- United States

- /

- Consumer Finance

- /

- NasdaqGS:QFIN

What Qfin Holdings (QFIN)'s Declining Margins and Share Buybacks Mean for Shareholders

Reviewed by Sasha Jovanovic

- Qfin Holdings announced its unaudited financial results for the third quarter ended September 30, 2025, reporting revenue of CNY 5.21 billion and net income of CNY 1.44 billion, with updated earnings guidance for the rest of the year.

- An interesting insight from the disclosure is that despite resilient platform activity and a significant share repurchase plan, quarterly net income declined compared to the prior year, highlighting ongoing macroeconomic and regulatory headwinds.

- Next, we'll assess how the latest dip in quarterly profit margins could reshape Qfin Holdings’ investment narrative and outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Qfin Holdings Investment Narrative Recap

Qfin Holdings’ investment story rests on the belief that its AI-powered credit-tech platform can sustain growth despite regulatory shifts and a volatile macro backdrop. The third quarter results, with revenue up year on year but net income down, do not appear to meaningfully shift the main catalyst, ongoing digital lending adoption, but do reinforce the near-term risk of earnings pressure from heightened regulatory and economic uncertainties.

Among recent announcements, the board’s approval of a substantial share repurchase plan, with US$281 million already spent, stands out in this context. While capital returns can signal management’s confidence, their impact could be muted if macro conditions and regulatory scrutiny continue to impact profit margins and growth expectations.

In contrast, what isn’t always visible from headline numbers is the deeper concern around ongoing regulatory uncertainty and potential new lending rules that investors should be aware of…

Read the full narrative on Qfin Holdings (it's free!)

Qfin Holdings' outlook anticipates CN¥23.0 billion in revenue and CN¥8.4 billion in earnings by 2028. This implies a yearly revenue growth rate of 7.0% and a CN¥1.1 billion increase in earnings from the current CN¥7.3 billion level.

Uncover how Qfin Holdings' forecasts yield a $47.10 fair value, a 110% upside to its current price.

Exploring Other Perspectives

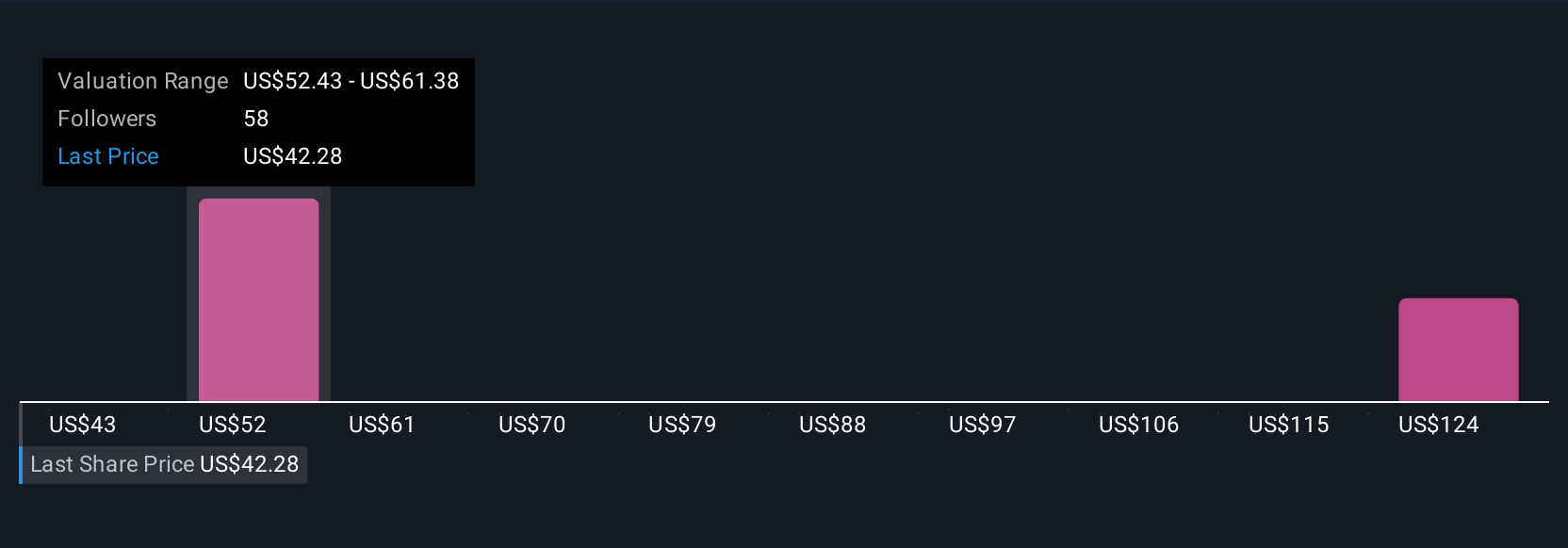

Ten private investors from the Simply Wall St Community estimated Qfin’s fair value between CNY 45.27 and CNY 118.33 per share. With recent profit margin pressure, some may question whether this wide range fully reflects the risks around future regulatory tightening or earnings fluctuations.

Explore 10 other fair value estimates on Qfin Holdings - why the stock might be worth over 5x more than the current price!

Build Your Own Qfin Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qfin Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Qfin Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qfin Holdings' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qfin Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QFIN

Qfin Holdings

Qfin Holdings, Inc., together with its subsidiaries, operate AI- driven credit-tech platform under the Qifu Jietiao brand in the People’s Republic of China.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives