- United States

- /

- Capital Markets

- /

- NasdaqGS:TW

Should Analyst Outlook Shift and Rising Volatility Spur Reassessment of Tradeweb (TW) Investment Thesis?

Reviewed by Sasha Jovanovic

- Earlier this week, analyst sentiment toward Tradeweb Markets shifted as a major investment bank revised its outlook on the company, coinciding with heightened financial market volatility due to the recent U.S. government shutdown.

- This confluence of sector-wide reassessment and broader economic uncertainty sharpened investor and market focus on Tradeweb’s role within electronic trading infrastructure during periods of stress.

- We’ll examine how this analyst outlook adjustment and increased market volatility may shape the current investment narrative for Tradeweb Markets.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tradeweb Markets Investment Narrative Recap

To be a shareholder in Tradeweb Markets, you need confidence in the continued shift of fixed income and derivatives trading from manual to electronic platforms, especially as financial market uncertainty highlights the value of resilient electronic infrastructure. The recent price target reduction from Morgan Stanley amid market turbulence brought short-term attention to potential downside in market share or revenue growth, but does not appear to materially alter the main near-term catalyst: persistent adoption of electronic trading for U.S. Treasuries, which remains central to Tradeweb’s investment thesis. The biggest risk remains that even during volatile periods, portions of the market continue to favor manual, voice-based execution, especially for more complex trades, potentially capping the pace of Tradeweb’s share gains.

Among recent company announcements, Tradeweb’s direct U.S. Treasury bill trading launch for corporate treasurers via ICD Portal is most relevant, given heightened Treasury market volatility. This product aims to deepen Tradeweb’s presence in its core market, supporting the core catalyst of electronification, though strong sector competition and price pressure remain challenges for sustained margin and market share growth.

By contrast, investors should also be aware that reliance on voice trading for complex U.S. Treasury trades during market disruptions can...

Read the full narrative on Tradeweb Markets (it's free!)

Tradeweb Markets' narrative projects $2.6 billion revenue and $917.7 million earnings by 2028. This requires 10.6% yearly revenue growth and a $359.9 million increase in earnings from the current $557.8 million.

Uncover how Tradeweb Markets' forecasts yield a $150.27 fair value, a 39% upside to its current price.

Exploring Other Perspectives

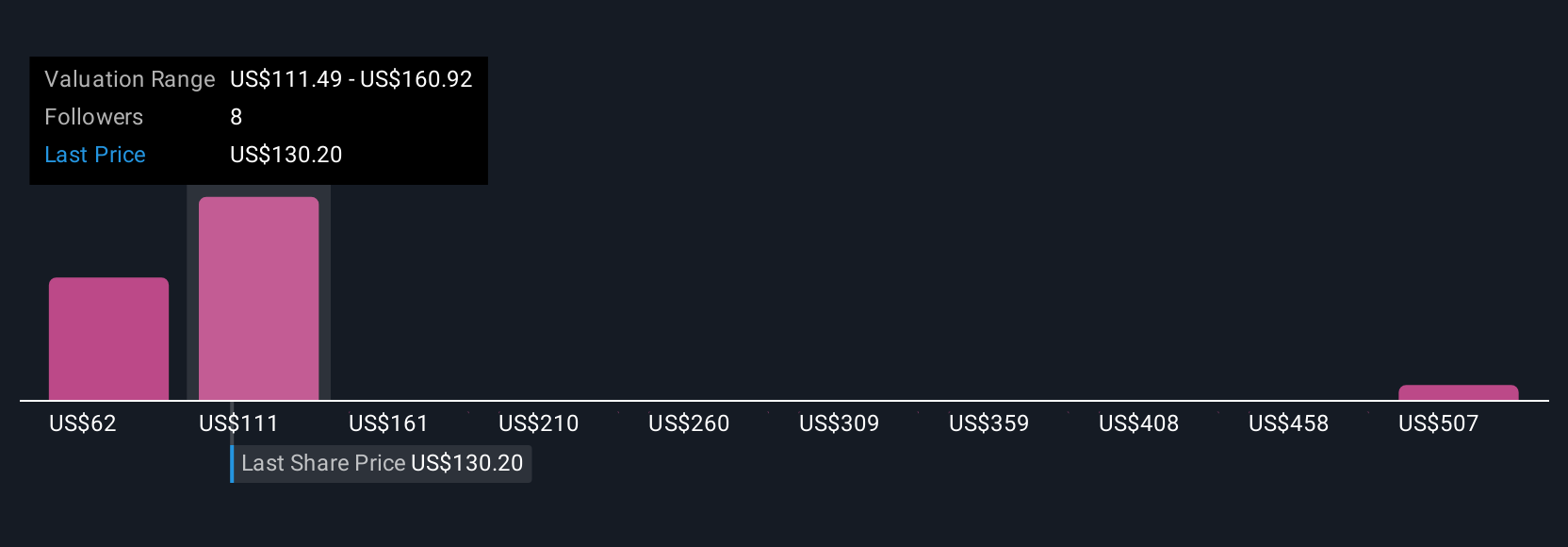

Four individual fair value estimates from the Simply Wall St Community range widely, from US$73.72 to US$556.37 per share. While opinions differ sharply about upside and downside, the ongoing shift in trading from voice to electronic platforms is a central theme affecting Tradeweb’s longer term outlook.

Explore 4 other fair value estimates on Tradeweb Markets - why the stock might be worth over 5x more than the current price!

Build Your Own Tradeweb Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tradeweb Markets research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Tradeweb Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tradeweb Markets' overall financial health at a glance.

No Opportunity In Tradeweb Markets?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tradeweb Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TW

Tradeweb Markets

Tradeweb Markets Inc., together with its subsidiaries, builds and operates electronic marketplaces worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives