- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Should Investors Rethink Upstart After a 27% Drop and New AI Lending Debate?

Reviewed by Bailey Pemberton

- Ever wondered if Upstart Holdings is a hidden bargain or just another tech story? If you are value-curious, you are in the right place.

- Upstart has seen some wild swings, dropping 16.1% in the past week and 27.2% over the last month. This suggests shifting views on its growth potential and risks.

- Recent news has highlighted changing trends in consumer lending and renewed debates about AI-powered credit models. These developments have drawn attention to Upstart’s unique business approach and provided new context for the recent stock price movements, sparking discussions among investors.

- According to our six-point valuation check, Upstart scores just 1 out of 6 for being undervalued. We will explore what this means for long-term investors, and suggest a potentially smarter way to look at valuation by the end of the article.

Upstart Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Upstart Holdings Excess Returns Analysis

The Excess Returns model evaluates a company by assessing how much profit it generates above its cost of equity, based on how effectively management puts shareholder capital to work. Instead of focusing purely on cash flow, this approach considers both the returns on invested capital and the company’s ability to grow its book value over time.

For Upstart Holdings, the analysis is based on these key numbers:

- Book Value: $7.65 per share

- Stable EPS: $2.89 per share (Source: Weighted future Return on Equity estimates from 5 analysts.)

- Cost of Equity: $0.99 per share

- Excess Return: $1.90 per share

- Average Return on Equity: 26.17%

- Stable Book Value: $11.05 per share (Source: Weighted future Book Value estimates from 2 analysts.)

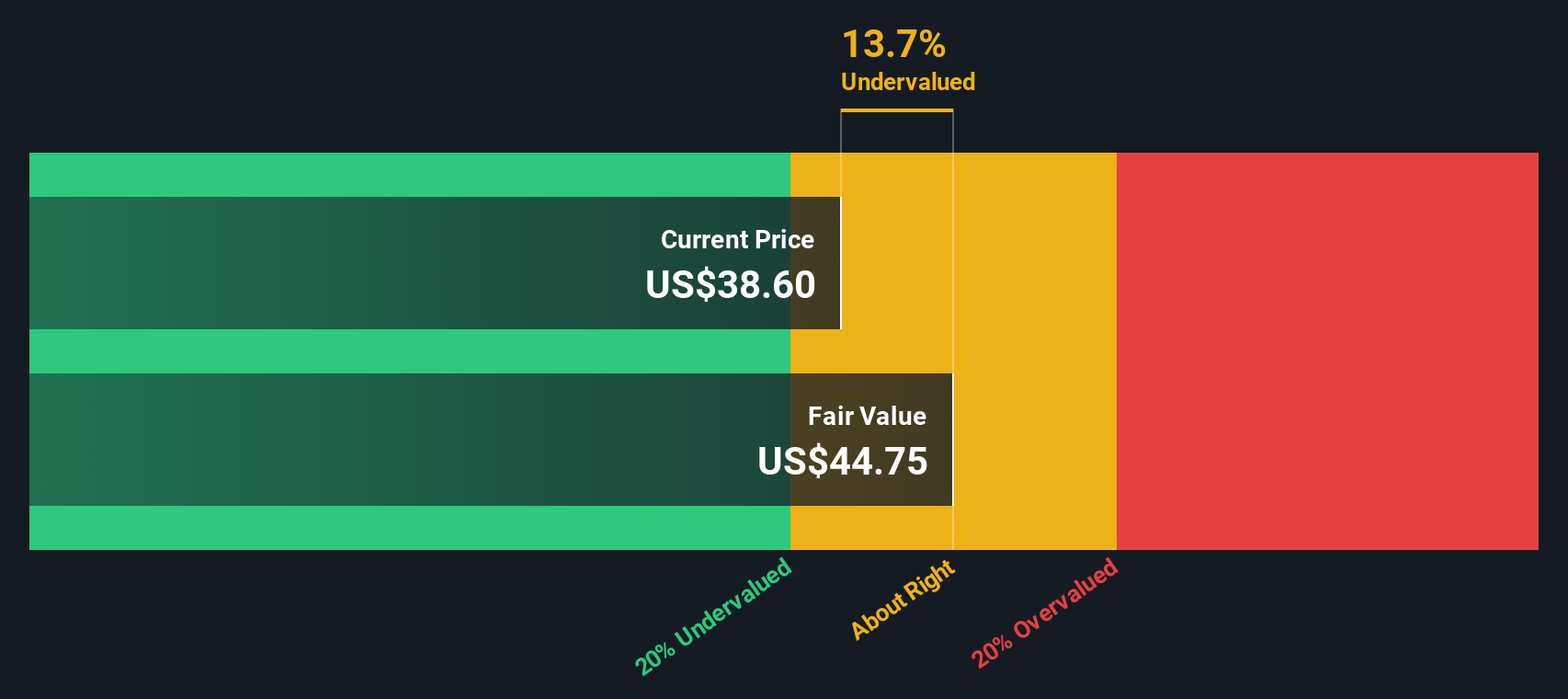

This model estimates Upstart’s intrinsic value at $44.24 per share. With the current share price trading at approximately a 14.7% discount to this valuation, Upstart appears undervalued according to the Excess Returns approach. The company’s ability to generate returns well above its cost of equity suggests that its long-term prospects may be stronger than current market sentiment indicates.

Result: UNDERVALUED

Our Excess Returns analysis suggests Upstart Holdings is undervalued by 14.7%. Track this in your watchlist or portfolio, or discover 861 more undervalued stocks based on cash flows.

Approach 2: Upstart Holdings Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is often the go-to metric for evaluating profitable companies because it directly links a company’s earnings to its share price. A sensible PE ratio makes it easy to compare how much investors are willing to pay for a dollar of earnings, helping to gauge both value and growth prospects.

However, a “normal” or fair PE ratio can vary considerably depending on expectations for future earnings growth and the perceived risks a business faces. Higher growth opportunities or lower risks often justify a higher PE, while increased uncertainty or slowing growth may push the ratio downward.

Upstart Holdings currently trades at a PE of 113.94x. This is far above the Consumer Finance industry average of 10.37x and the average of similar peers at 9.06x. The large gap reflects the market’s optimistic view of Upstart’s unique business model and potential growth, but also highlights the risks of high expectations.

Simply Wall St’s proprietary "Fair Ratio" stands at 49.86x for Upstart Holdings. Unlike raw peer or industry comparisons, this Fair Ratio is tailored for the company. It factors in expected earnings growth, profit margins, industry dynamics, company size, and unique risk profile. This approach provides a more balanced benchmark for valuation.

Comparing Upstart’s current PE ratio of 113.94x to its Fair Ratio of 49.86x, the stock is currently trading well above a level justified by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Upstart Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your personalized story of what you believe about a company, linking your assumptions about its future revenue, earnings, and margins to a financial forecast and a fair value estimate. Instead of just looking at ratios, Narratives help you articulate why you think a stock is a good or bad investment, making your decisions more intentional and transparent.

Narratives work by connecting the company’s unique story, your expectations for its future, and the numbers behind its valuation. All of this is brought together in a simple tool available to millions of investors on Simply Wall St’s Community page. By updating dynamically whenever new information or news comes in, Narratives ensure your estimates and reasoning stay relevant, so you are not making decisions based on outdated data.

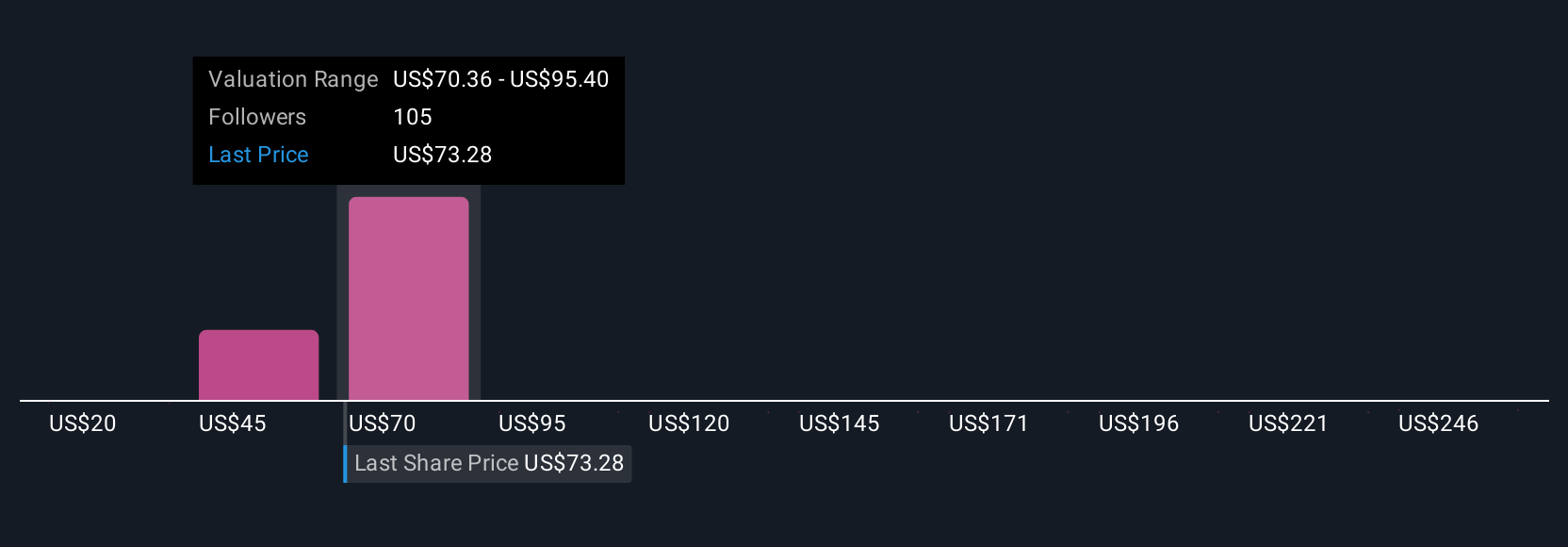

This approach lets you track and compare Fair Value to the current Price easily, helping you decide if and when to buy or sell. For instance, some community investors estimate Upstart Holdings could be worth as much as $105, based on optimistic growth and operational improvements. Others set a much lower fair value near $20, reflecting concerns about loan defaults and market volatility. Narratives empower you to document your own perspective and see how it stacks up against others, making investment analysis more approachable and actionable.

Do you think there's more to the story for Upstart Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives