- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Northern Trust (NTRS): Profit Margin Beats Raise Questions for Bullish Narratives

Reviewed by Simply Wall St

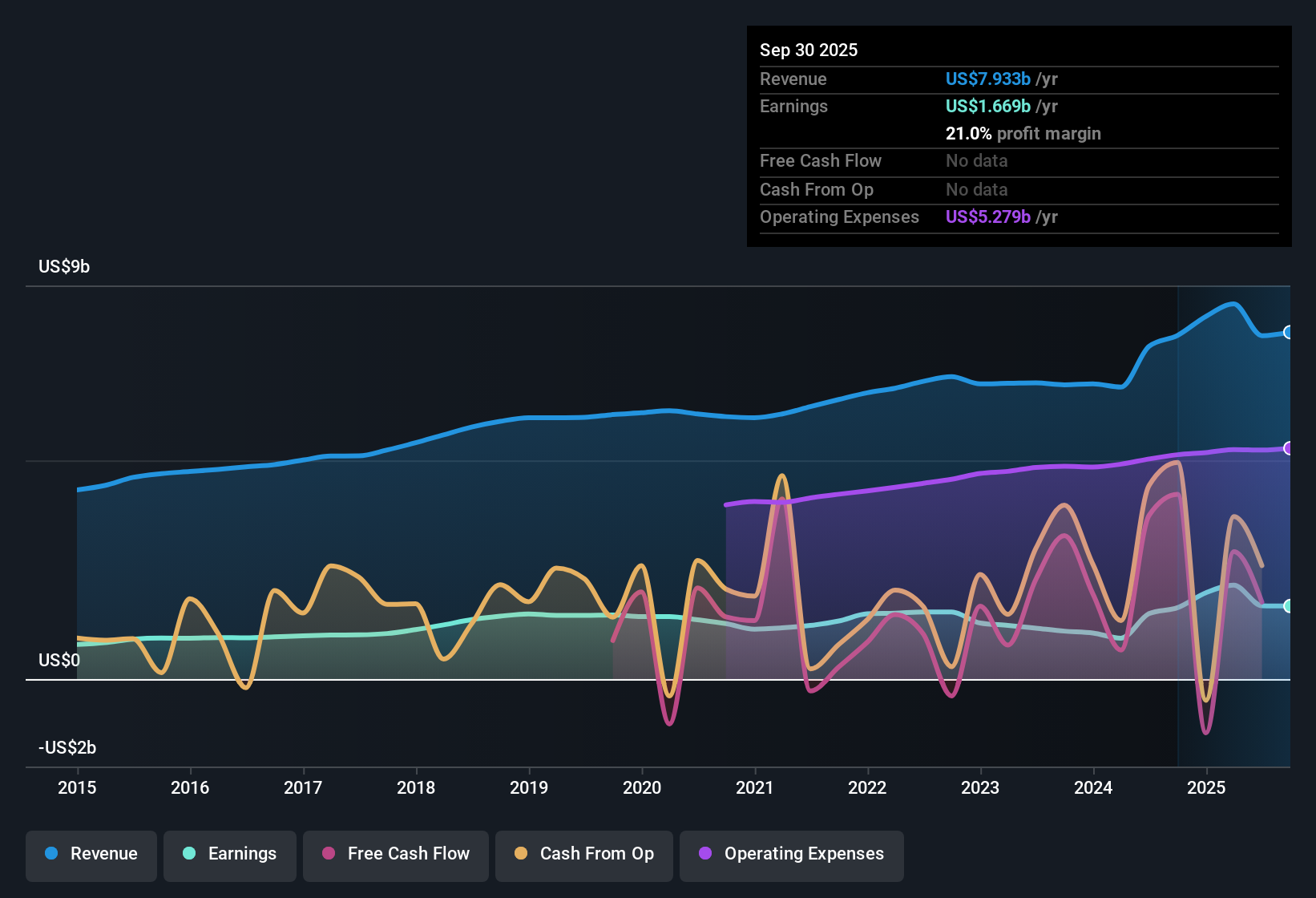

Northern Trust (NTRS) posted a robust 12.1% earnings growth this year, topping its five-year annual average of 7%. Net profit margins improved from 19.7% to 21.4%, highlighting a stronger bottom line. With earnings forecast to rise 4.2% per year and revenue projected at 3.5% annual growth, the company is pacing behind the broader US market. However, it remains attractively valued at a 14.3x P/E compared to industry peers. Investors may find the combination of widening margins, disciplined growth, and a competitive valuation especially compelling.

See our full analysis for Northern Trust.Next up, we will put these headline numbers side by side with the main narratives that drive investor sentiment to see which stories hold up and which get upended.

See what the community is saying about Northern Trust

Profit Margins Edge Higher Despite Cost Pressures

- Net profit margins improved from 19.7% to 21.4% year over year, outpacing many capital markets peers even as revenue growth lags the US market average.

- Analysts' consensus view highlights that while operational efficiencies boosted recent margins, persistent industry-wide fee pressure and technology spending, especially from the shift to passive investing and digitalization, could challenge the durability of these gains.

- Consensus narrative notes that increased technology investments might offset ongoing operational streamlining, putting future profit margins at risk based on current forecasts.

- Despite this, the continued pursuit of automation and client diversification is seen as helping Northern Trust stay competitive with industry peers.

- Consensus narrative flags that the most recent uptick in margins may prove temporary if Northern Trust cannot maintain cost discipline as industry pressures mount. See how analysts are debating this margin story in the full Consensus Narrative. 📊 Read the full Northern Trust Consensus Narrative.

Analyst Price Target Sits Below Current Share Price

- Northern Trust’s latest share price is $125.48, which stands about 7% above the consensus analyst target of 134.71, signaling that on average, analysts view the stock as nearly fully valued, if not slightly overvalued at current levels.

- According to the consensus narrative, analysts tie their price targets to assumptions that by 2028 revenue will reach $8.2 billion, earnings will come in at $1.4 billion, and the P/E multiple will rise to 18.7x.

- There is notable dispersion between bull and bear analyst case targets, with the most bullish calling for 134.71 and the most cautious eyeing 134.71, showing a lack of clear agreement on upside potential.

- Despite robust historical growth and improved profitability, the muted target price suggests analysts are cautious about the sustainability of current trends versus the industry’s more ambitious growth trajectory.

Valuation Discount Narrows Versus Peers and Fair Value

- At a current P/E of 14.3x, Northern Trust trades at a steep discount to both its peer group’s 47x average and the broader US capital markets industry at 26x, though its share price now sits well above DCF fair value at $111.84.

- Consensus narrative points out that although the valuation looks attractive at first glance, the forecasted decline in profit margins from 25% to 17.6% over the next 3 years raises questions about how long the discount will hold.

- Analysts tie the fair value shortfall, current price $125.48 vs DCF fair value $111.84, to expectations of moderating earnings, warning that a shrinking margin buffer could limit further rerating unless revenue surprises on the upside.

- The faster growth outlook for the industry as a whole (projected 15.5% earnings growth) versus Northern Trust’s 4.2% forecast further complicates the discount story, potentially capping relative upside unless the company can outpace guidance.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Northern Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do these numbers tell a different story to you? Share your take and shape the narrative in just a few minutes. Do it your way

A great starting point for your Northern Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Northern Trust’s slowing earnings growth and uncertain profit margins leave it lagging behind the industry’s more robust and sustainable expansion prospects.

If you’re looking for investments that consistently deliver steady performance, check out stable growth stocks screener (2094 results) for companies showing reliable growth across all market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives