- United States

- /

- Capital Markets

- /

- NasdaqGS:SEIC

Is SEI Investments' H.I.G. Capital Mandate Shaping a New Growth Path for SEIC?

Reviewed by Sasha Jovanovic

- In recent weeks, SEI Investments has announced a series of client partnerships and leadership changes, including being selected by H.I.G. Capital to provide fund administration and depositary services for private equity and infrastructure assets, as well as a collaboration with Graphene to strengthen wealth management offerings.

- SEI's investment in technology and executive leadership underscores its focus on streamlining operations, expanding service reach, and supporting continued business growth across wealth management and private banking.

- We'll examine how the H.I.G. Capital mandate to SEI for private markets services could influence SEI's investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

SEI Investments Investment Narrative Recap

To own SEI Investments, I believe you need conviction in the firm’s ability to scale its outsourcing and fund administration solutions, especially as the financial sector turns to technology for efficiency. The recent H.I.G. Capital mandate adds a prominent client but is unlikely to rapidly transform short-term financial catalysts or immediately offset the ongoing risk of margin pressure from rising tech and talent investment, these structural headwinds remain the most pressing challenge for the company right now.

Of the recent announcements, SEI’s agreement with H.I.G. Capital stands out as particularly relevant since it touches directly on the firm's ambition to win large, complex mandates in private markets, supporting its ongoing push for broader revenue streams. While onboarding significant clients like H.I.G. can enhance growth visibility, the timing and profitability from such wins can be unpredictable, and larger mandates may heighten operational demands that impact near-term cost performance.

However, it’s worth noting that if expense growth from hiring and tech upgrades continues to outpace realized revenue, investors should be aware that ...

Read the full narrative on SEI Investments (it's free!)

SEI Investments' narrative projects $2.5 billion revenue and $733.0 million earnings by 2028. This requires 4.8% yearly revenue growth and a $43.7 million earnings increase from $689.3 million today.

Uncover how SEI Investments' forecasts yield a $102.17 fair value, a 22% upside to its current price.

Exploring Other Perspectives

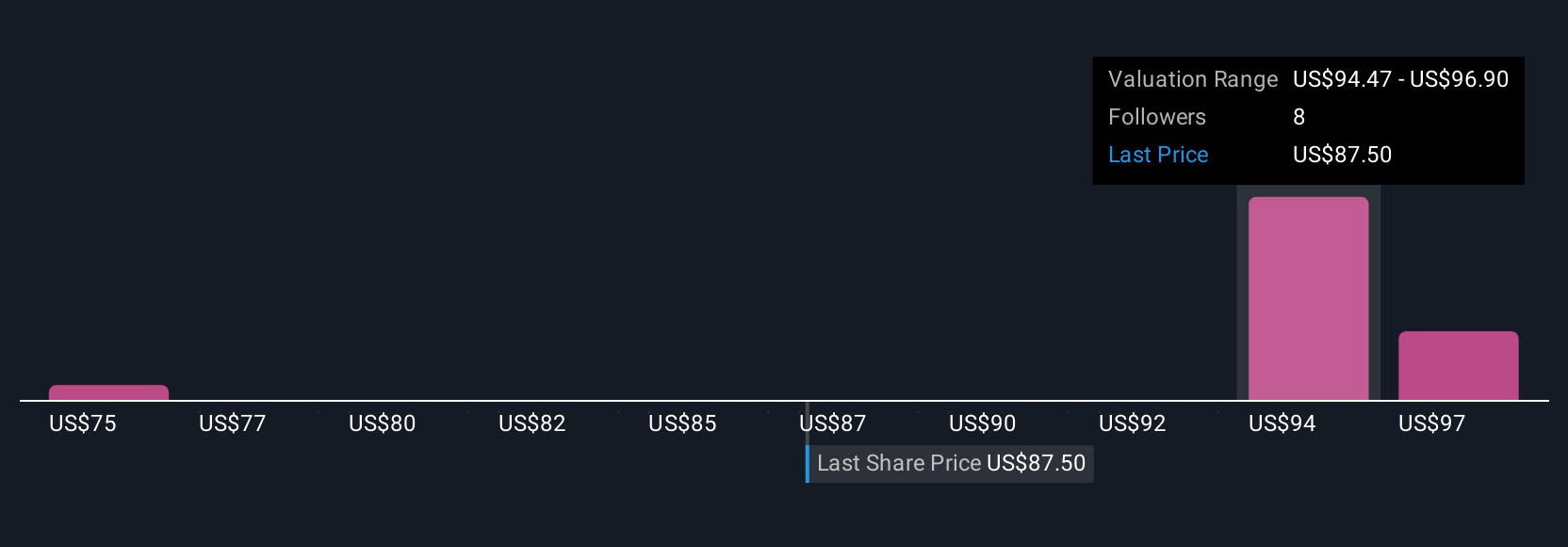

Simply Wall St Community members generated three fair value estimates for SEI Investments ranging from US$75 to US$102.17 per share, showing wide opinion diversity. Against this backdrop of varied valuations, many are also weighing the firm’s persistent margin risks and what they mean for future profitability, consider exploring several perspectives before forming your view.

Explore 3 other fair value estimates on SEI Investments - why the stock might be worth as much as 22% more than the current price!

Build Your Own SEI Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SEI Investments research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free SEI Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SEI Investments' overall financial health at a glance.

No Opportunity In SEI Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEIC

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives