- United States

- /

- Capital Markets

- /

- NasdaqGS:TROW

T. Rowe Price Group (NasdaqGS:TROW) Reports Decrease In Net Income And EPS In Q1 2025

Reviewed by Simply Wall St

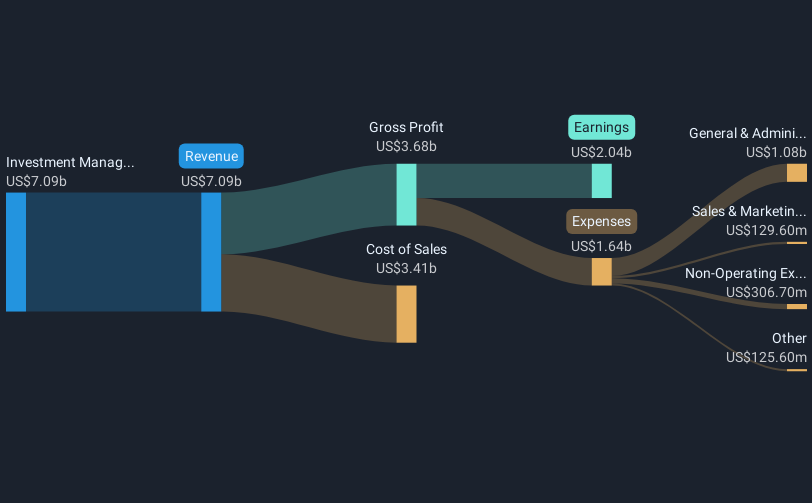

T. Rowe Price Group (NasdaqGS:TROW) recently announced its first-quarter 2025 earnings, showing a decline in net income and lower EPS despite a small increase in total revenue compared to the previous year. The earnings report highlighted operational challenges, reflected in decreased sales. This development seemingly contributed to a slightly lower share price over the last week. The company's performance contrast with the broader market trend, which has been positive, supported by strong jobs data and optimistic trade talk prospects. This mix of company-specific pressures and robust general market conditions underscores the complexity of the investment landscape.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent earnings announcement from T. Rowe Price Group could present challenges to its growth narrative, given the decline in net income and EPS. Despite a small revenue increase, ongoing operational challenges portend potential headwinds for maintaining or growing future revenue. This development coincides with the company's strategic shift toward lower-fee products, which may compress its net margins. Additionally, higher real estate and expansion costs in ETFs and insurance might constrain short-term earnings. Viewed in light of these circumstances, the earnings report could necessitate adjustments in revenue and earnings forecasts.

Looking at the longer-term performance, T. Rowe Price's total return, which includes share price and dividends, was 3.12% decline over the past five years. Conversely, the company underperformed the US Capital Markets industry, which saw a 19.6% return over the last year. Against the backdrop of the broader market, T. Rowe Price's underperformance highlights some of the challenges it faces in enhancing shareholder value amidst competitive pressures and strategic shifts in its product mix.

The slight dip in T. Rowe Price's share price, noted in recent developments, leaves it 2.8% below the analysts' consensus price target of US$91.38. This suggests that the market anticipates modest growth potential, aligning with expectations for relatively stable revenues and earnings over the coming years. Given its current challenges in revenue growth and ongoing investments, achieving this price target may depend on successful market expansions and product performance improvements. Investors should assess whether these expectations align with their understanding and views on T. Rowe Price's prospects.

Our valuation report here indicates T. Rowe Price Group may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if T. Rowe Price Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TROW

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Trending Discussion