- United States

- /

- Diversified Financial

- /

- NasdaqCM:SEZL

Reassessing Sezzle (NasdaqCM:SEZL) Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Sezzle (NasdaqCM:SEZL) shares have been on the move recently, catching investors' attention as the company continues delivering double-digit annual revenue and net income growth. Investors are watching closely to see if this momentum can be sustained in light of recent share price changes.

See our latest analysis for Sezzle.

Sezzle’s share price has pulled back considerably in recent weeks, with a 30-day share price return of -29.41 percent and an even steeper drop over the past 90 days. While the stock is still up 14.68 percent year-to-date, total shareholder return over the past year has slipped into negative territory at -18.74 percent. This suggests that recent volatility has weighed on longer-term holders. This kind of momentum shift signals the market is actively reassessing either the company’s future growth prospects or risk profile.

If you’re looking for your next growth idea beyond Sezzle, now’s the perfect opportunity to broaden your outlook and discover fast growing stocks with high insider ownership

Given the recent drop but ongoing revenue and net income growth, the key question now is whether Sezzle is trading below its true value or if the current price already reflects all future growth prospects. Could this be a buying opportunity, or is everything priced in?

Most Popular Narrative: 51.9% Undervalued

According to the most widely followed narrative, Sezzle's estimated fair value far exceeds the latest close, suggesting substantial upside. With analysts projecting much stronger future financials, the attention now shifts to the core factors that underlie this gap.

Strong momentum from younger consumers, efficient customer acquisition, and expanding product offerings position Sezzle for sustained revenue growth and improved margins. Disciplined risk management, cost optimization, and robust merchant acceptance support stable long-term earnings and a competitive edge in the digital payments space.

Curious how bold projections for revenue and margins could lead to such an aggressive upside versus the market price? There is a powerful engine of growth and efficiency fueling this target. But what is the crucial assumption driving the consensus valuation so much higher than today’s price? Dive in to unveil exactly what is propelling this narrative’s optimism and see if it matches your outlook.

Result: Fair Value of $108.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising credit losses and ongoing litigation present meaningful risks. These factors could slow Sezzle’s growth and challenge the current bullish outlook.

Find out about the key risks to this Sezzle narrative.

Another View: Is Sezzle Really That Undervalued?

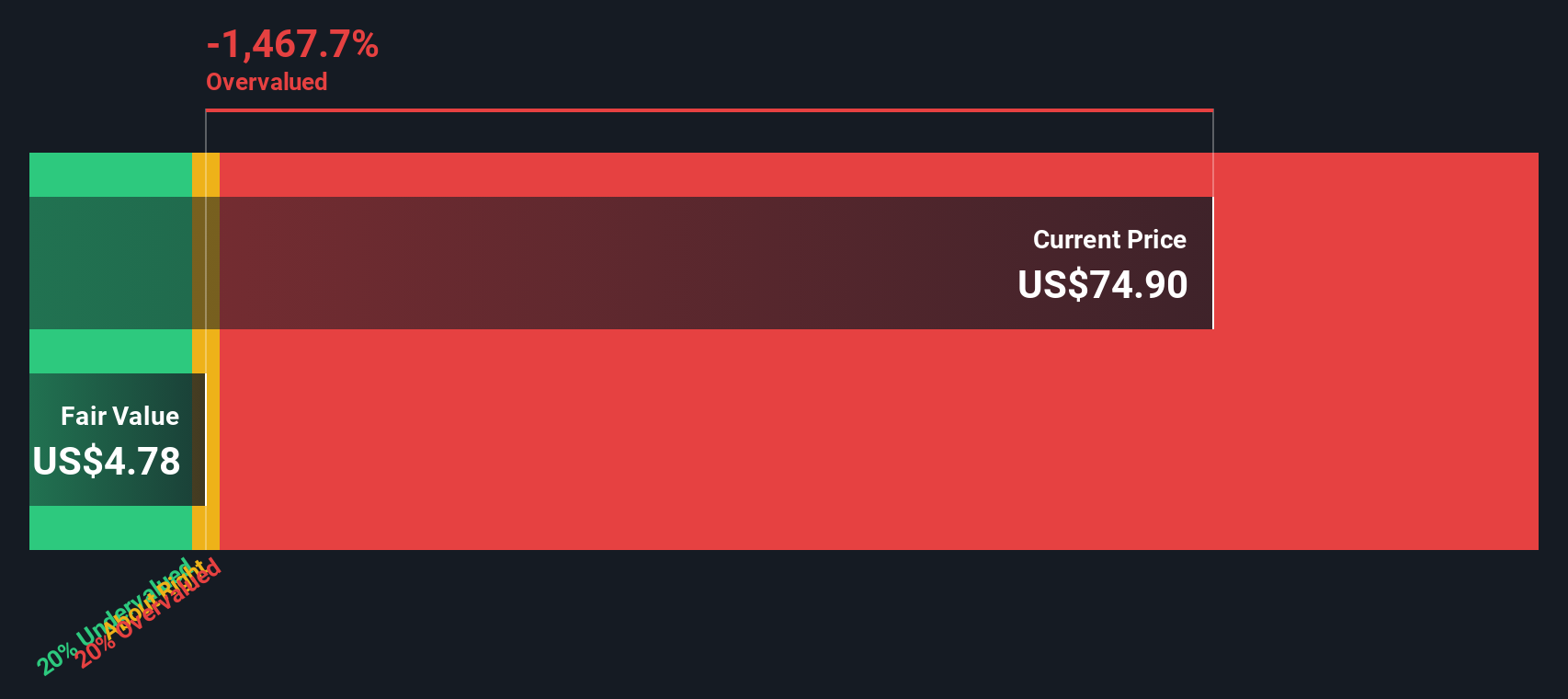

Looking at Sezzle’s valuation through our SWS DCF model gives a sharply different picture. This approach points to a much lower fair value than the current share price, suggesting the market may be too optimistic about future growth. This raises the question: are downside risks understated, or is the DCF too conservative given recent momentum?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sezzle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sezzle Narrative

If you see things differently or want to form your own perspective, digging into the details yourself is easy and takes just minutes. Do it your way

A great starting point for your Sezzle research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities pass you by. If you want to target new growth themes or income streams, use the Simply Wall St Screener to find smart alternatives in just minutes.

- Catch the next wave of innovation by focusing on game-changing tech with these 25 AI penny stocks, set to disrupt entire industries through artificial intelligence advancements.

- Lock in steady returns and boost your portfolio’s resilience when you consider these 16 dividend stocks with yields > 3%, offering reliable income paired with financial strength.

- Position yourself ahead of market trends by choosing value opportunities among these 886 undervalued stocks based on cash flows, that analysts say are priced below their real potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SEZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives