- United States

- /

- Diversified Financial

- /

- NasdaqGS:STNE

StoneCo (NasdaqGS:STNE): Exploring Valuation After Analyst Upgrades and Earnings Estimate Hike

Reviewed by Kshitija Bhandaru

StoneCo (NasdaqGS:STNE) just grabbed the spotlight after landing a Zacks Rank of #1 (Strong Buy), backed by a 9% bump in its full-year earnings estimates this quarter. For investors tracking financial stocks, that kind of analyst upgrade is hard to ignore and usually signals shifting sentiment. With many re-evaluating their positions after this news, the market is clearly rethinking what StoneCo might deliver in the coming months.

Over the year, StoneCo's story has been one of outperformance. Its shares have soared 143% year-to-date, far outpacing the broader Computer and Technology sector average of 22%. This rally comes as the company posts stronger-than-expected earnings growth and continues to leave its industry peers behind on a year-to-date basis. Recent momentum suggests that confidence in StoneCo's growth prospects is building, with the latest analyst sentiment contributing to this move.

With this kind of surge and upbeat outlook, is the market too enthusiastic, or is there still room for upside if you're thinking about investing?

Most Popular Narrative: 8.6% Overvalued

The latest and most closely watched narrative now considers StoneCo slightly overvalued, with its fair value estimated at $17.64. This is about 8.6% below the current share price. This view is shaped by evolving assumptions around future profit growth, margins, and market risks.

"Cross-selling of end-to-end financial solutions (payments, digital banking, working capital credit) is increasing client engagement and wallet share, demonstrated by growing deposit balances (+36% year-over-year) and credit portfolio expansion (+25% sequentially), supporting higher recurring revenue and long-term net earnings improvement."

How does a platform unlock outsized value with a single pivot in business strategy? The most popular narrative claims that StoneCo's transformation could spark a rapid profit resurgence, if you believe some bold assumptions about future growth and financial leverage. What numbers are packed into the latest projection behind this valuation? Dive in to uncover what could separate the bulls from the skeptics.

Result: Fair Value of $17.64 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower payment growth or rising credit losses could quickly challenge the current optimism and act as potential catalysts for a shift in StoneCo's outlook.

Find out about the key risks to this StoneCo narrative.Another View: Discounted Cash Flow Tells a Different Story

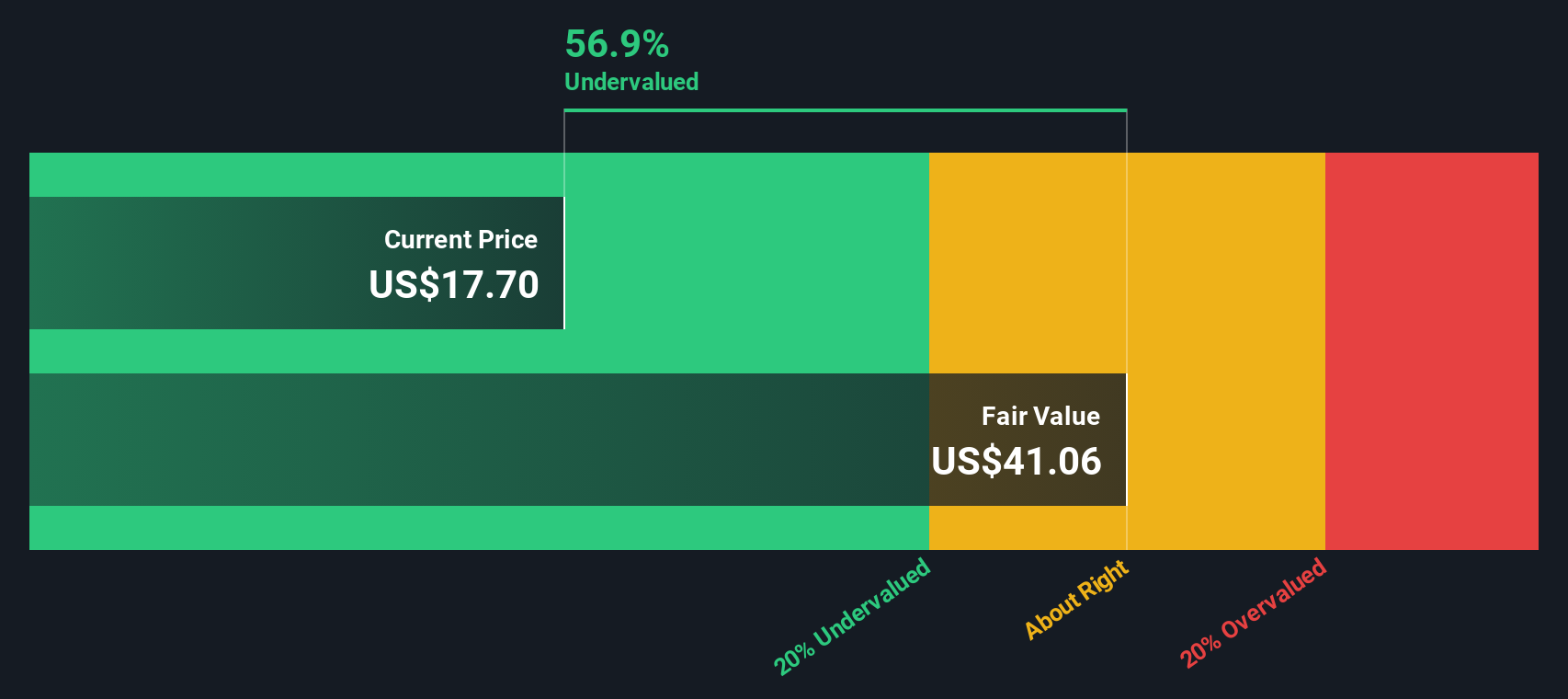

While the most followed narrative suggests StoneCo is slightly overvalued, our SWS DCF model presents a sharply different perspective. The model indicates the stock could actually be trading at a sizable discount. Which view will prove right?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding StoneCo to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own StoneCo Narrative

If you have a different take or want to dive even deeper into StoneCo’s numbers, you can put together your own story in just minutes with Do it your way.

A great starting point for your StoneCo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at StoneCo? You can get ahead of the crowd by using the Simply Wall Street Screener to spot fresh, actionable opportunities specifically tailored to your goals.

- Capture tomorrow’s tech disruptors by targeting AI penny stocks, which are shaking up industries through real artificial intelligence breakthroughs and rapid business growth.

- Get ahead of the market by filtering for undervalued stocks based on cash flows, where share prices lag far behind their true earnings potential before others catch on.

- Boost your portfolio with steady income by zeroing in on dividend stocks with yields > 3%, built to reward investors with reliable yields exceeding 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STNE

StoneCo

Provides financial technology and software solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives