- United States

- /

- Capital Markets

- /

- NasdaqGS:TPG

Does TPG’s India AI Data Center and Vayona Energy Push Change The Bull Case For TPG (TPG)?

Reviewed by Sasha Jovanovic

- In recent months, TPG Capital has backed a TCS-led US$2.00 billion AI data center joint venture in India and, through a consortium with MAVCO, completed the acquisition of Siemens Gamesa’s onshore wind business in India and Sri Lanka, launching the Vayona Energy platform with 12.00 gigawatts of operational and under-development assets.

- These moves deepen TPG’s exposure to AI infrastructure and renewable energy in fast-growing South Asian markets, reinforcing its focus on long-term thematic investment areas like digital infrastructure and sustainability.

- We’ll now examine how TPG’s AI infrastructure partnership with TCS could reshape its investment narrative and long-term thematic growth focus.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

TPG Investment Narrative Recap

To own TPG, you need to believe it can convert its private markets platform and thematic investing approach into durable fee income and carried interest, despite fundraising and exit cycles. The recent AI data center and Vayona Energy moves support its long term themes, but do not materially change the near term picture where the key catalyst remains execution on fundraising and exits, while the biggest risk is that LPs feel overallocated to alternatives and constrain new commitments.

The US$2.00 billion AI data center joint venture with TCS is the clearest recent example of TPG leaning into its digital infrastructure theme, tying directly into its catalyst around thematic growth funds. If this partnership helps underpin performance and product expansion in areas like AI, it could strengthen TPG’s case with institutional and retail channels at a time when some LPs are cautious on adding more private equity exposure.

But while these growth stories are compelling, investors should also be aware of the risk that many LPs already feel overweight in alternatives and...

Read the full narrative on TPG (it's free!)

TPG’s narrative projects $2.3 billion revenue and $827.7 million earnings by 2028. This implies revenues will decline by 16.5% per year, while earnings are expected to rise by about $807.5 million from $20.2 million today.

Uncover how TPG's forecasts yield a $66.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

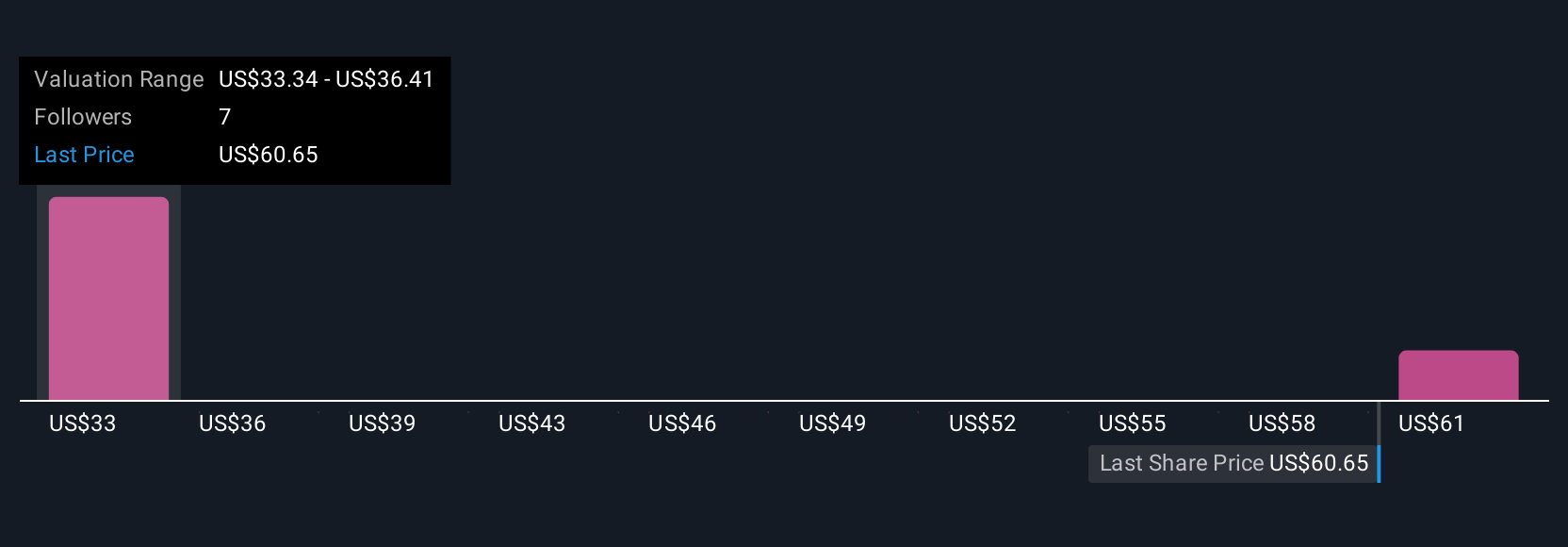

Two fair value estimates from the Simply Wall St Community span roughly US$40.90 to US$66, showing how far apart individual views can be. Against that backdrop, TPG’s push into AI infrastructure and renewables highlights how differently people might weigh its thematic growth potential versus the risk of slower private equity fundraising, so it can be worth comparing several perspectives before forming your own view.

Explore 2 other fair value estimates on TPG - why the stock might be worth as much as 8% more than the current price!

Build Your Own TPG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TPG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TPG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TPG's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TPG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TPG

TPG

Operates as an alternative asset manager in the United States and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026