- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Will Securing IFFEd's Global Custody Business Redefine Northern Trust's (NTRS) Strategic Narrative?

Reviewed by Sasha Jovanovic

- The International Finance Facility for Education (IFFEd) recently appointed Northern Trust to provide global custody services for its Switzerland-based organization, which is focused on innovative education financing and is endorsed by the G20 with a triple A credit rating.

- This mandate underscores Northern Trust's standing as a trusted institutional provider and highlights its ability to attract high-profile clients operating in critical global sectors.

- Given this major client win, we'll look at how securing IFFEd as a partner could affect Northern Trust’s investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Northern Trust Investment Narrative Recap

For shareholders, the key investment case for Northern Trust is its reputation as a global leader in asset servicing, wealth management, and capital markets, with a focus on expanding relationships with large, complex clients. The recent IFFEd mandate further supports Northern Trust's institutional credibility, but is unlikely to immediately shift the biggest short-term catalyst, continued growth in assets under management or servicing, and does not materially affect the primary risk of slower revenue growth compared to the broader market.

The company's recently announced share repurchase program of up to US$2.5 billion is especially relevant, as it underscores management’s focus on capital returns at a time when attracting high-profile mandates like IFFEd could enhance confidence in their growth outlook. This buyback also addresses one of the catalysts for near-term shareholder value, especially as Northern Trust seeks to manage lower forecasted revenue and profit growth than the overall market.

By contrast, investors should be aware that the single greatest risk in the current narrative remains Northern Trust’s revenue growth lagging the broader market, and how...

Read the full narrative on Northern Trust (it's free!)

Northern Trust's outlook anticipates $8.2 billion in revenue and $1.4 billion in earnings by 2028. This scenario is based on a 1.6% annual revenue decline and a $0.7 billion decrease in earnings from the current $2.1 billion.

Uncover how Northern Trust's forecasts yield a $133.21 fair value, a 4% upside to its current price.

Exploring Other Perspectives

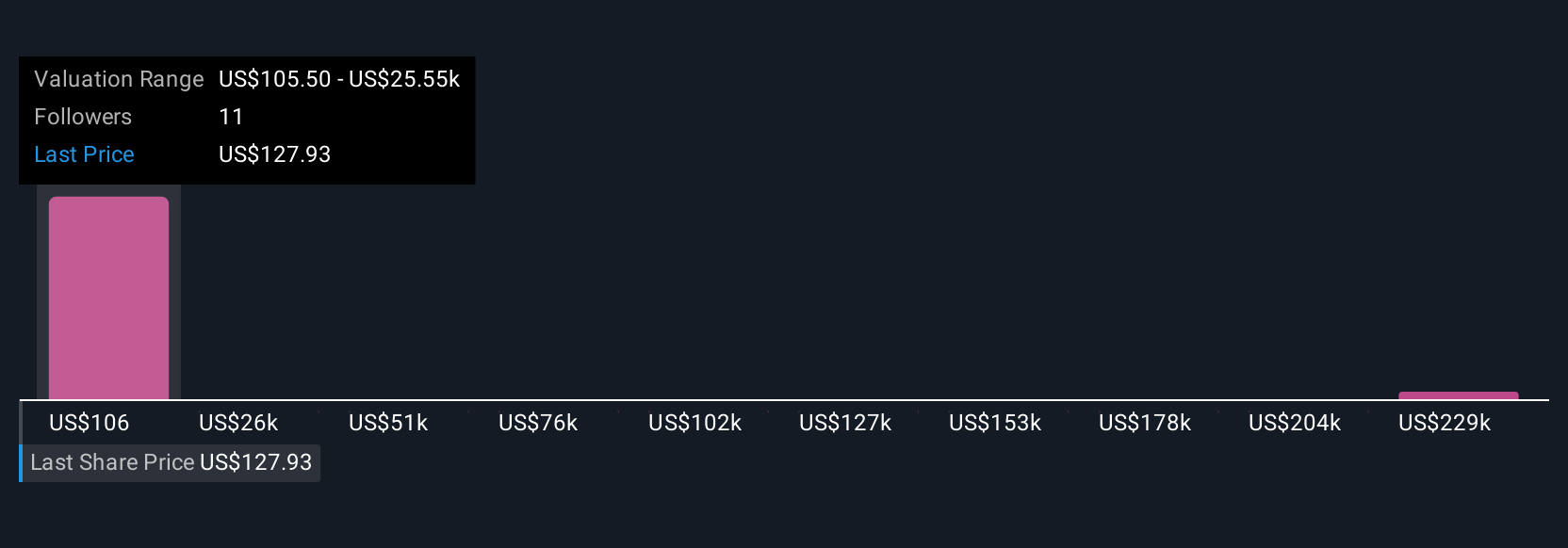

Four separate fair value estimates from the Simply Wall St Community range from US$110 to over US$254,000. While many see growth opportunities around large client mandates, opinions remain sharply divided about long-term earnings trends and the pace of market expansion, explore how your view compares.

Explore 4 other fair value estimates on Northern Trust - why the stock might be worth 14% less than the current price!

Build Your Own Northern Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northern Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Trust's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives