- United States

- /

- Diversified Financial

- /

- NasdaqCM:SEZL

Sezzle (NasdaqCM:SEZL) Reports Strong Q1 2025 Earnings With Doubling Sales

Reviewed by Simply Wall St

Sezzle (NasdaqCM:SEZL) was removed from several major indices, including the Russell Microcap and Russell 3000E indices, which may have influenced its visibility and investor sentiment. Despite this, the company experienced a remarkable 355% price increase over the last quarter. This significant price movement occurred alongside positive developments, such as a strong Q1 2025 earnings report, which saw sales more than double and net income increase. Additionally, favorable market conditions with rising major indices like the S&P 500 and Nasdaq Composite could have supported Sezzle's share price rally, even as the broader market gained momentum.

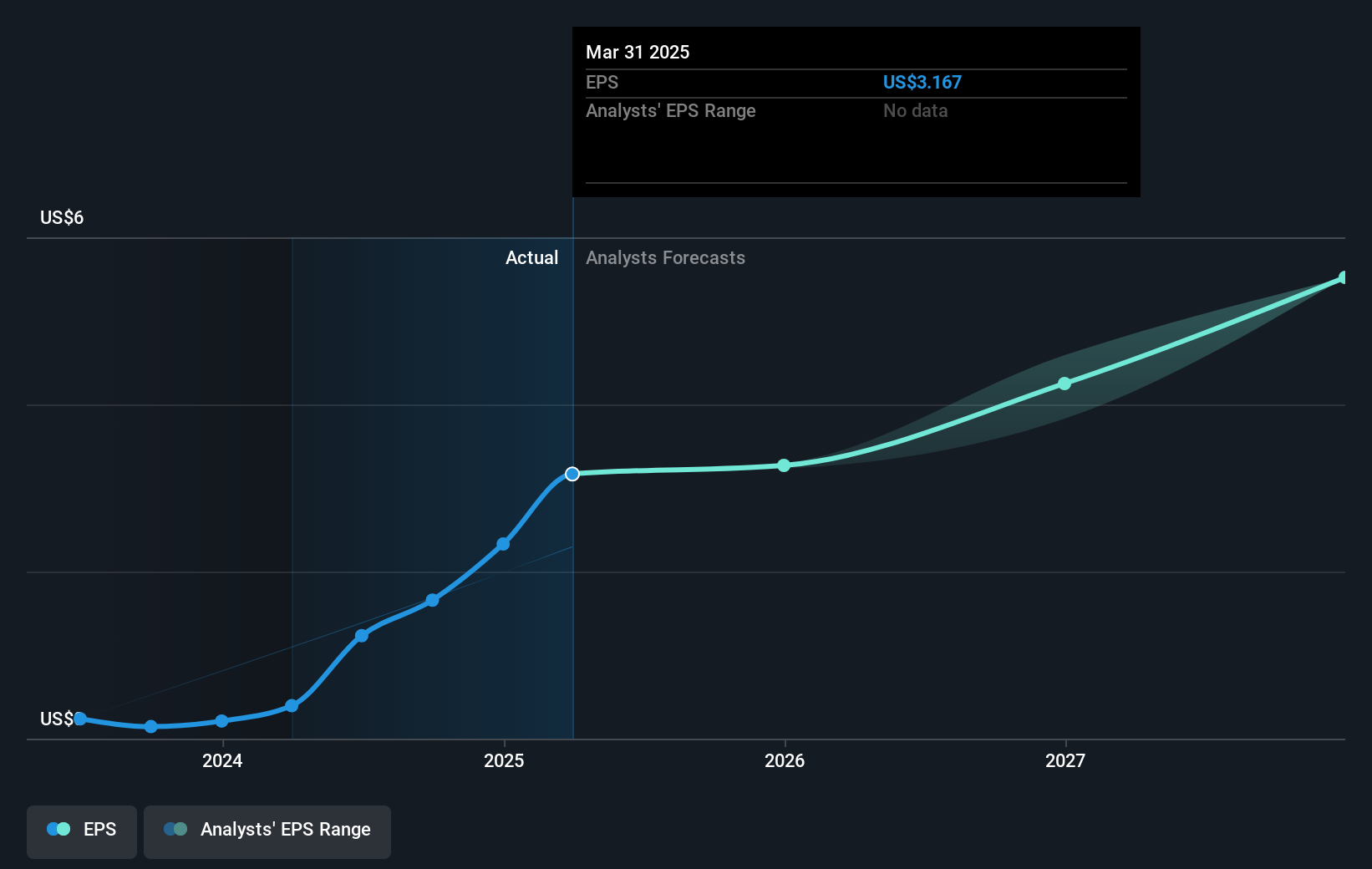

Sezzle's removal from major indices like the Russell Microcap and Russell 3000E could impact its future market visibility and investor sentiment, which aligns with the notable share price increase of 355% over the last quarter and significant developments such as a strong earnings report. The market reaction to these changes underscores investor optimism about Sezzle's growth trajectory, as demonstrated by the introduction of their On-Demand product and partnership with WebBank. This partnership is expected to enhance customer engagement and revenue growth, contributing positively to earnings forecasts for the company.

Over the last year, Sezzle's total returns, including share price and dividends, were exceptionally high, indicating robust long-term performance. Compared to the broader market, Sezzle exceeded both the US market returns of 13.7% and the US Diversified Financial industry returns of 22.9% over the past year. These figures emphasize Sezzle's substantial outperformance in its sector.

While Sezzle’s current share price of US$51.74 is below the consensus price target of US$61.5, a 15.9% increase would be needed to meet analyst expectations. Despite predictions of declining profit margins, analysts still view Sezzle as a promising investment. This outlook is underpinned by anticipated revenue of $494.2 million and earnings of $124.3 million by 2028, contingent upon successful customer engagement and market expansion.

Learn about Sezzle's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SEZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives