- United States

- /

- Capital Markets

- /

- NasdaqGS:VCTR

Victory Capital Holdings (VCTR): Evaluating Valuation Following Credit Facility Extension and Improved Financial Flexibility

Reviewed by Kshitija Bhandaru

Victory Capital Holdings (VCTR) just made some moves that could help its balance sheet breathe a little easier. The company extended the maturity of its revolving credit facility and lowered its interest rate margin, a shift that may trim future interest costs.

See our latest analysis for Victory Capital Holdings.

Shares of Victory Capital Holdings have edged up in recent months, signaling steady momentum as the company works to strengthen its financial position. Over the past year, the total shareholder return stands at a notable 20%, highlighting the longer-term value investors have enjoyed even as day-to-day price shifts remain modest.

If this kind of financial recalibration sparks your interest, it might be a good time to see what else is happening among fast-growing companies with strong insider alignment by checking out fast growing stocks with high insider ownership

With steady shareholder returns and a recent boost to financial flexibility, the next question for investors is clear: is Victory Capital Holdings trading at a bargain today, or has the market already accounted for all its future growth?

Most Popular Narrative: 13.7% Undervalued

Victory Capital Holdings last closed at $65.96, while the most popular narrative suggests fair value sits at $76.43. This suggests the narrative remains more optimistic on the company’s growth runway, despite only a modest gap to the current price.

The global partnership and integration with Amundi and the acquisition of Pioneer Investments allow Victory Capital to access an extensive international distribution network across Europe and Asia. This significantly expands their addressable client base beyond the U.S., positioning the company for higher long-term asset inflows and revenue growth.

Want to know which powerful growth levers analysts are betting on? The narrative’s valuation leans heavily on assumptions about surging earnings and game-changing margins. Curious which bold targets underpin such an ambitious fair value? The numbers might surprise you.

Result: Fair Value of $76.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net outflows and rising costs from global expansion could put pressure on margins and challenge the bullish growth expectations surrounding Victory Capital Holdings.

Find out about the key risks to this Victory Capital Holdings narrative.

Another View: What Do Market Ratios Reveal?

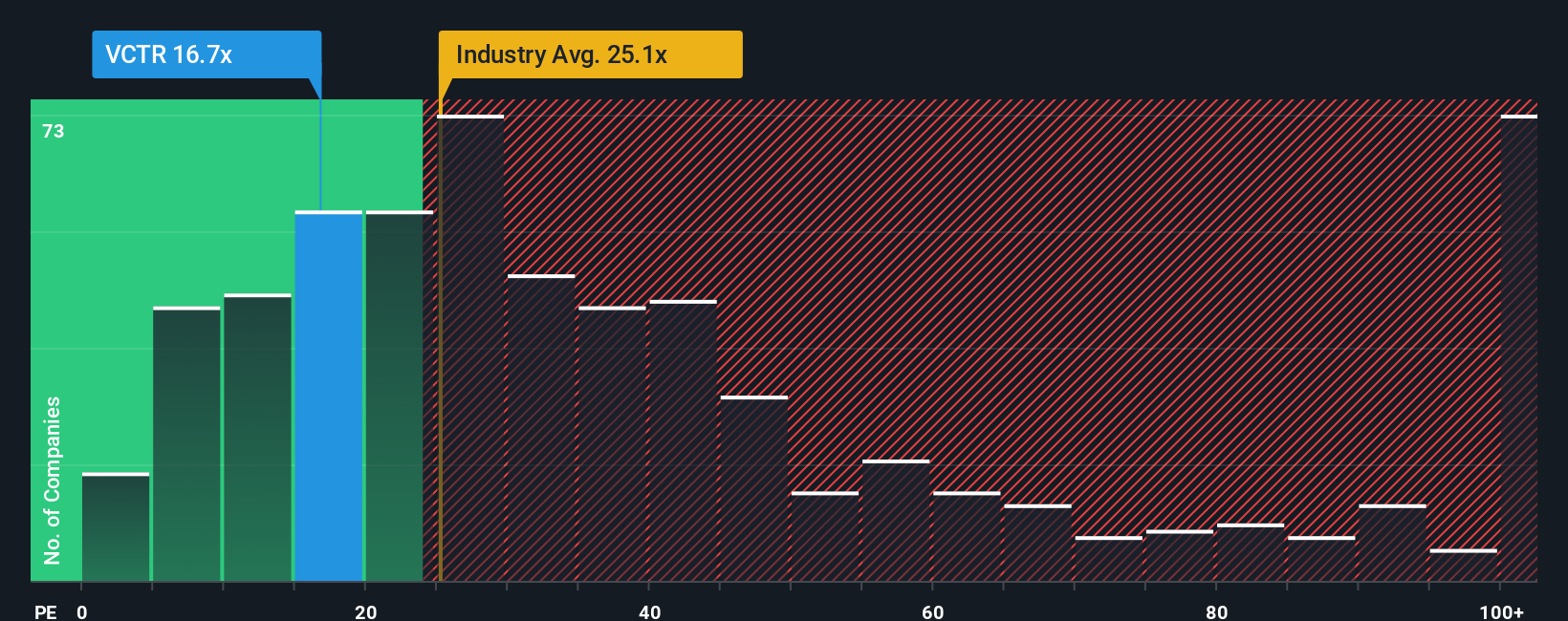

Taking a look at Victory Capital Holdings through the lens of price-to-earnings, the stock trades at 16.6x, which is higher than the peer average of 13.9x but lower than the industry average of 27.1x. Interestingly, the fair ratio is estimated at 23.2x, hinting at valuation wiggle room if the market’s view changes. Does this market premium signal confidence or warn of risk if results falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Victory Capital Holdings Narrative

If the prevailing view doesn’t quite match your own, or you want to dig deeper into the data yourself, it only takes a few minutes to craft your own story. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Victory Capital Holdings.

Looking for More Investment Ideas?

Give your portfolio an edge by harnessing top screening tools on Simply Wall Street. The next big opportunity could be one click away, so don’t hesitate.

- Tap into the potential of steady income by scanning through these 19 dividend stocks with yields > 3% that consistently deliver yields above 3% and offer strong fundamentals.

- Spot transformative tech innovators by checking out these 25 AI penny stocks with the potential to disrupt industries through artificial intelligence and automation.

- Uncover bargain opportunities with these 894 undervalued stocks based on cash flows companies that are trading below their intrinsic value and may be primed for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VCTR

Victory Capital Holdings

Operates as an asset management company in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives