- United States

- /

- Capital Markets

- /

- NasdaqGS:VCTR

How Investors Are Reacting to Victory Capital (VCTR) Extending Debt Maturities and Securing Lower Interest Rates

Reviewed by Sasha Jovanovic

- On September 23, 2025, Victory Capital Holdings, Inc. entered into its Sixth Amendment to its Credit Agreement, extending the maturity dates and lowering the interest margin on both its $100 million senior secured revolving credit facility and $985 million term loans.

- This refinancing provides the company with improved debt terms and longer repayment schedules, potentially enhancing its financial flexibility and ability to support future growth initiatives.

- We will explore how Victory Capital Holdings' lower interest rate and extended debt maturities could influence its investment outlook and earnings trajectory.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Victory Capital Holdings Investment Narrative Recap

To be a shareholder in Victory Capital Holdings, you need confidence in the company’s ability to offset headwinds from continued asset outflows and fee compression through strategic product expansion and global integration. The recent refinancing extends debt maturities and lowers interest expense, but its impact on the most important near-term catalyst, return to organic asset growth, appears limited, as operational execution and net inflow turnaround remain the key focus. The biggest current risk continues to be persistent net outflows, which could pressure future earnings.

Among recent developments, Victory Capital’s August 2025 announcement of a $300 million increase to its equity buyback program stands out. While enhanced financial flexibility from the new debt terms supports such capital return initiatives, ultimately, the effectiveness of buybacks may depend on tackling core business challenges like asset retention and organic growth. The deeper issue that investors should be aware of, however, is how even favorable debt refinancing might not fully address persistent...

Read the full narrative on Victory Capital Holdings (it's free!)

Victory Capital Holdings' outlook suggests revenues of $1.8 billion and earnings of $735.1 million by 2028. This is based on analysts projecting annual revenue growth of 20.4% and an increase in earnings of $470.5 million from the current $264.6 million.

Uncover how Victory Capital Holdings' forecasts yield a $76.43 fair value, a 19% upside to its current price.

Exploring Other Perspectives

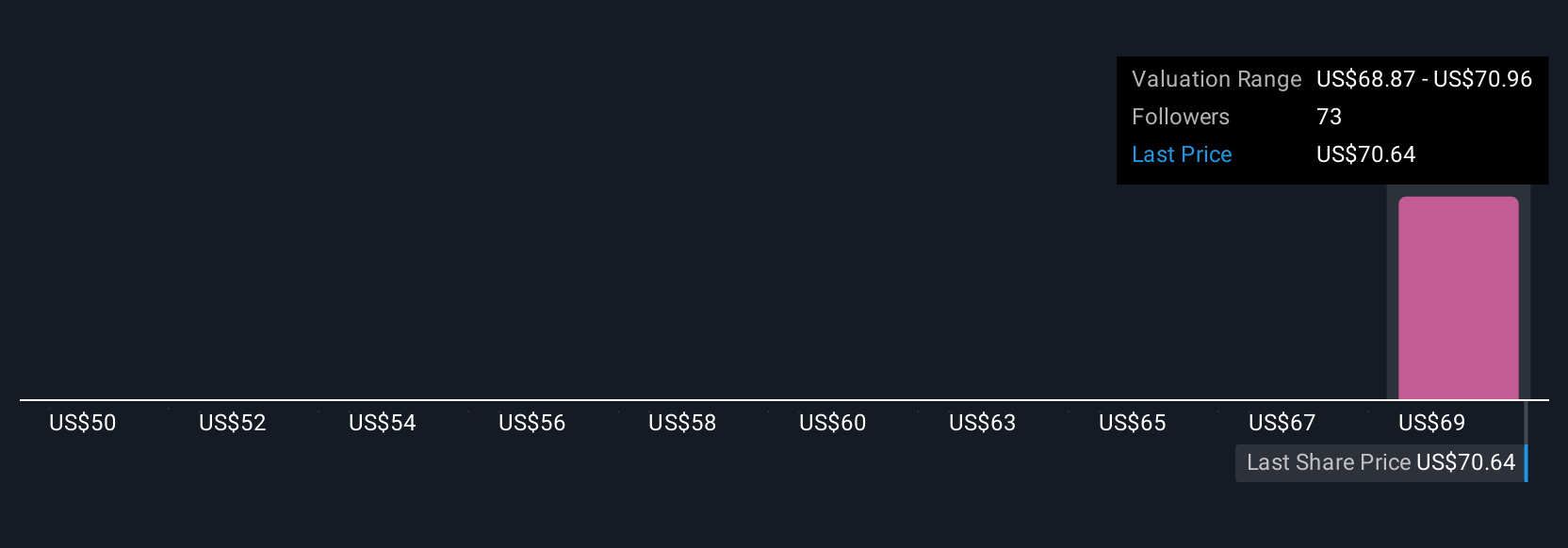

Fair value estimates from the Simply Wall St Community span US$63.48 to US$76.43 across three individual perspectives. While some expect lower valuation, others see higher upside potential, reflecting diverging views on Victory Capital’s ability to reverse asset outflows and strengthen performance. Explore these viewpoints to see how your outlook compares.

Explore 3 other fair value estimates on Victory Capital Holdings - why the stock might be worth just $63.48!

Build Your Own Victory Capital Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Victory Capital Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Victory Capital Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Victory Capital Holdings' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VCTR

Victory Capital Holdings

Operates as an asset management company in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives