- United States

- /

- Capital Markets

- /

- NasdaqGS:SEIC

SEI Investments Company (NASDAQ:SEIC) Vies For A Place In Your Dividend Portfolio: Here's Why

Is SEI Investments Company (NASDAQ:SEIC) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

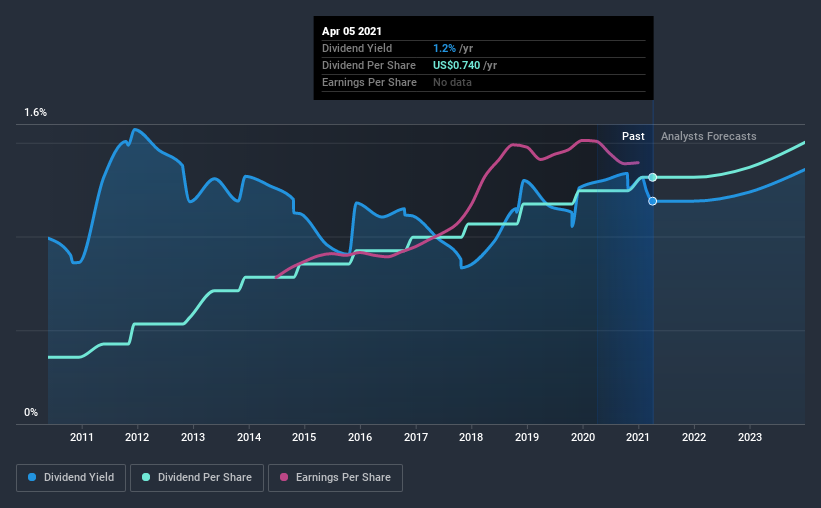

While SEI Investments's 1.2% dividend yield is not the highest, we think its lengthy payment history is quite interesting. The company also returned around 4.2% of its market capitalisation to shareholders in the form of stock buybacks over the past year. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on SEI Investments!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. SEI Investments paid out 24% of its profit as dividends, over the trailing twelve month period. We'd say its dividends are thoroughly covered by earnings.

Remember, you can always get a snapshot of SEI Investments' latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of SEI Investments' dividend payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past 10-year period, the first annual payment was US$0.2 in 2011, compared to US$0.7 last year. This works out to be a compound annual growth rate (CAGR) of approximately 14% a year over that time.

With rapid dividend growth and no notable cuts to the dividend over a lengthy period of time, we think this company has a lot going for it.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Earnings have grown at around 8.8% a year for the past five years, which is better than seeing them shrink! A low payout ratio and strong historical earnings growth suggests SEI Investments has been effectively reinvesting in its business. We think this generally bodes well for its dividend prospects.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, we like that SEI Investments has a low and conservative payout ratio. We like that it has been delivering solid improvement in its earnings per share, and relatively consistent dividend payments. Overall, we think there are a lot of positives to SEI Investments from a dividend perspective.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for SEI Investments that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

When trading SEI Investments or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade SEI Investments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:SEIC

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives