- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Nasdaq (NDAQ) Profit Margin Jump Reinforces Bullish Narratives Despite Revenue Concerns

Reviewed by Simply Wall St

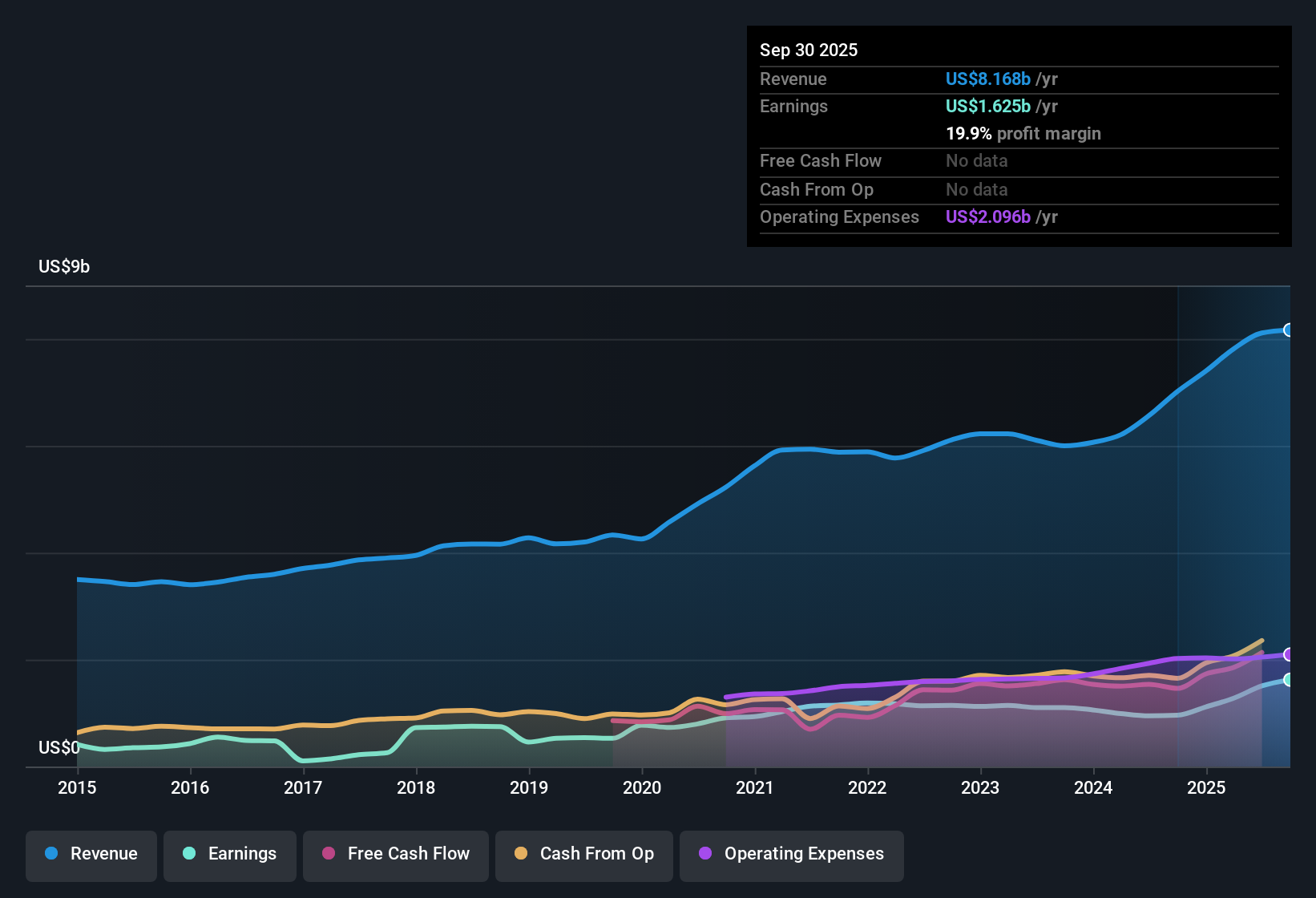

Nasdaq (NDAQ) reported a net profit margin of 19.9%, up from 13.7% a year ago, and posted standout EPS growth of 69.4% over the past year, which is well above its own five-year average annual earnings growth of 5%. Looking forward, analysts expect annual earnings to grow 8.4% per year even as revenue is projected to decline 10.1% annually over the next three years. With the share price at $87.42, which is above an estimated fair value of $61.45, investors are weighing a mix of improved profits and quality earnings against a more cautious outlook for top-line growth and valuation multiples.

See our full analysis for Nasdaq.The next section dives in to see how the latest results for Nasdaq compare with the market’s prevailing narratives and whether the numbers reinforce or disrupt widely held views about the company.

See what the community is saying about Nasdaq

Profit Margin Expansion Faces Revenue Headwinds

- Net profit margin climbed to 19.9% from last year’s 13.7%. Analysts expect annual revenue to decline by 10.1% over the next three years, indicating improving profitability against a backdrop of top-line contraction.

- The analysts' consensus view highlights that margin expansion to a projected 33.5% within three years could offset shrinking revenue and help sustain earnings growth.

- Consensus narrative notes product innovation and partnerships, such as AWS and Verafin, are expected to drive operational efficiencies and higher net margins despite revenue pressure.

- What stands out is that declining sales and rising margins create conflicting signals for future returns. This means execution on cost controls or high-value services matters more than simply chasing sales growth.

Curious how Nasdaq’s earnings boost lines up with analyst expectations? Consensus is shifting. Read the full story in our 📊 Read the full Nasdaq Consensus Narrative.

Trading at a Premium to Industry But Below Peers

- The Price-to-Earnings ratio stands at 30.9x, above the US Capital Markets industry average of 26x, yet slightly below the peer average of 32.7x, meaning Nasdaq fetches a market premium but not the highest in its group.

- The analysts' consensus view points out that the current share price of $87.42 trades above the DCF fair value of $61.45 and is only 14.3% below the official analyst price target of 101.94.

- Consensus narrative stresses the analyst price target factors in further margin expansion to 33.5% and continued buybacks, so much of the value case depends on sustaining these trends.

- Bears argue that paying a premium for contracting revenues could be risky if margin gains stall or macro headwinds grow stronger than expected.

Analysts Forecast $2.0 Billion Earnings by 2028

- Consensus estimates call for earnings to rise from $1.5 billion today to $2.0 billion by September 2028, underpinned by a moderate projected annual earnings increase of 8.4% per year.

- The analysts' consensus view underscores that to meet the price target, Nasdaq would need to sustain a 36.1x PE ratio in 2028, remaining above the industry average and requiring ongoing investor confidence in future profitability.

- Consensus narrative suggests equity reduction from share repurchases, margin expansion, and new product launches are seen as supporting catalysts by analysts.

- Notably, actual revenue forecasts are declining. This means upward pressure on future earnings relies on scaling efficiencies or reducing dilution to deliver at the high end of expectations in order to support this growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Nasdaq on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Shape your personal perspective and build a narrative in just a few minutes. Do it your way

A great starting point for your Nasdaq research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Nasdaq’s promising profit margins are currently overshadowed by declining revenues and a share price that remains well above its estimated fair value.

If you’re seeking stocks positioned for potential upside, check out these 876 undervalued stocks based on cash flows and discover investments where the fundamentals point to compelling undervaluation right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives