- United States

- /

- Capital Markets

- /

- NasdaqGS:PWP

Does PWP’s Talent Push Offset M&A Slowdown After Sharp Earnings Drop?

Reviewed by Sasha Jovanovic

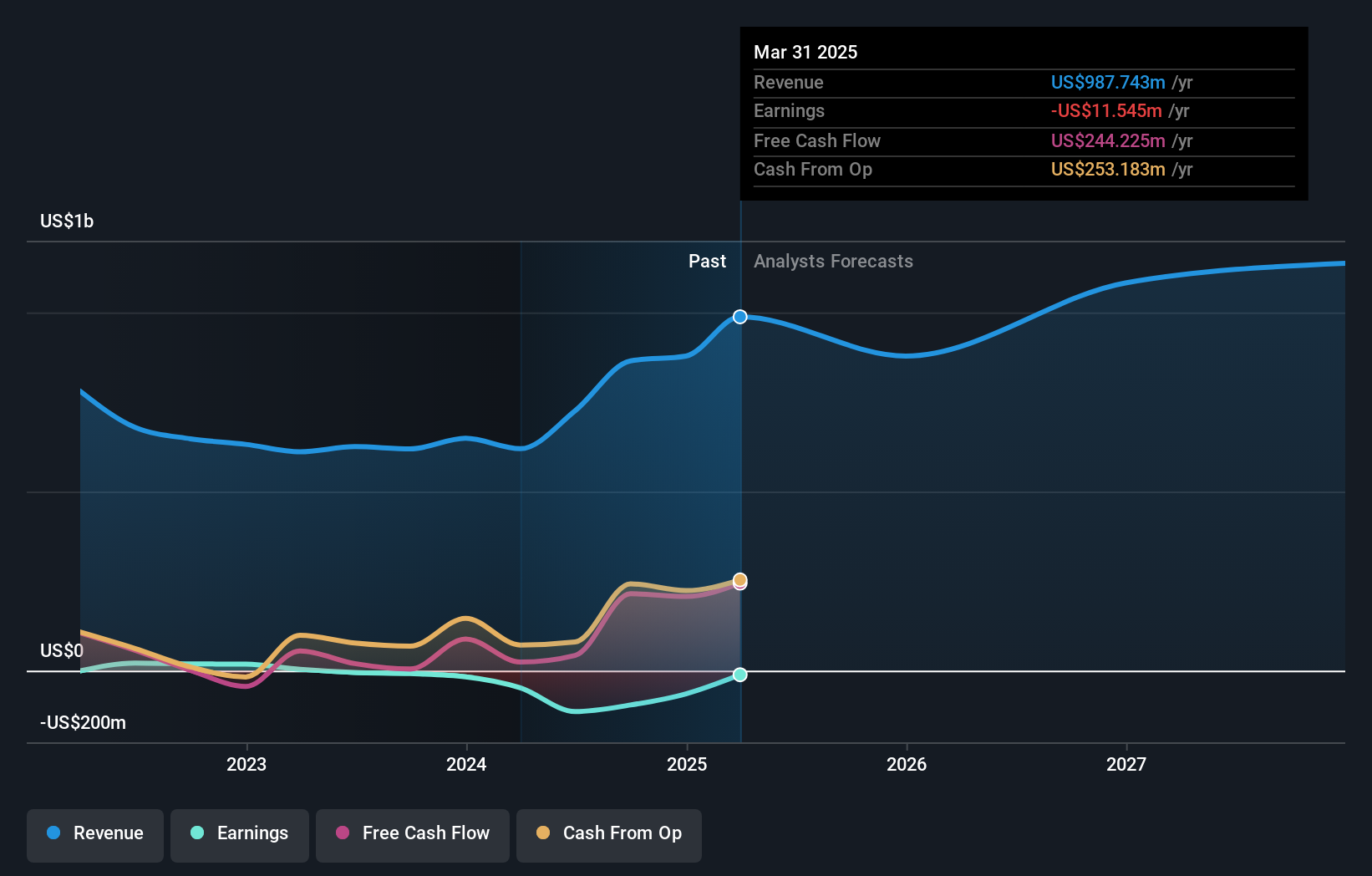

- Perella Weinberg Partners announced third quarter 2025 results, reporting a 41% year-over-year revenue decline driven by reduced M&A activity and net income of US$6 million, down from US$16.37 million a year ago.

- Despite the earnings miss, the firm highlighted an ongoing focus on talent acquisition and completed its Devon Park Advisors acquisition, aiming to strengthen its future advisory capabilities.

- We'll explore how Perella Weinberg's investment in new senior bankers shapes the company's investment narrative amid current market pressures.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Perella Weinberg Partners' Investment Narrative?

For investors looking at Perella Weinberg Partners, the big picture centers around the firm’s ability to steer through swings in M&A activity while leveraging its balance sheet strength and recent investments in advisory talent. The third quarter’s sharp revenue decline and earnings miss reinforce how sensitive the business remains to deal flow, which is a crucial short-term catalyst. However, the immediate impact on outlook may not be as material as feared, PWP has no debt, maintains a strong cash position, and continued shareholder returns with a steady dividend and ongoing buybacks. The acquisition of Devon Park Advisors and a push to add senior bankers reflect clear intent to capitalize on a rebound in transaction volumes. The biggest current risks include ongoing weakness in M&A markets or an extended period of low transaction activity, which would challenge near-term profit growth and could test investor patience if the recent softness continues. In this context, the latest news fits as both a reminder of cyclical volatility and a signal that management is proactively positioning the firm for recovery.

But watch out: recent M&A softness is a risk not all investors are considering. Our expertly prepared valuation report on Perella Weinberg Partners implies its share price may be too high.Exploring Other Perspectives

Explore another fair value estimate on Perella Weinberg Partners - why the stock might be worth just $24.75!

Build Your Own Perella Weinberg Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perella Weinberg Partners research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Perella Weinberg Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perella Weinberg Partners' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PWP

Perella Weinberg Partners

An independent advisory firm, provides strategic and financial advice services in the United States and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives