- United States

- /

- Diversified Financial

- /

- NasdaqCM:SEZL

Will Sezzle’s (SEZL) Leadership Shift and Upbeat Outlook Fortify Its Edge in Fierce BNPL Competition?

Reviewed by Sasha Jovanovic

- Sezzle Inc. recently reported robust third quarter results, raising its 2025 earnings guidance, while announcing a planned CFO transition following Karen Hartje’s 2025 resignation for personal reasons and continuation in a consulting role.

- These updates arrive amid intensified competition in the Buy Now, Pay Later space, with new solutions from PayPal and US Bank entering Sezzle’s core markets.

- We'll now explore how Sezzle's raised earnings outlook and leadership changes shape its investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sezzle Investment Narrative Recap

To be a shareholder in Sezzle, you need to believe in the company's ability to consistently grow its customer base and drive higher engagement in the increasingly competitive Buy Now, Pay Later market. The recent CFO transition, while important for corporate governance, does not appear to materially impact the company's biggest near-term catalysts (continued top-line growth and subscriber migration) or its most pressing risk, which remains higher credit losses as Sezzle expands to new user segments.

Most relevant to current investor focus, Sezzle’s raised guidance for 2025 net income to US$125 million and diluted EPS of US$3.52 underscores management’s ongoing confidence in operational momentum, even as larger rivals increase competition in key markets. This guidance comes as Sezzle aims to reduce credit risk through disciplined underwriting and technology investments, both potential mitigants to the higher provision for credit losses recently reported.

However, it is important to remember that beneath these growth headlines, rising credit losses remain an issue investors should be aware of, especially if macro conditions worsen…

Read the full narrative on Sezzle (it's free!)

Sezzle's narrative projects $885.4 million revenue and $232.2 million earnings by 2028. This requires 33.5% yearly revenue growth and a $127.6 million earnings increase from $104.6 million today.

Uncover how Sezzle's forecasts yield a $108.50 fair value, a 108% upside to its current price.

Exploring Other Perspectives

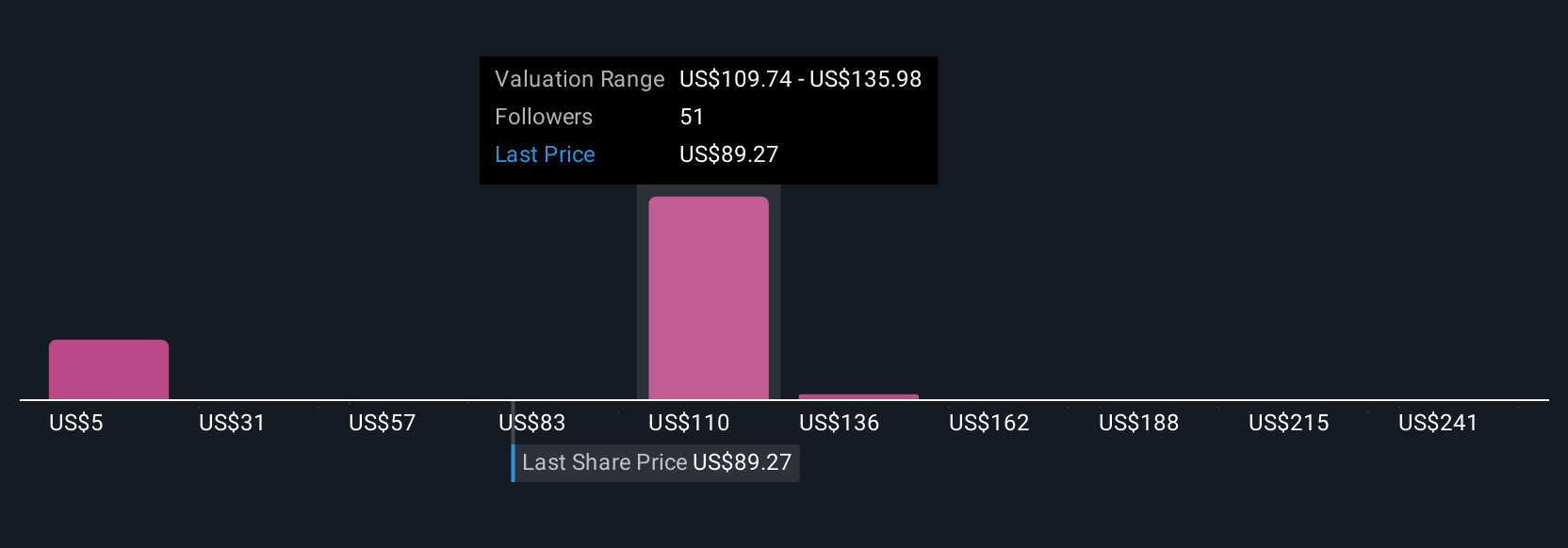

Sixteen fair value estimates from the Simply Wall St Community for Sezzle range from as low as US$8.78 to US$267.23 per share. While viewpoints vary widely, many are watching closely for signs that credit risk will stay contained as Sezzle targets rapid expansion.

Explore 16 other fair value estimates on Sezzle - why the stock might be worth less than half the current price!

Build Your Own Sezzle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sezzle research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sezzle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sezzle's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SEZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives