- United States

- /

- Diversified Financial

- /

- NasdaqGS:STNE

Assessing StoneCo Shares After a 125.6% Surge and Recent Pullback in 2025

Reviewed by Bailey Pemberton

If you are wondering whether now is the right time to buy, sell, or simply watch StoneCo stock, you are not alone. With shares closing recently at $18.27, StoneCo has given investors quite a ride. In just the past week, the stock climbed 7.5%, a burst of momentum that may have caught your attention, especially considering its eye-popping 125.6% return since the start of the year. Still, the journey has not been all smooth sailing. Over the last 30 days, StoneCo pulled back by 5.8%. If you zoom out far enough, its five-year return stands at -67.4%, making this stock a tale of dramatic highs and lows.

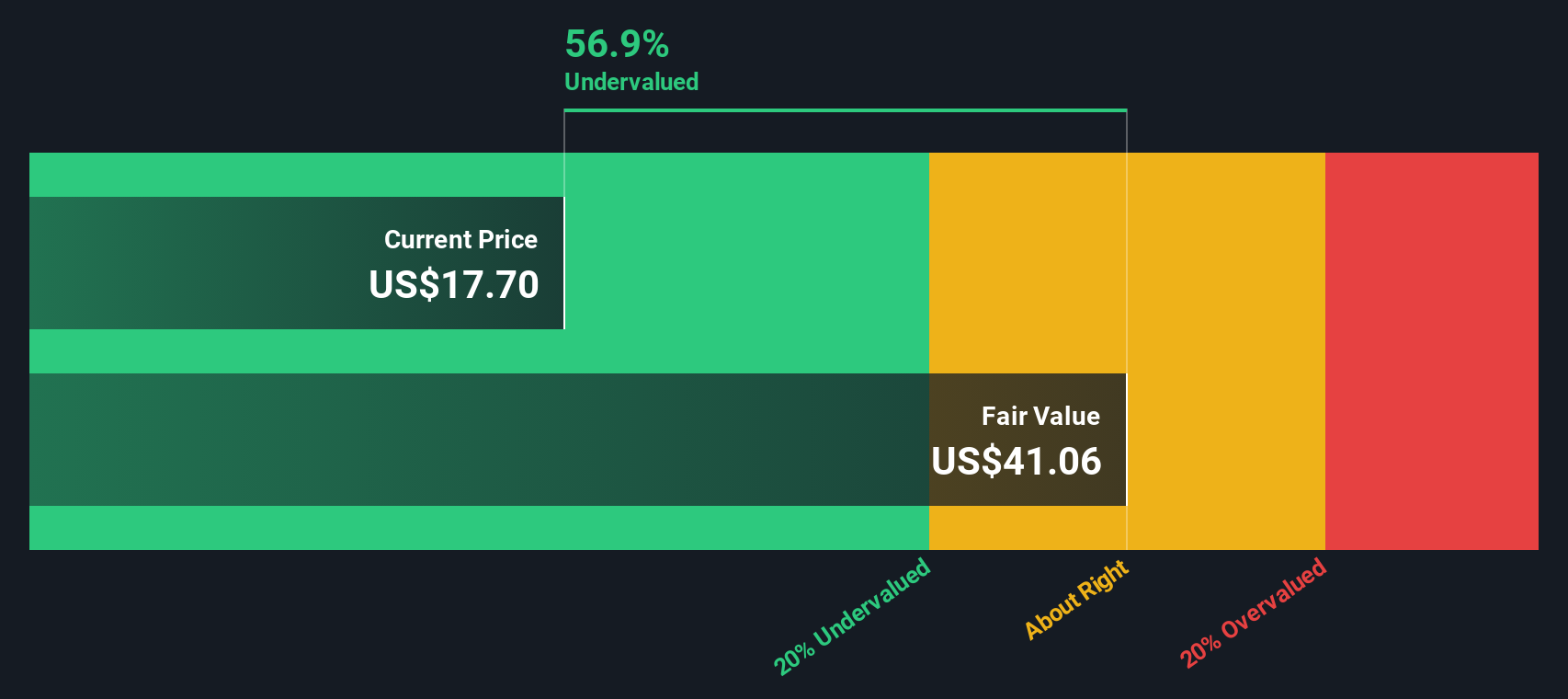

Much of the recent optimism around StoneCo comes from upbeat developments in Brazil’s digital payments market and the company’s strategic moves to strengthen its financial platform. Investors seem to be reappraising the risk and growth potential here, which is reflected in the stock’s sharp rebound over the past twelve months. With a current valuation score of 5, based on checks for undervaluation across six different measures, the data points strongly suggest that StoneCo is undervalued by most conventional standards.

But as any seasoned investor knows, numbers and ratios only paint part of the picture. In the next sections, I will walk you through the key valuation methods used to assess StoneCo, and hint at an even more insightful way to look at the company’s true worth by the end of this article.

Approach 1: StoneCo Excess Returns Analysis

The Excess Returns valuation model estimates a company's worth by assessing how much profit it generates over and above the return required by its investors. In other words, it asks whether StoneCo is turning its invested capital into returns far beyond what shareholders expect, based on the company's equity cost.

In StoneCo's case, the fundamentals look solid according to this approach. The company has a book value of $43.24 per share, and analysts project a stable, future earnings-per-share of $11.83. The cost of equity, or what shareholders demand for investing, is $3.82 per share. StoneCo is generating an excess return of $8.00 per share, meaning the company is consistently producing more profit than the baseline expectation. The average Return on Equity is a robust 23.79 percent, with expectations for the stable book value to rise to $49.71, reflecting optimism in future growth.

Using the Excess Returns methodology, StoneCo's intrinsic value is estimated at $41.44 per share. At the current share price of $18.27, this suggests the stock is 55.9 percent undervalued using this lens. For investors seeking value, the figures here point to plenty of upside potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests StoneCo is undervalued by 55.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: StoneCo Price vs Sales

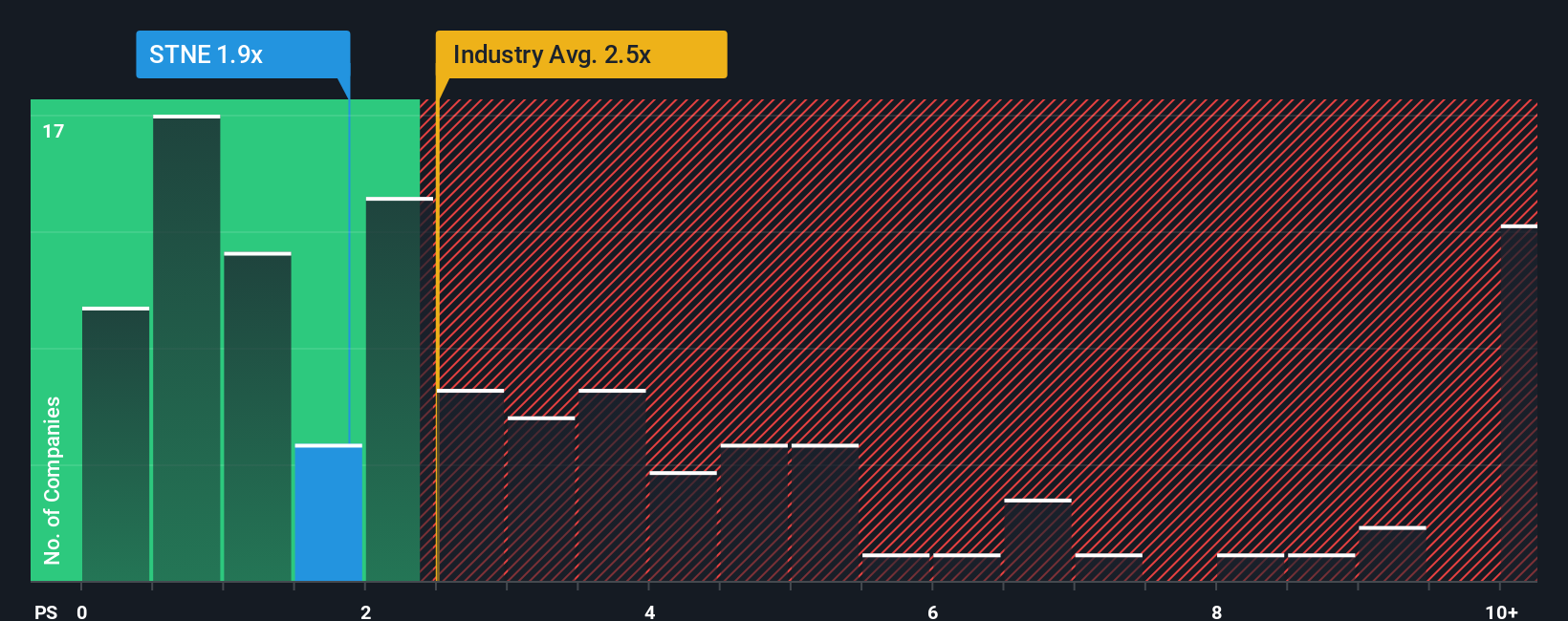

The Price-to-Sales (P/S) multiple is widely regarded as a practical valuation measure, especially for companies like StoneCo that demonstrate consistent revenue generation, even if earnings may be variable. P/S is often favored when evaluating growth companies or businesses in rapidly evolving industries because it is less affected by accounting differences or temporary profitability swings.

What constitutes a "normal" or "fair" P/S ratio depends on many factors, including expected revenue growth, risk profile, and the industry’s competitive landscape. Higher expected growth or unique business positioning can justify above-average P/S multiples. Elevated risk can, on the other hand, drag them lower.

StoneCo currently trades at a P/S ratio of 1.91x. For context, the average for the Diversified Financial industry stands at 2.55x, and the peer group averages 2.39x. This puts StoneCo below both key benchmarks. However, not all companies should be held to the same standard, which is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, calculated at 3.06x for StoneCo, is a proprietary metric that incorporates the company’s revenue growth, profit margins, risk factors, industry positioning, and market cap to give a tailored benchmark. This deeper approach allows for a more nuanced judgment than a simple comparison with peers or the industry, as it accounts for StoneCo’s unique situation within the sector.

Since StoneCo’s P/S multiple (1.91x) is significantly below the Fair Ratio (3.06x), the data supports the case that the stock is undervalued using this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your StoneCo Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives.

A Narrative is your investment story, a simple way to tie together your expectations about a company’s future (such as growth, profits, and risk) with concrete financial forecasts and a fair value that reflects your view.

On Simply Wall St’s Community page, Narratives let you capture your personal perspective about StoneCo, from your fair value estimate down to your projections for revenue, earnings, and margins.

This approach helps you make more informed buy or sell decisions by allowing you to compare your fair value calculation to the latest share price. Narratives automatically recalculate when earnings, news, or forecasts change, ensuring your view remains relevant.

For example, some investors see StoneCo’s role in driving digital payments across Brazil and set their fair value as high as $19.97, expecting rapid profit growth and margin expansion, while others worry about rising competition and tighter margins, setting a fair value closer to $14.37.

Narratives make it easy to explore, define, and update your own view, helping you cut through the noise and invest with genuine conviction.

Do you think there's more to the story for StoneCo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STNE

StoneCo

Provides financial technology and software solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives