- United States

- /

- Diversified Financial

- /

- NasdaqGS:WSBF

What Do Recent Insider and Institutional Moves Reveal About Waterstone Financial's (WSBF) Leadership Alignment?

Reviewed by Simply Wall St

- In the past week, director Michael L. Hansen sold nearly all of his shares in Waterstone Financial, accompanied by changes in institutional ownership, including a reduction by Goldman Sachs Group Inc. and new positions from other hedge funds.

- This level of insider selling and shifting institutional stakes often prompts closer scrutiny of company leadership confidence and future prospects.

- Given the substantial insider share sale, we'll examine what this means for Waterstone Financial's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Waterstone Financial's Investment Narrative?

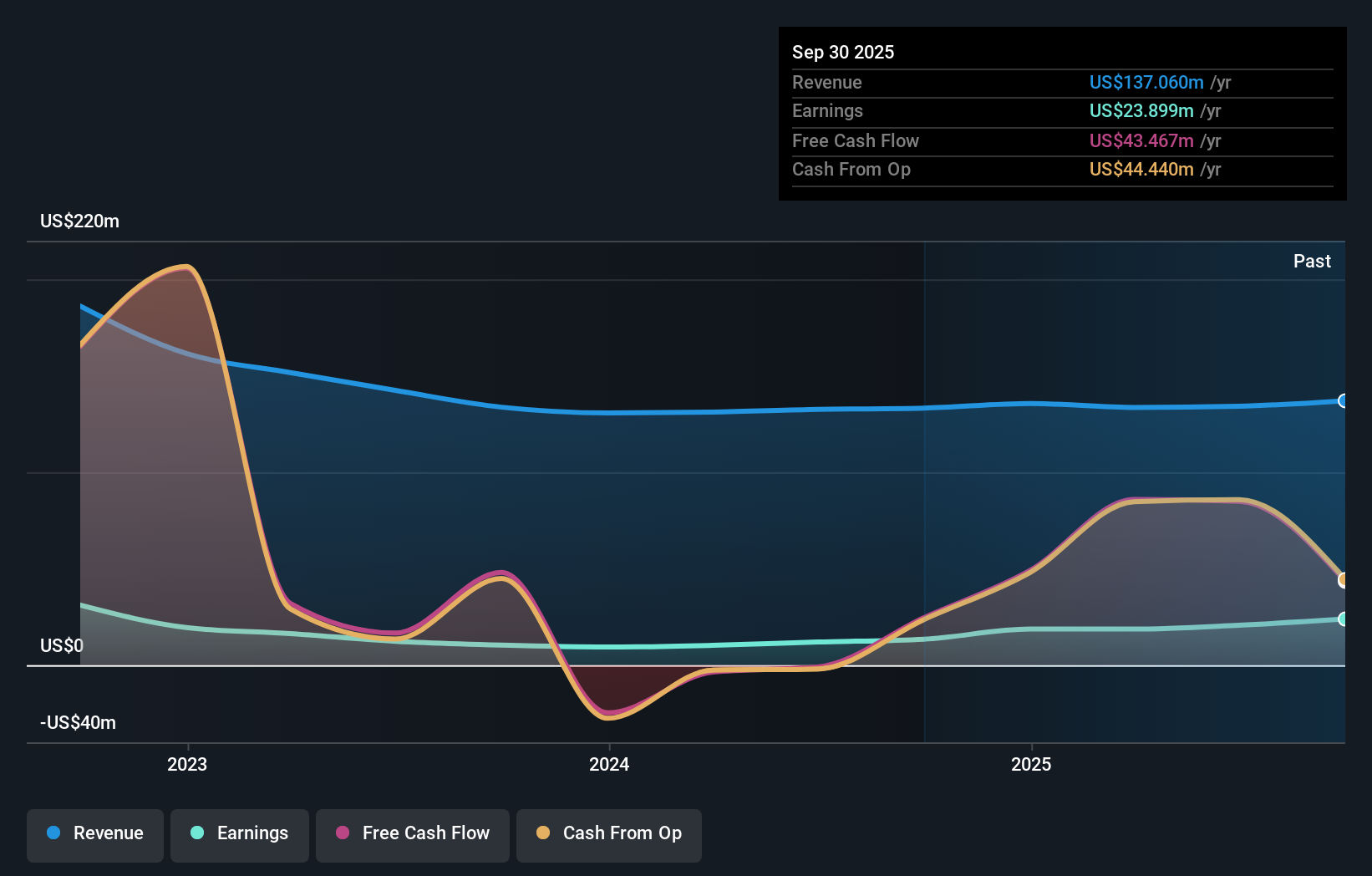

For someone considering Waterstone Financial, the big picture centers on whether recent earnings growth, dividend consistency and ongoing share buybacks can meaningfully offset historical underperformance versus the broader market and financial sector. A core belief here would be that management’s approach to capital returns, through both dividends and buybacks, signals continued focus on shareholder value. The recent insider sale by director Michael L. Hansen, paired with shifts in institutional holdings like Goldman Sachs trimming its stake, introduces a fresh layer of uncertainty regarding internal confidence and future momentum. While the July quarter showed robust net income growth and the board has seen positive refreshment, substantial insider selling could shift short-term catalysts away from the positive narrative around buybacks and profitability, and toward questions of potential leadership or operational risk. So far, share price action remains upward, suggesting limited immediate negative impact, but it’s a development investors should watch closely. On the other hand, a sudden rise in insider selling could signal something important beneath the surface.

Waterstone Financial's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Waterstone Financial - why the stock might be worth as much as $12.44!

Build Your Own Waterstone Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Waterstone Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Waterstone Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Waterstone Financial's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waterstone Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBF

Waterstone Financial

Operates as a bank holding company for WaterStone Bank SSB that provides various financial services to customers in southeastern Wisconsin, the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026