- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

PayPal (PYPL): Evaluating Whether Recent Stock Moves Offer a Value Opportunity

Reviewed by Simply Wall St

If you hold shares in PayPal Holdings (PYPL), or are thinking about it, recent movements in the stock might have you wondering what comes next. There hasn't been any breaking news or a headline-grabbing announcement, but a shift in the share price can still trigger important questions for those evaluating where to put their money. Sometimes, even a lack of news can be telling, especially as PayPal navigates an increasingly competitive payments landscape.

Looking at the bigger picture, PayPal Holdings has seen its stock lose momentum throughout the past year. The shares have trended lower, with returns slipping both in the last month and over the past year. Even as revenue and net income have managed mid-single-digit growth, longer-term returns have lagged behind broader market benchmarks and many of its peers. This sluggish performance has left the market re-assessing the company’s growth prospects and risk profile.

The real question now is whether PayPal’s current share price is reflecting all of its challenges and opportunities, or if markets are overlooking the potential for stronger growth ahead. Could there be a window for investors to get in at an attractive valuation?

Most Popular Narrative: 36% Undervalued

According to Zwfis, PayPal appears significantly undervalued relative to its intrinsic value, mainly due to the market overlooking major growth catalysts and ambitious profitability targets.

Venmo is a very popular app/tool that people are using all over. One thing that they/past management had issues with was how to monetize it. Slowly, besides transaction fees and earning interest off of customers' unused cash, they have started to begin to add a Debit and a Credit card into the mix. Along with that, what I am most bullish on is how they are having Venmo being able to be used in stores. I mean, even the other day when I was on DoorDash I noticed that Venmo is now an option to use for payment. They already made a very simple process begin to spread into the merchant business, which I believe will bring in a lot of revenue while raising profit margins.

Ready for the breakdown behind this bold valuation? The narrative leans on surprisingly optimistic assumptions about profit expansion and new revenue streams, especially within PayPal’s most recognizable brands. Want to see what aggressive targets fuel this projection? Keep reading to uncover the quantitative drivers; some may defy your expectations.

Result: Fair Value of $105.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain if PayPal’s rivals capture market share or if new product launches, such as PayPal World, do not deliver expected results.

Find out about the key risks to this PayPal Holdings narrative.Another View: The SWS DCF Model

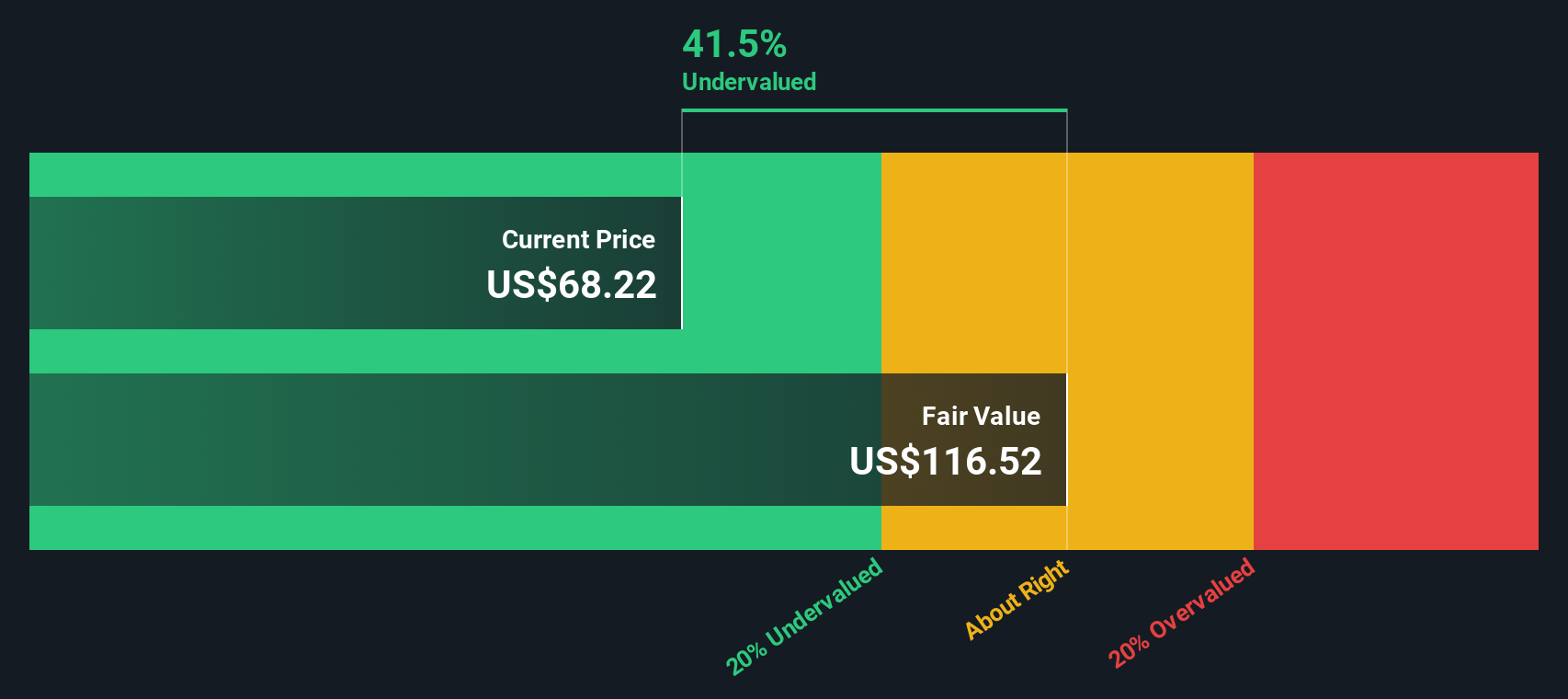

While the previous argument focused on PayPal’s growth prospects, our SWS DCF model also finds the stock undervalued at recent levels. Despite recent headwinds, cash flow projections still suggest meaningful upside potential. Could this model be missing risks that matter? Or does it reinforce the opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PayPal Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PayPal Holdings Narrative

If you have your own perspective or want to dig deeper, you’re welcome to review the numbers and build your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding PayPal Holdings.

Looking for More Sharply-Priced Opportunities?

Smart portfolios are built on fresh ideas, and the best opportunities do not wait around. Use these handpicked stock guides to power up your watchlist before the next market mover hits.

- Spot hidden gems with solid fundamentals by targeting penny stocks with strong financials. These companies stand out for their financial health and growth potential.

- Tap into tomorrow’s innovation leaders by focusing on AI penny stocks that are positioned to drive breakthroughs in artificial intelligence and automation.

- Boost your income strategy by uncovering dividend stocks with yields > 3% that consistently deliver strong, reliable yields above average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives