- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

How a Regulated Digital Carbon Credit Partnership at Northern Trust (NTRS) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Earlier this month, Absolute Climate announced a partnership with Northern Trust to deliver a regulated, infrastructure-rich carbon credit issuance system, integrating third-party certification and digital lifecycle management for project developers and buyers through the Northern Trust Carbon Ecosystem™.

- This collaboration aims to address credibility and transparency in carbon markets by aligning rigorous, independent certification with regulated credit issuance, offering enhanced support for compliance and voluntary market participants.

- We'll explore how the addition of regulated digital carbon solutions could reshape Northern Trust's investment narrative and longer-term growth outlook.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Northern Trust Investment Narrative Recap

To hold Northern Trust shares, an investor needs confidence in its ability to generate steady growth from asset servicing, capital markets, and wealth management, sectors driven by operational excellence and trusted client relationships. The recent Absolute Climate partnership enhances Northern Trust’s ESG and digital credentials, addressing the transparency and credibility gaps in carbon markets, but does not represent a material change to near-term growth catalysts or the most pressing financial risks right now.

The partnership with Absolute Climate stands out as highly relevant, given rising demand for regulated digital carbon credit solutions. This initiative underscores Northern Trust’s push to capture new revenue streams from ESG trends, a growing area of client focus, but does not displace core earnings drivers or key risks like compressed margins and slower profit growth projections.

By contrast, investors should be mindful of the impact that sustained cost pressures and the pace of operational automation could have on returns if fee growth underwhelms...

Read the full narrative on Northern Trust (it's free!)

Northern Trust is projected to have $8.2 billion in revenue and $1.4 billion in earnings by 2028. This outlook assumes a 1.6% annual revenue decline and a $0.7 billion decrease in earnings from the current $2.1 billion.

Uncover how Northern Trust's forecasts yield a $124.25 fair value, in line with its current price.

Exploring Other Perspectives

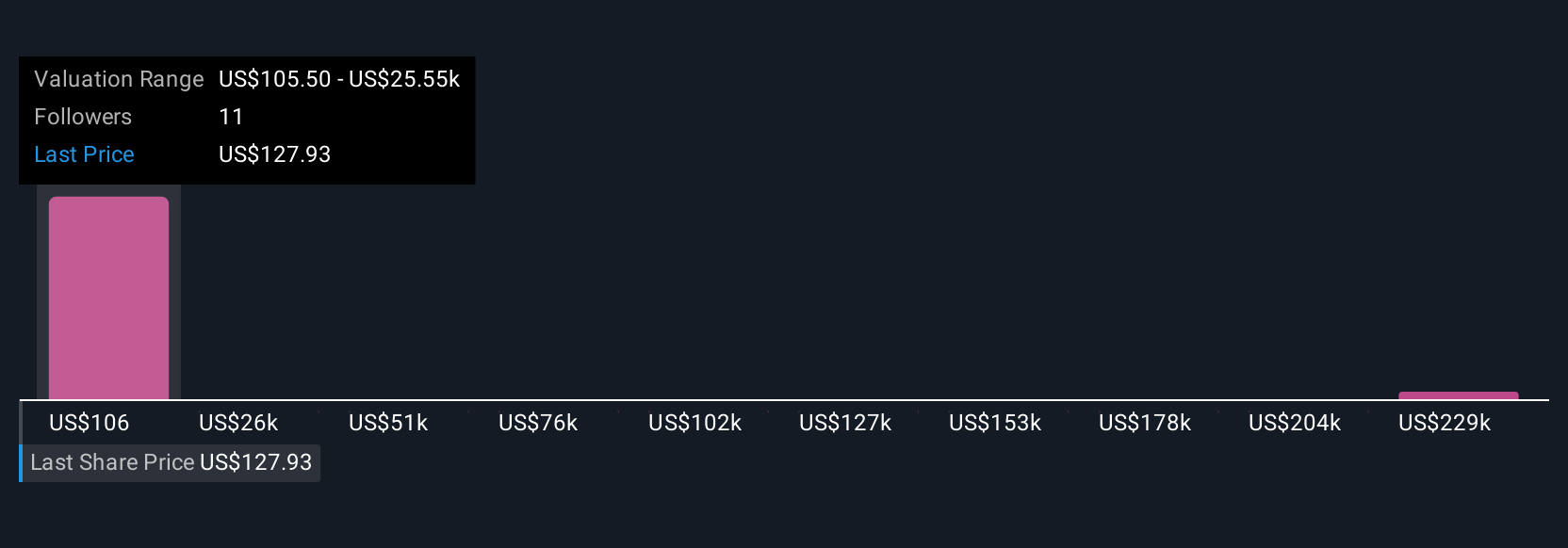

Four Simply Wall St Community members set fair value for Northern Trust between US$107 and a striking US$254,541 per share. While opinions vary, growth in digital solutions and ESG demand could influence future revenue momentum, explore how these community perspectives compare to broader market projections.

Explore 4 other fair value estimates on Northern Trust - why the stock might be worth 16% less than the current price!

Build Your Own Northern Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northern Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Trust's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives