- United States

- /

- Capital Markets

- /

- NasdaqGS:STEP

Is Kroll Partnership on Private Credit Benchmarks Changing the Investment Case for StepStone Group (STEP)?

Reviewed by Simply Wall St

- In recent news, Kroll and StepStone Group announced the launch of the Kroll StepStone Private Credit Benchmarks, an industry-first offering that utilizes data from more than 15,000 private credit deals to enhance market transparency and valuation accuracy.

- This collaboration addresses the growing investor need for better analytics amid increased retail participation in private markets, positioning StepStone as a provider of advanced portfolio intelligence tools.

- We'll take a closer look at how StepStone's push toward market transparency with private credit benchmarks could influence its investment story.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

What Is StepStone Group's Investment Narrative?

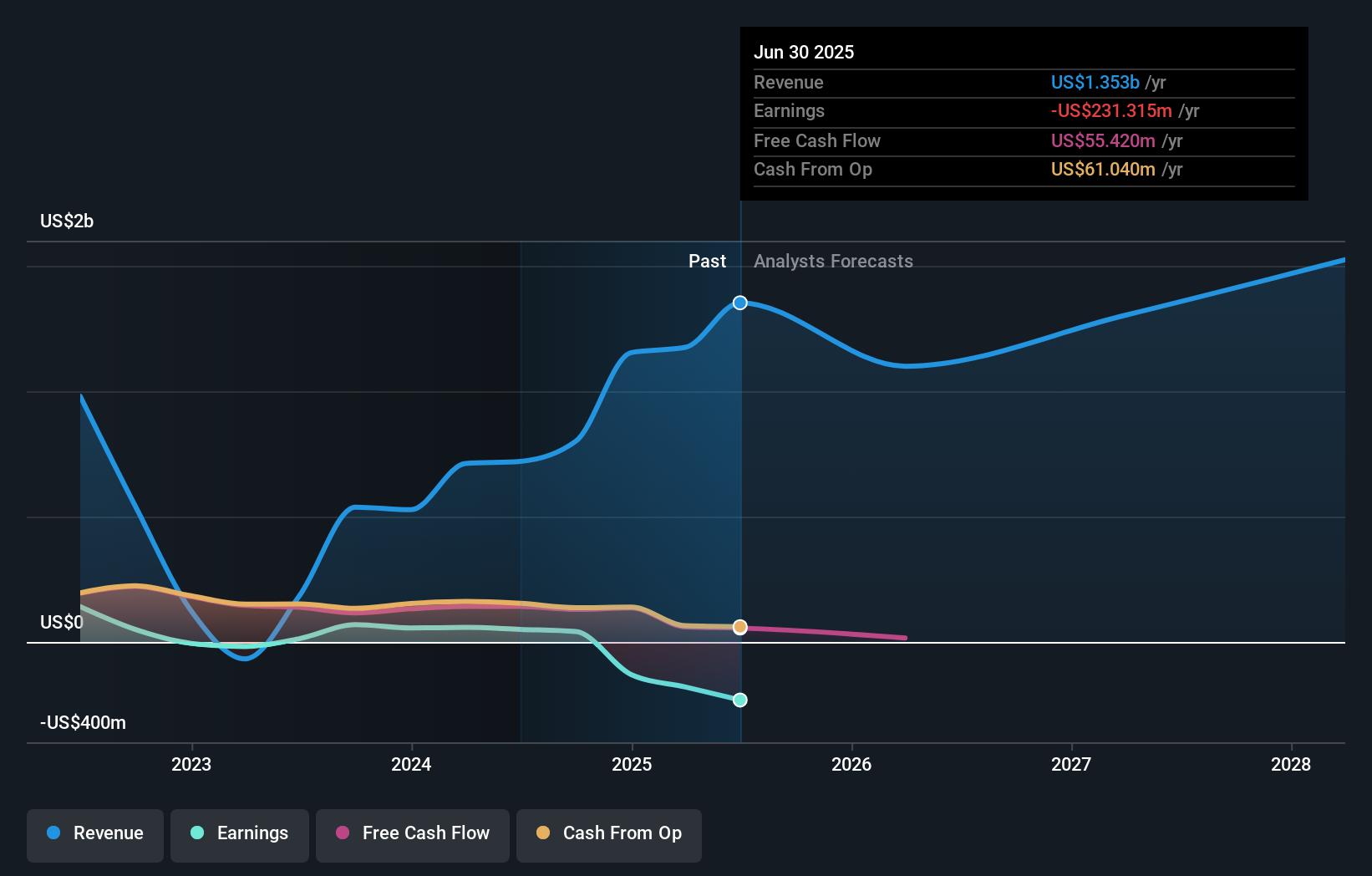

To buy into StepStone Group’s investment story, you need to believe the long-term opportunity in private markets outweighs the risks of inconsistent earnings and patchy profitability. The recent launch of private credit benchmarks with Kroll positions StepStone as a technology-forward player aiming for market transparency, addressing a growing appetite for better data among investors. This partnership could become an important near-term catalyst if it attracts new clients or higher-margin flows, especially as private credit expands its footprint. However, StepStone remains unprofitable and its losses have increased in recent years, raising questions about how quickly innovation can translate into financial gains, particularly after its recent drop from key indices and amid continued insider selling. If the Kroll venture drives sustained client interest, risks tied to earnings volatility may ease, but the impact will need time to show in results.

On the other hand, ongoing net losses remain something investors should keep front of mind.

Exploring Other Perspectives

Explore another fair value estimate on StepStone Group - why the stock might be worth less than half the current price!

Build Your Own StepStone Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StepStone Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free StepStone Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StepStone Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STEP

StepStone Group

A private equity and venture capital firm specializing in primary, direct, fund of funds, secondary direct, and secondary indirect investments.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives