- United States

- /

- Capital Markets

- /

- NasdaqGS:TW

What Tradeweb Markets (TW)'s Launch of Saudi Arabia’s First Regulated Electronic Bond Market Means For Shareholders

Reviewed by Sasha Jovanovic

- Tradeweb Markets Inc. announced the successful launch of its Alternative Trading System (ATS) for Sukuk and Saudi Riyal-denominated debt in Saudi Arabia, with its inaugural transactions involving BlackRock, BNP Paribas, and Goldman Sachs under the oversight of the Capital Market Authority.

- This milestone marks the Kingdom's first regulated electronic bond market infrastructure, reflecting both significant global institutional participation and progress in Saudi Arabia’s efforts to deepen its capital markets.

- We'll examine how Tradeweb's entry into Saudi Arabia's electronic bond market could shape its global diversification and growth story.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Tradeweb Markets Investment Narrative Recap

To own Tradeweb Markets stock, an investor typically needs to believe in the ongoing electronification of fixed income markets, global multi-asset connectivity, and institutional adoption of automated trading. The Saudi ATS launch underscores Tradeweb's international ambitions and could boost its global diversification, though its main short-term catalyst, growing share in U.S. Treasuries, remains largely unchanged, as voice trading and industry habits still present limitations; the impact of this news on near-term core revenue leadership appears limited.

Recent expansion of dealer algorithmic execution for U.S. Treasuries is more immediately relevant for the company's main performance drivers, as this innovation targets a core challenge: winning back or growing market share in electronically traded American government bonds. While Tradeweb's global moves are essential for long-term story, improving electronic liquidity in the U.S. addresses short-term catalysts tied to revenue momentum and market share concerns.

However, investors should also be aware that despite international progress, persistent pressure on U.S. Treasury market share could pose a risk if...

Read the full narrative on Tradeweb Markets (it's free!)

Tradeweb Markets' narrative projects $2.6 billion revenue and $917.7 million earnings by 2028. This requires 10.6% yearly revenue growth and a $359.9 million earnings increase from $557.8 million today.

Uncover how Tradeweb Markets' forecasts yield a $134.33 fair value, a 24% upside to its current price.

Exploring Other Perspectives

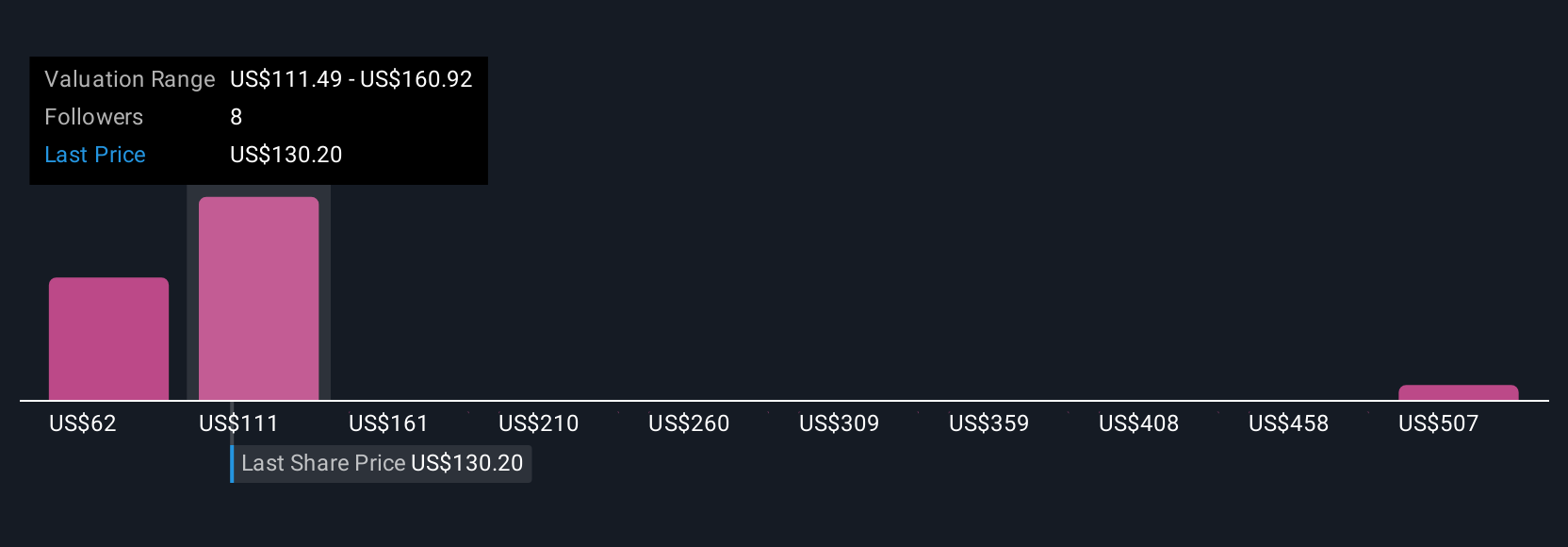

Fair value opinions from the Simply Wall St Community span US$62 to US$556 across three users, reflecting a broad spectrum of outlooks. Many see international growth as a key catalyst for Tradeweb, but the wide range signals the importance of comparing viewpoints and understanding how shifts in global market structure could influence future results.

Explore 3 other fair value estimates on Tradeweb Markets - why the stock might be worth 42% less than the current price!

Build Your Own Tradeweb Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tradeweb Markets research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Tradeweb Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tradeweb Markets' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tradeweb Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TW

Tradeweb Markets

Tradeweb Markets Inc., together with its subsidiaries, builds and operates electronic marketplaces worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives