- United States

- /

- Capital Markets

- /

- NasdaqGS:STEP

StepStone Group Inc.'s (NASDAQ:STEP) 27% Share Price Surge Not Quite Adding Up

StepStone Group Inc. (NASDAQ:STEP) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 60% in the last year.

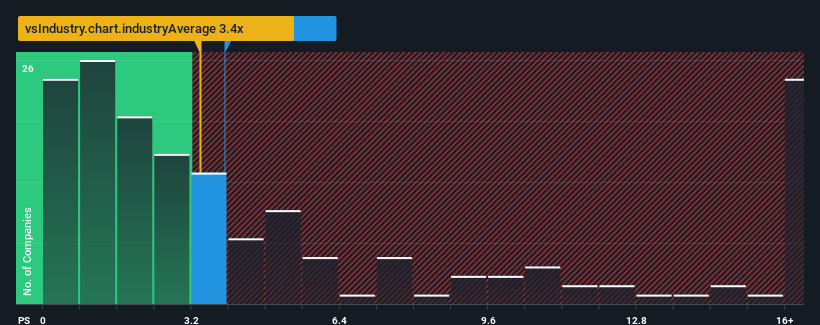

Even after such a large jump in price, it's still not a stretch to say that StepStone Group's price-to-sales (or "P/S") ratio of 3.9x right now seems quite "middle-of-the-road" compared to the Capital Markets industry in the United States, where the median P/S ratio is around 3.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We've discovered 2 warning signs about StepStone Group. View them for free.View our latest analysis for StepStone Group

What Does StepStone Group's Recent Performance Look Like?

StepStone Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on StepStone Group.Is There Some Revenue Growth Forecasted For StepStone Group?

In order to justify its P/S ratio, StepStone Group would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 119% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 15% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 15% over the next year. Meanwhile, the broader industry is forecast to expand by 2.2%, which paints a poor picture.

With this information, we find it concerning that StepStone Group is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

StepStone Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our check of StepStone Group's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Plus, you should also learn about these 2 warning signs we've spotted with StepStone Group.

If you're unsure about the strength of StepStone Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:STEP

StepStone Group

A private equity and venture capital firm specializing in primary, direct, fund of funds, secondary direct, and secondary indirect investments.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives