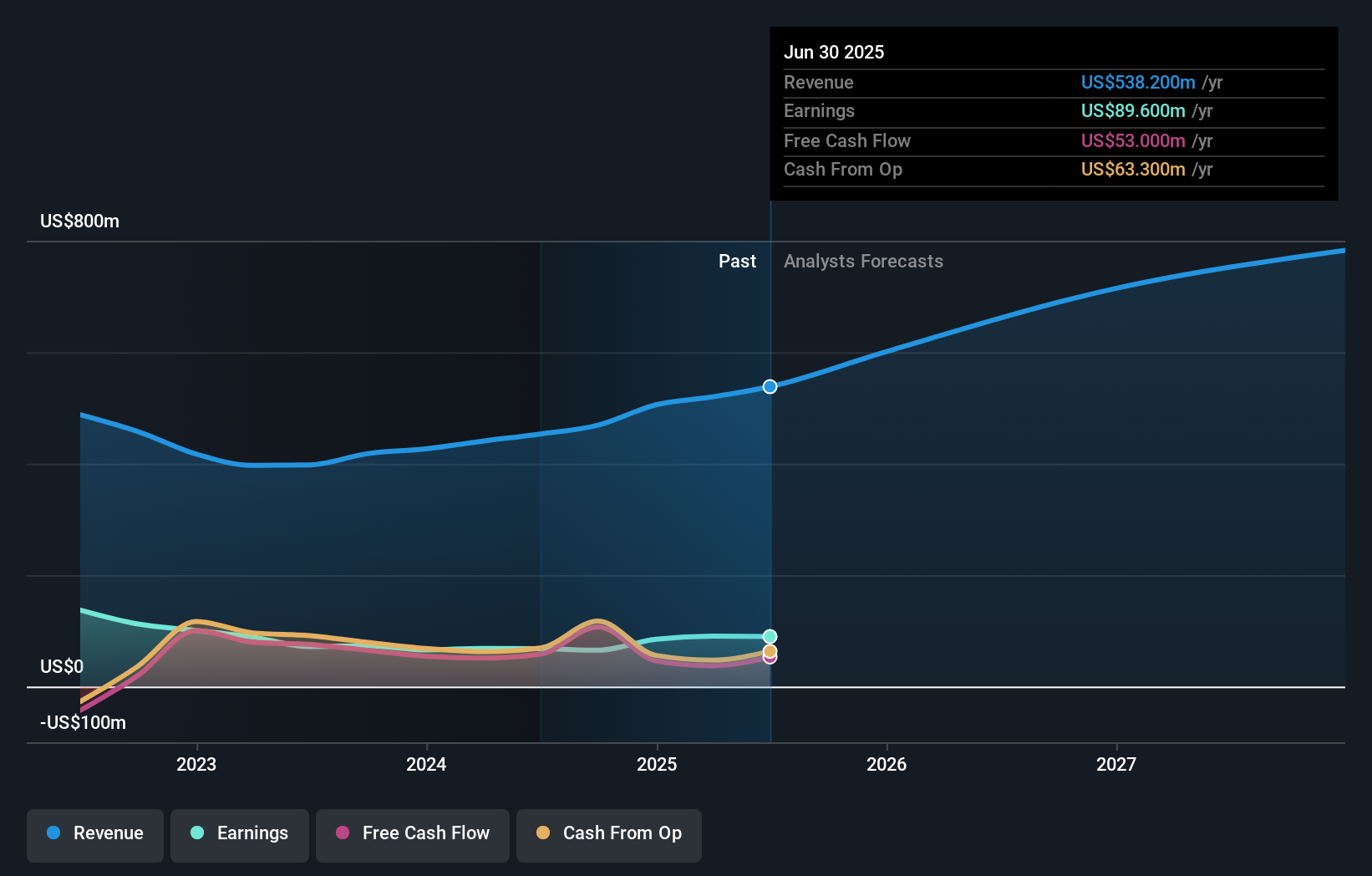

Being a shareholder in Acadian Asset Management right now means buying into a story of strong recent returns and substantial investor optimism about its management and growth strategy, as seen in the surge of nearly 88% in its share price this year. The recent spotlight on confidence in leadership has certainly helped, yet it also sharpens the focus on key questions: Is this optimism justified, and what happens if expectations reset? The company’s fundamentals reveal both progress, like robust revenue growth and disciplined share buybacks, and risks, particularly the high valuation relative to its discounted cash flow fair value and a history of fluctuating earnings. The latest earnings confirm continued revenue gains, but declining net income and ongoing high debt levels signal that new optimism may have already been priced in. For now, the recent news is fueling sentiment, but whether this becomes a lasting catalyst depends on how management turns momentum into sustained profitability and value.

On the flip side, keep in mind the ongoing debate about whether today's price reflects more hope than fundamentals.

Exploring Other Perspectives

Explore another fair value estimate on Acadian Asset Management - why the stock might be worth as much as $17.98!

Build Your Own Acadian Asset Management Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Acadian Asset Management research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Acadian Asset Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Acadian Asset Management's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAMI

Acadian Asset Management

BrightSphere Investment Group Inc. is a publically owned asset management holding company.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives