- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Nasdaq (NDAQ): Exploring Valuation After Recent Steady Gains and Analyst Target Gap

Reviewed by Simply Wall St

Nasdaq (NDAQ) shares moved slightly higher today, capturing interest after a relatively quiet stretch for the company. Investors are weighing recent stock performance in relation to broader market trends and the company's latest earnings dynamics.

See our latest analysis for Nasdaq.

Nasdaq’s recent share price movement, while modest in the last day, caps off a year marked by steady momentum, delivering a 14.8% year-to-date price return and a standout total shareholder return of over 21% for investors. This shows strength compared to many peers. With gains compounding over three and five years, there is evidence that long-term holders have reaped substantial rewards as sentiment around risk and growth potential continues to evolve.

If you’re thinking about what’s performing well beyond the usual suspects, now’s the perfect moment to expand your horizons and discover fast growing stocks with high insider ownership

With Nasdaq currently trading below analyst price targets but after a notable run-up, the real question is whether current levels reflect an undervalued opportunity or if the market has already priced in future growth potential.

Most Popular Narrative: 12.6% Undervalued

Narrative watchers see Nasdaq trading well below its consensus fair value, with the last close of $88.86 against a fair value near $101.67. What are analysts factoring in that the market may be overlooking?

The enhanced partnership with AWS is expected to modernize Nasdaq's market infrastructure across its financial services clientele. This development may drive operational efficiencies, improve scalability, and potentially increase market share, which could positively impact net margins and future revenue growth.

Want to know what’s fueling this bullish take? Profit margins and future earnings projections are driving big expectations. Get the inside scoop on how fresh partnerships and recurring revenue models are tipping the balance in Nasdaq's favor. Don’t miss what could be the most pivotal assumptions behind this valuation.

Result: Fair Value of $101.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in client decision-making or intensified competition could easily shift the outlook for Nasdaq’s growth and margin sustainability in the quarters ahead.

Find out about the key risks to this Nasdaq narrative.

Another View: What Do The Multiples Say?

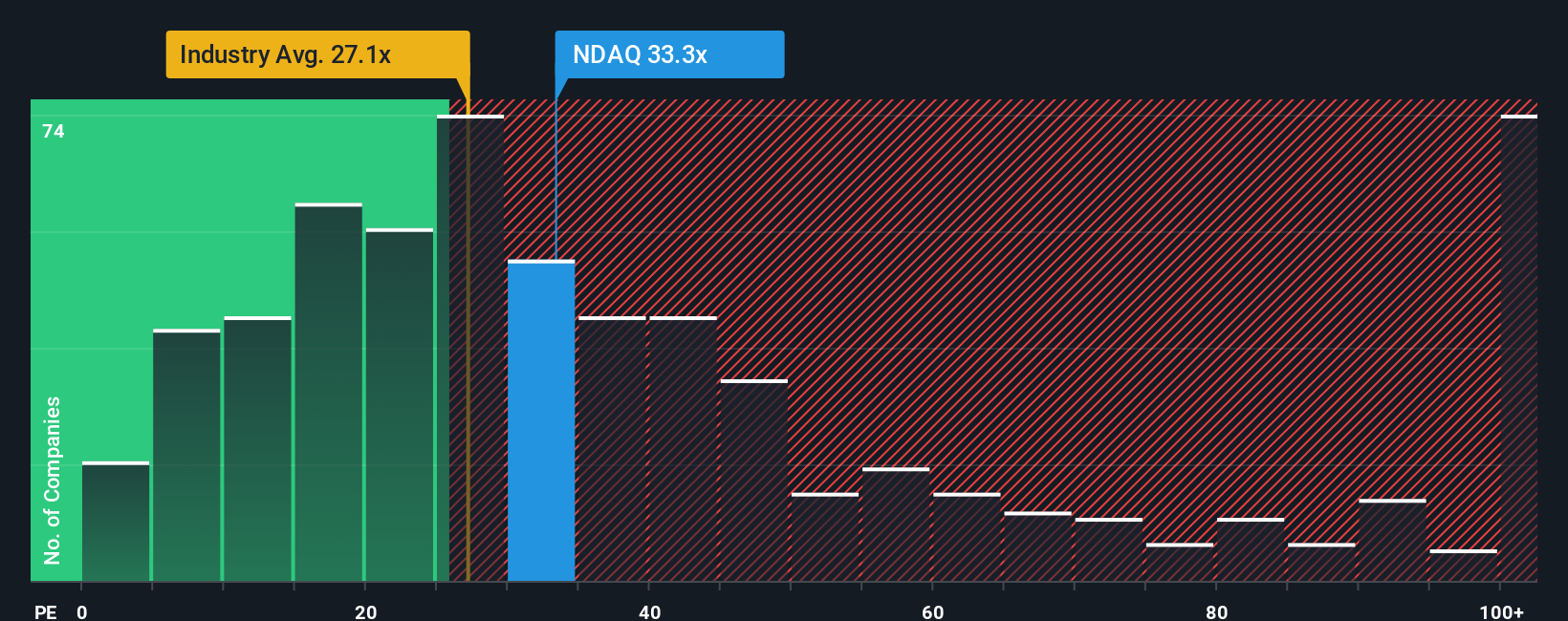

While fair value estimates point to upside, Nasdaq's current price-to-earnings ratio of 33.8 is noticeably above the industry average of 25.7 and even further from our fair ratio of 18. This premium signals the market's high confidence, but it also highlights added valuation risk if growth expectations stall.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nasdaq Narrative

If you want to double-check these numbers or dig deeper into the story yourself, you can shape your own view with just a few clicks. Do it your way.

A great starting point for your Nasdaq research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to level up your portfolio with fresh, high-potential opportunities tailored for today’s forward-thinking investor. These ideas could be exactly what you've been waiting for.

- Uncover tomorrow’s industry leaders by reviewing these 876 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Tap into growth potential with these 24 AI penny stocks driving innovation in artificial intelligence and next-generation automation.

- Lock in reliable income streams through these 17 dividend stocks with yields > 3% offering strong yields above 3% for steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives