- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

Is SoFi a Bargain After 116% Rally and New Banking Partnerships?

Reviewed by Bailey Pemberton

- Curious whether SoFi Technologies could be a bargain or overpriced at these levels? You are not alone, as investors are trying to make sense of its eye-popping rise and what that could mean for future value.

- After a strong run that has delivered a 116.8% gain over the last year and 99.6% year-to-date, the stock has pulled back 5.0% in the past week but remains up 7.7% for the last month.

- Several recent headlines have kept SoFi in the spotlight, including the company’s continued expansion of its product offerings and growing partnerships with major financial institutions. These efforts have fueled optimism about SoFi’s long-term growth, even as volatility persists in the broader fintech sector.

- Despite all the enthusiasm, SoFi currently scores just 0 out of 6 on our valuation checks. This means it does not appear undervalued according to traditional metrics. Next, we will examine the valuation methods usually used to assess SoFi, and at the end of the article, we will reveal a smarter way to understand the company’s true worth.

SoFi Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SoFi Technologies Excess Returns Analysis

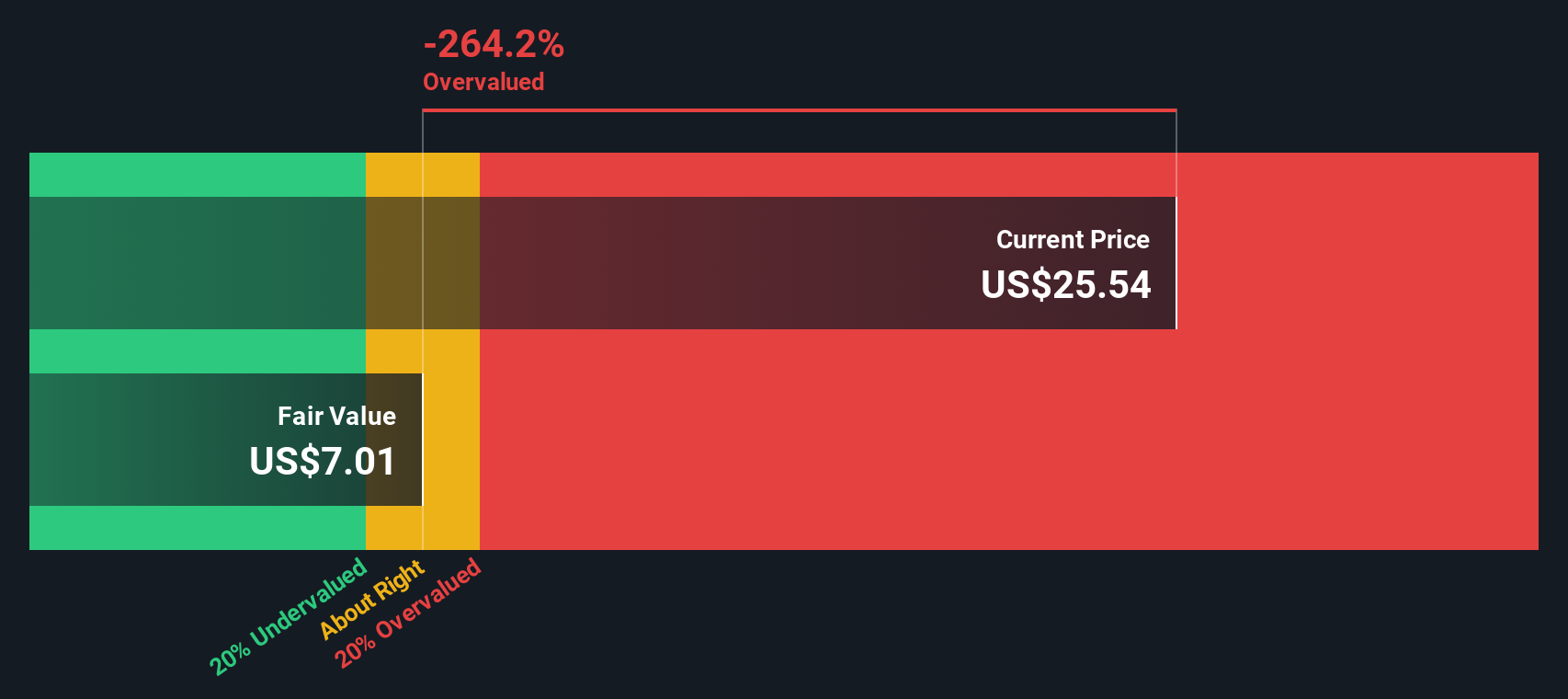

The Excess Returns valuation model measures how much profit a company is able to generate above its cost of equity, using key metrics like book value and return on equity to assess whether a stock is creating value for shareholders over time. For SoFi Technologies, this approach highlights several important fundamentals.

SoFi’s current book value per share stands at $7.29, while its projected stable book value is expected to reach $7.68 per share. The company’s stable earnings per share is forecast at $0.69, based on weighted future return on equity estimates from five analysts. SoFi’s cost of equity is calculated at $0.62 per share, with an annual excess return of $0.07 per share. This indicates a modest ability to generate profits above its financing cost. The average Return on Equity expected is 8.97%, pointing to gradual improvement, though not dramatically outpacing the cost of capital.

Based on these factors, the Excess Returns model estimates that SoFi Technologies’ intrinsic value is significantly lower than its current share price. Specifically, the intrinsic discount implied by this approach is 205.2%, suggesting the stock is more than twice as expensive as its calculated value.

Result: OVERVALUED

Our Excess Returns analysis suggests SoFi Technologies may be overvalued by 205.2%. Discover 874 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: SoFi Technologies Price vs Earnings

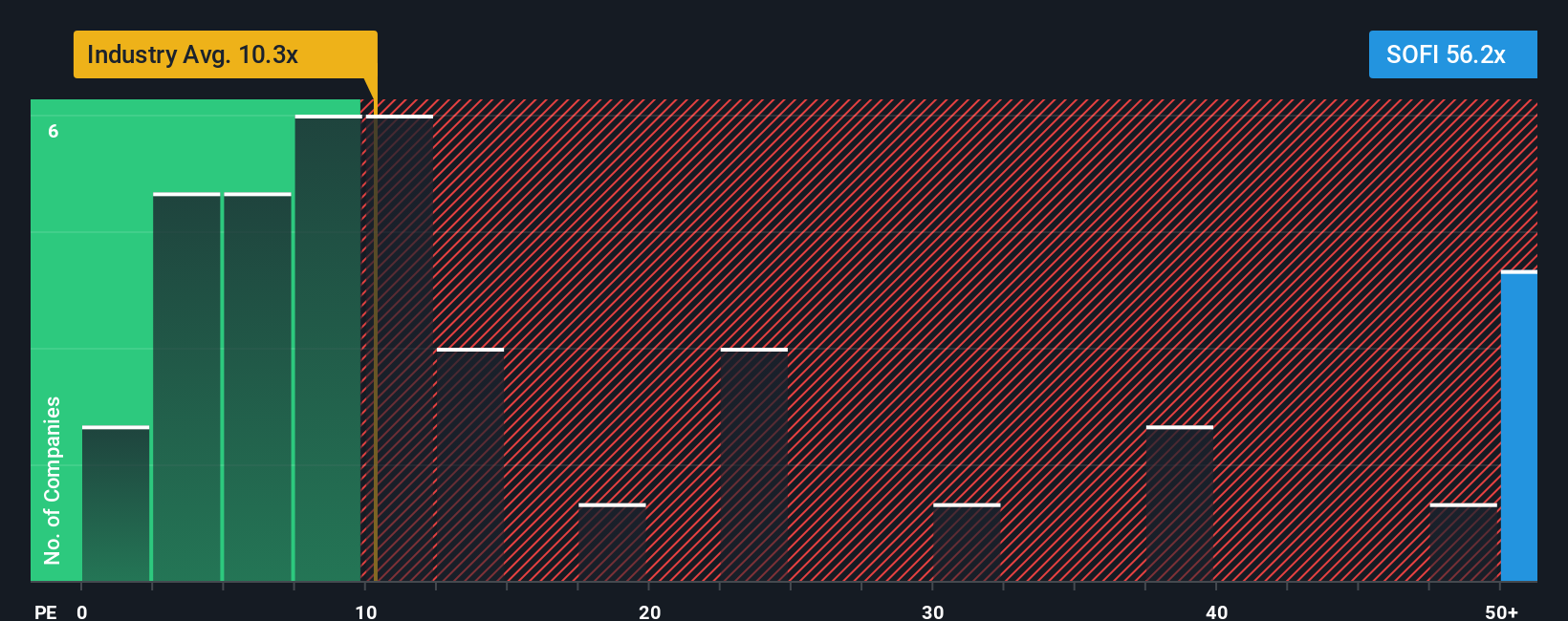

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like SoFi Technologies. It helps investors understand how much they are paying for each dollar of a company's earnings. Generally, higher expected growth and lower risk can justify a higher PE ratio. Companies with slower growth or higher risk tend to trade at lower multiples.

Currently, SoFi Technologies trades at a PE ratio of 53.13x. In comparison, the Consumer Finance industry average PE is 10.27x, and peer companies average 15.01x. These quick benchmarks suggest SoFi’s shares are priced at a significant premium relative to both its industry and peer group. This likely reflects high expectations for future growth and profitability.

Simply Wall St’s proprietary “Fair Ratio” for SoFi stands at 24.88x, which factors in not just industry and peer multiples, but also the company’s specific earnings growth outlook, profit margins, risk profile, and market capitalization. Unlike simple benchmarks, the Fair Ratio adjusts for these fundamental factors and provides a more tailored view of what a reasonable multiple should be for SoFi.

Comparing SoFi’s actual PE ratio of 53.13x to its Fair Ratio of 24.88x, the stock appears priced well above what is justified by its fundamentals and prospects. This suggests the market is currently overvaluing the company relative to its true earnings power.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SoFi Technologies Narrative

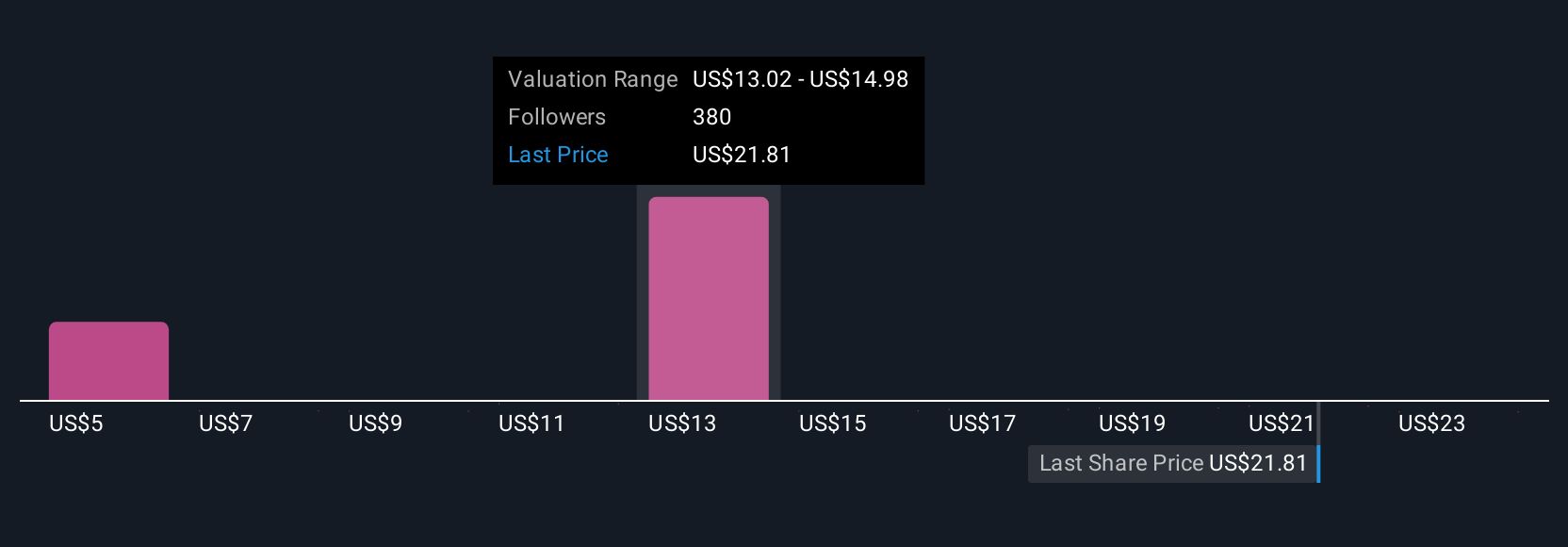

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a way to tell the story behind your investment view, tying together your interpretation of SoFi Technologies’ business prospects with your own assumptions about future revenue, earnings, and profit margins. Narratives translate that story into a clear financial forecast and, ultimately, a fair value, making your investment thesis transparent and actionable.

Unlike static valuation metrics, Narratives empower anyone to combine their personal outlook or analysis with up-to-date market data, producing a fair value that is recalculated whenever new information arrives, such as earnings releases or breaking news. This dynamic approach is straightforward and available to everyone. Millions of investors already use Narratives within the Community page on Simply Wall St’s platform to make smarter, confidence-backed decisions.

Narratives help you decide when to buy or sell by comparing your calculated Fair Value with the current share price, continually adapting as the facts change. For example, some SoFi investors are optimistic, forecasting a Fair Value above $30 per share, while others see more risk and assign values as low as $6, reflecting their unique beliefs about SoFi’s future growth and profitability.

Do you think there's more to the story for SoFi Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives