- United States

- /

- Capital Markets

- /

- NasdaqGM:RILY

B. Riley Financial (RILY): Evaluating Valuation After a Sharp Earnings Rebound and Profitability Turnaround

Reviewed by Simply Wall St

B. Riley Financial (RILY) just swung from a huge loss to solid profitability in its latest second quarter report, with revenue more than doubling and earnings per share flipping sharply back into positive territory.

See our latest analysis for B. Riley Financial.

The strong earnings rebound comes after a volatile stretch, with a sharp 1 day share price return of minus 17.5 percent and a 90 day share price return of minus 34.1 percent. The 3 year total shareholder return of minus 84.4 percent shows that long term confidence still needs rebuilding even as near term momentum looks tentative.

If this turnaround story has your attention, it could be a good moment to scan the market for other potential rebounds and discover fast growing stocks with high insider ownership.

With earnings rebounding but multi year returns still deeply negative and the stock trading at a steep intrinsic discount, is B. Riley Financial quietly undervalued today, or is the market already pricing in the next leg of growth?

Price to Sales of 0.2x: Is It Justified?

B. Riley Financial closed at $4.72, and on a price to sales basis the stock looks extremely cheap versus peers and the broader Capital Markets industry.

The preferred multiple here is the price to sales ratio, which compares the company’s market value with the revenue it generates. For a diversified financial services group with volatile earnings and negative equity, sales based valuation can sometimes be a cleaner lens than profit based metrics.

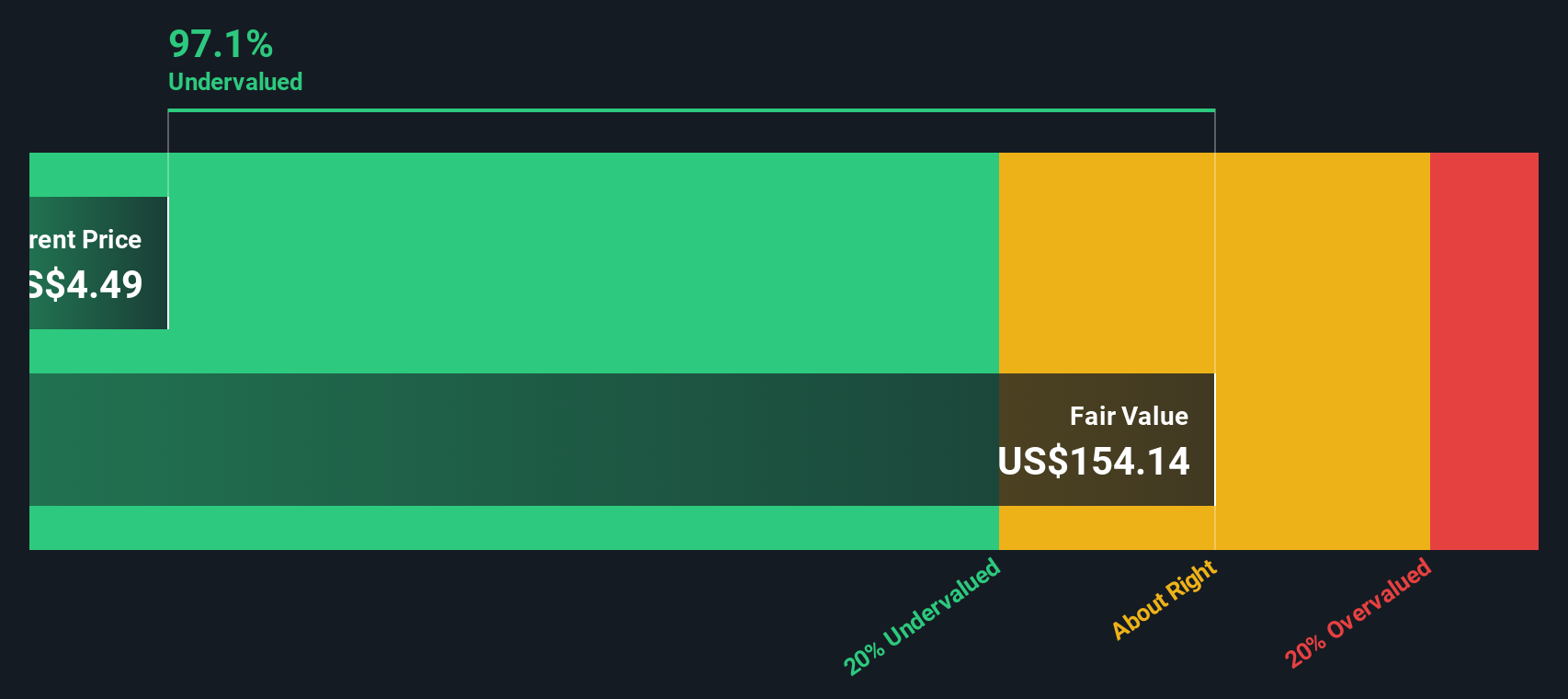

RILY trades on a price to sales ratio of just 0.2 times, while its closest peers average 17.2 times and the wider US Capital Markets industry sits at 3.8 times. That is a dramatic discount and suggests the market is heavily discounting the durability, quality and risk profile of those revenues, even as our DCF work also flags the stock as deeply undervalued versus an estimated fair value of $154.14.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Sales of 0.2x (UNDERVALUED)

However, investors still face meaningful risks, including RILY’s history of steep shareholder losses and structurally volatile earnings across its diversified and sometimes cyclical businesses.

Find out about the key risks to this B. Riley Financial narrative.

Another View: SWS DCF Points to Even Deeper Value

Our DCF model paints an even starker picture, suggesting fair value around $154.14 versus today’s $4.72 share price. That implies RILY could be significantly undervalued if cash flows normalize, but also raises a hard question: is the market pricing in risks the model cannot fully capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out B. Riley Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own B. Riley Financial Narrative

If you see the numbers differently or want to stress test our assumptions against your own, you can build a personalized narrative in just a few minutes: Do it your way.

A great starting point for your B. Riley Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, scan fresh opportunities on the Simply Wall St Screener so you can stay updated on potential standout ideas.

- Explore these 26 AI penny stocks that are harnessing artificial intelligence to reshape industries and create powerful new business models.

- Review these 13 dividend stocks with yields > 3% that can help support your portfolio with potential cash returns during a range of market conditions.

- Look into these 80 cryptocurrency and blockchain stocks that are building businesses around blockchain and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if B. Riley Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RILY

B. Riley Financial

Through its subsidiaries, provides financial services in North America, Australia, the Asia Pacific, and Europe.

Good value with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)