- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

Did PayPal's (PYPL) Launch of Ads Manager Just Shift Its Payment-to-Commerce Investment Narrative?

Reviewed by Sasha Jovanovic

- On October 7, PayPal introduced PayPal Ads Manager, a new digital advertising platform that enables the millions of small businesses in its network to monetize their store traffic and manage ad inventory through their existing PayPal Merchant Portal.

- This launch allows PayPal to open up retail media network opportunities, traditionally available only to large enterprises, to small businesses, potentially reshaping the digital advertising landscape for merchants and brands alike.

- We'll explore how PayPal's expansion into digital advertising with Ads Manager could influence its broader transition from payments to commerce.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

PayPal Holdings Investment Narrative Recap

To own PayPal shares today, you need to believe in the company’s ongoing transformation from a pure-play payments business into a broader commerce platform with data-driven services for merchants. The launch of PayPal Ads Manager is an incremental step within this strategy, broadening potential near-term revenue streams; however, its immediate effect on the company’s core transaction growth, still the most important short-term catalyst, remains limited. The largest risk in focus continues to be competition in key markets like the UK, which could restrain PayPal’s ability to maintain revenue growth regardless of product launches.

Among recent announcements, the partnership with Google, focusing on digital commerce solutions, aligns closely with PayPal’s push into integrated platforms and expanded merchant services. This context matters to the Ads Manager introduction, providing potential cross-platform advantages as PayPal looks to scale new offerings and drive greater merchant engagement. Yet, even as product breadth widens, the ultimate outcome will depend on ...

Read the full narrative on PayPal Holdings (it's free!)

PayPal Holdings' outlook anticipates $38.1 billion in revenue and $5.4 billion in earnings by 2028. This is based on an expected 5.6% annual revenue growth rate and a $0.7 billion increase in earnings from the current $4.7 billion.

Uncover how PayPal Holdings' forecasts yield a $82.52 fair value, a 22% upside to its current price.

Exploring Other Perspectives

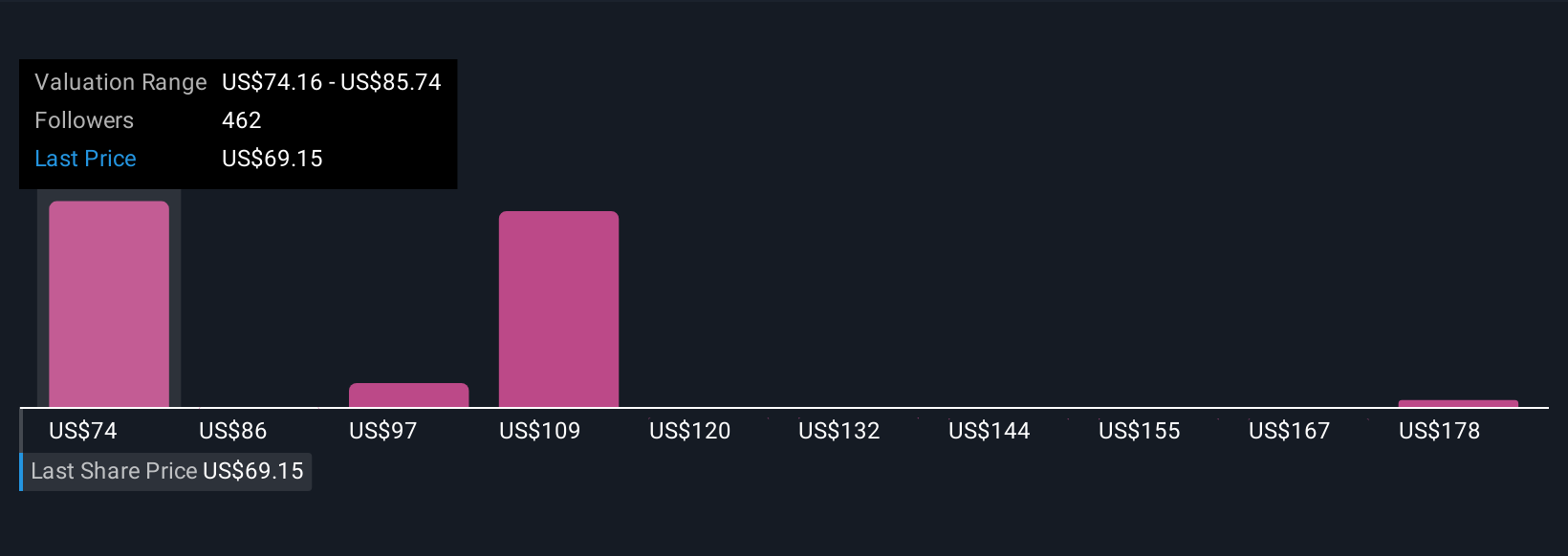

Sixty-six individual fair value estimates from the Simply Wall St Community span from US$74.16 to US$189.96 per share. As PayPal expands beyond payments, competition in core markets remains critical to watch for long-run performance. Review alternative opinions now.

Explore 66 other fair value estimates on PayPal Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own PayPal Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PayPal Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free PayPal Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PayPal Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion