- United States

- /

- Capital Markets

- /

- NasdaqGS:TW

Tradeweb Markets (TW): Examining Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

Tradeweb Markets (TW) has seen its stock experience shifts in recent weeks, following a mix of routine trading dynamics and investor response to broader market movements. Shares have moved down nearly 3% over the past month.

See our latest analysis for Tradeweb Markets.

While the past month brought a dip for Tradeweb Markets, the bigger story is how last year's momentum has faded. The share price sits at $108.88, reflecting a challenging period with a year-to-date share price return of -17.09%. However, if you zoom out, its three-year total shareholder return of 102.02% reminds us the long-term picture is much brighter for patient investors.

If you’re wondering what else might be gathering pace, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

Given the stock's recent dip and its distance below analyst price targets, investors might be wondering if Tradeweb Markets is now trading at a bargain or if the current price already reflects all future growth prospects.

Most Popular Narrative: 18.9% Undervalued

Compared to its last close at $108.88, the prevailing narrative pegs Tradeweb Markets' fair value at $134.33, highlighting a notable gap. This creates an optimistic thesis focused on digital transformation and global expansion.

Tradeweb is poised to benefit from the ongoing migration of fixed income and derivatives trading from manual and voice channels to electronic platforms. This is evidenced by record electronic trading volumes and expanding adoption of automated tools like AiEX and Portfolio Trading. These factors can support sustained transaction growth and fee revenue expansion.

What’s driving this valuation? Behind the scenes, analysts are betting on ambitious growth in revenues, profit margins, and a bold multiple that defies industry norms. Want a peek at the assumptions setting this price apart? Find out what could propel Tradeweb far ahead of its current trajectory.

Result: Fair Value of $134.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering reliance on voice trading during volatile periods and narrowing transaction fees in core products could limit Tradeweb's growth and valuation potential.

Find out about the key risks to this Tradeweb Markets narrative.

Another View: Is Valuation Actually Stretched?

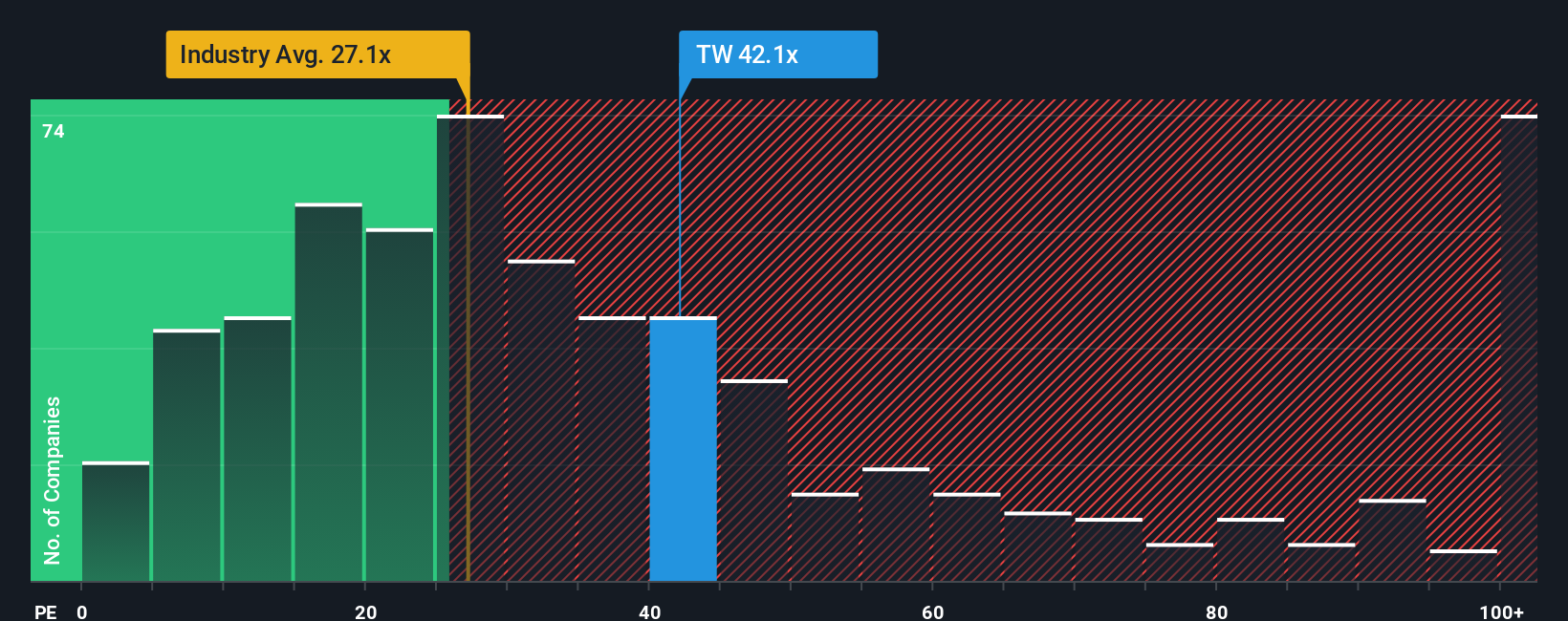

Looking from a different angle, Tradeweb Markets’ price-to-earnings ratio sits at 41.6x, which is much higher than both the US Capital Markets industry average of 25.9x and the peer average of 28.8x. It is also well above its fair ratio of 18.4x, suggesting investors are paying a hefty premium for future growth. Does this price capture too much optimism, or is there more upside ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tradeweb Markets Narrative

Want to see if your perspective paints a different picture? Dive into the data yourself and build your own story in just minutes, and Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tradeweb Markets.

Looking for more investment ideas?

Don’t wait on the sidelines while new opportunities emerge every day. Tap into handpicked stock ideas and spot where growth, innovation, or value could work to your advantage.

- Uncover rare value plays by checking out these 877 undervalued stocks based on cash flows that benefit from strong cash flow and market mispricing.

- Power your portfolio with future-ready companies by targeting these 24 AI penny stocks advancing cutting-edge artificial intelligence technology.

- Unlock income potential as you browse these 17 dividend stocks with yields > 3% offering attractive dividend yields and robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tradeweb Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TW

Tradeweb Markets

Tradeweb Markets Inc., together with its subsidiaries, builds and operates electronic marketplaces worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives