- United States

- /

- Capital Markets

- /

- NasdaqGS:STEP

StepStone’s New Private Equity Fund STPEX Might Change the Case for Investing in StepStone Group (STEP)

Reviewed by Sasha Jovanovic

- StepStone Group recently announced the successful launch of the StepStone Private Equity Strategies Fund (STPEX), an evergreen interval fund that has raised over US$750 million since its September debut to invest in private equity assets managed by leading sponsors.

- STPEX aims to broaden private equity access through daily investments, semi-annual liquidity options, and simplified tax reporting, now available to a wide range of U.S. investors with no accreditation requirement.

- We’ll explore how STPEX’s accessibility and diversification features may shape StepStone’s investment narrative in the evolving private markets landscape.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is StepStone Group's Investment Narrative?

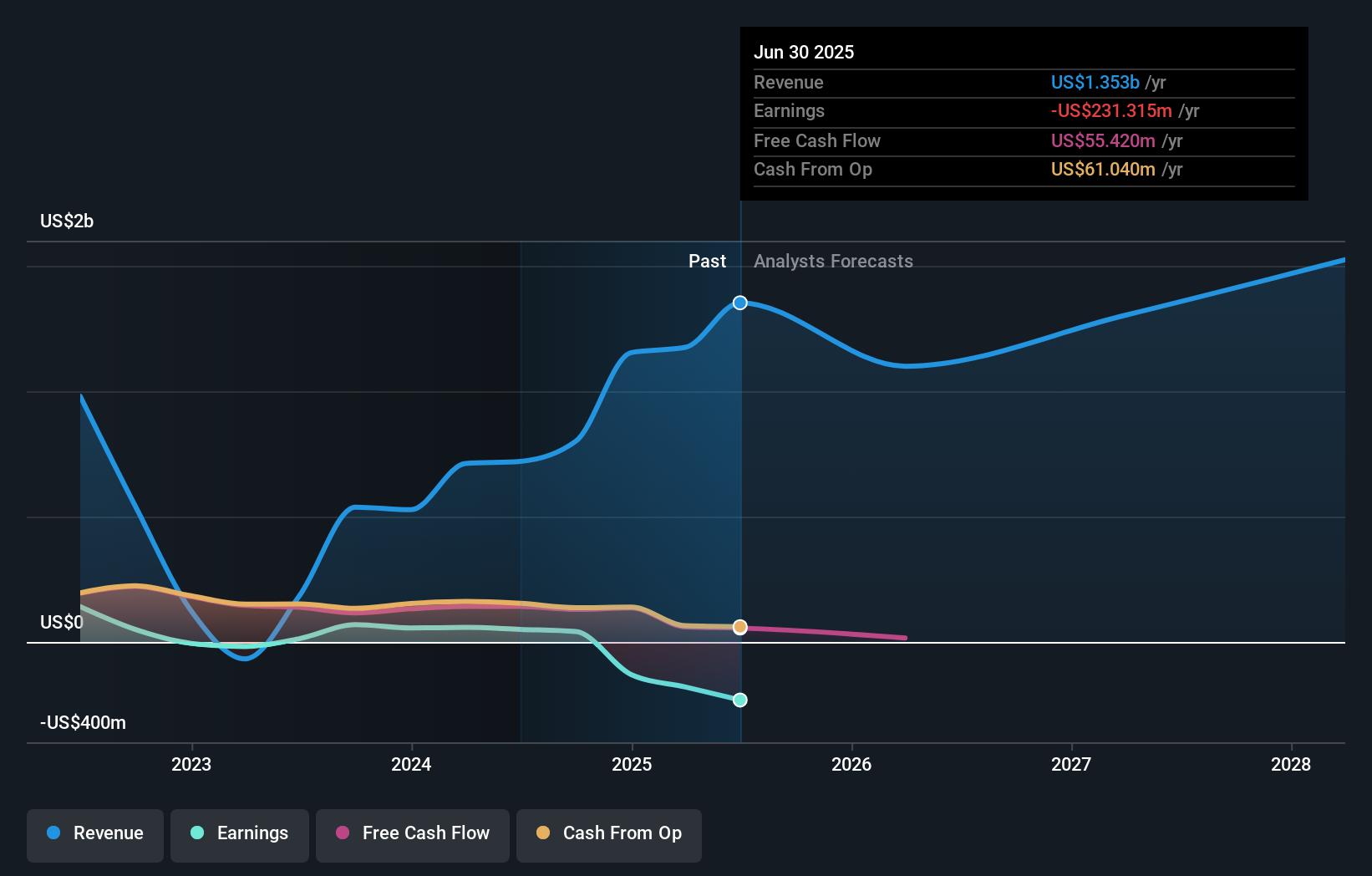

For those considering StepStone Group, the big picture often comes down to belief in the long-term growth of private markets and StepStone’s ability to broaden access and scale. The launch of STPEX is a direct move to capture the growing demand from individual and non-institutional investors, potentially serving as a near-term catalyst if inflows remain strong. This product's simplicity, diverse private equity exposure and accessibility could help differentiate StepStone, especially as recent results showed rising revenues but ongoing net losses. However, while STPEX introduces a fresh access point for capital, the company’s persistent unprofitability and slow expected revenue growth versus the US market remain critical risks. Recent stock price weakness suggests the STPEX launch may not immediately offset concerns about earnings and valuation, but it could alter the narrative if asset flows turn significant. On the other hand, changes in earnings quality could impact sentiment faster than new product momentum.

The valuation report we've compiled suggests that StepStone Group's current price could be quite moderate.Exploring Other Perspectives

Explore another fair value estimate on StepStone Group - why the stock might be worth as much as $9.10!

Build Your Own StepStone Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StepStone Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free StepStone Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StepStone Group's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STEP

StepStone Group

A private equity and venture capital firm specializing in primary, direct, fund of funds, secondary direct, and secondary indirect investments.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.