- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Nasdaq (NDAQ): Evaluating Valuation and Growth Prospects After Steady Trading

Reviewed by Kshitija Bhandaru

Nasdaq (NDAQ) shares traded at $87.34 in the latest session, holding steady over the past week and month. Investors are examining recent performance metrics and considering potential catalysts that could influence the stock’s direction.

See our latest analysis for Nasdaq.

Over the past year, Nasdaq’s total shareholder return has edged up slightly, reflecting steady performance amid changing market conditions. While recent share price changes have been muted, the long-term picture suggests resilience and a potential setup for renewed momentum if new catalysts emerge.

Curious about what else the market has to offer? This could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and long-term returns trending higher, the key question is whether Nasdaq is currently undervalued and presenting a buying opportunity, or if the market has already priced in future growth.

Most Popular Narrative: 13.2% Undervalued

With Nasdaq's fair value according to the most closely watched narrative sitting higher than the last close, investors may be underestimating future potential. The stage is set for a closer look at how product innovation and strategic partnerships might transform the company’s growth trajectory.

Nasdaq's strategic investments in product innovation, international market expansion, and new product launches, especially in the index business, are expected to drive sustained revenue growth. These initiatives aim to strengthen their global position and diversify revenue streams from the Nasdaq 100, supporting long-term earnings performance.

Want to know the drivers behind this bullish stance? This narrative leans on aggressive growth moves and a bold margin outlook. The most surprising projection centers on how profit acceleration could reshape the valuation debate. Ready to see what the experts are really betting on?

Result: Fair Value of $100.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant macroeconomic uncertainty and delays in client decision-making could challenge Nasdaq’s growth expectations and affect future revenue momentum.

Find out about the key risks to this Nasdaq narrative.

Another View: What Do Earnings Ratios Suggest?

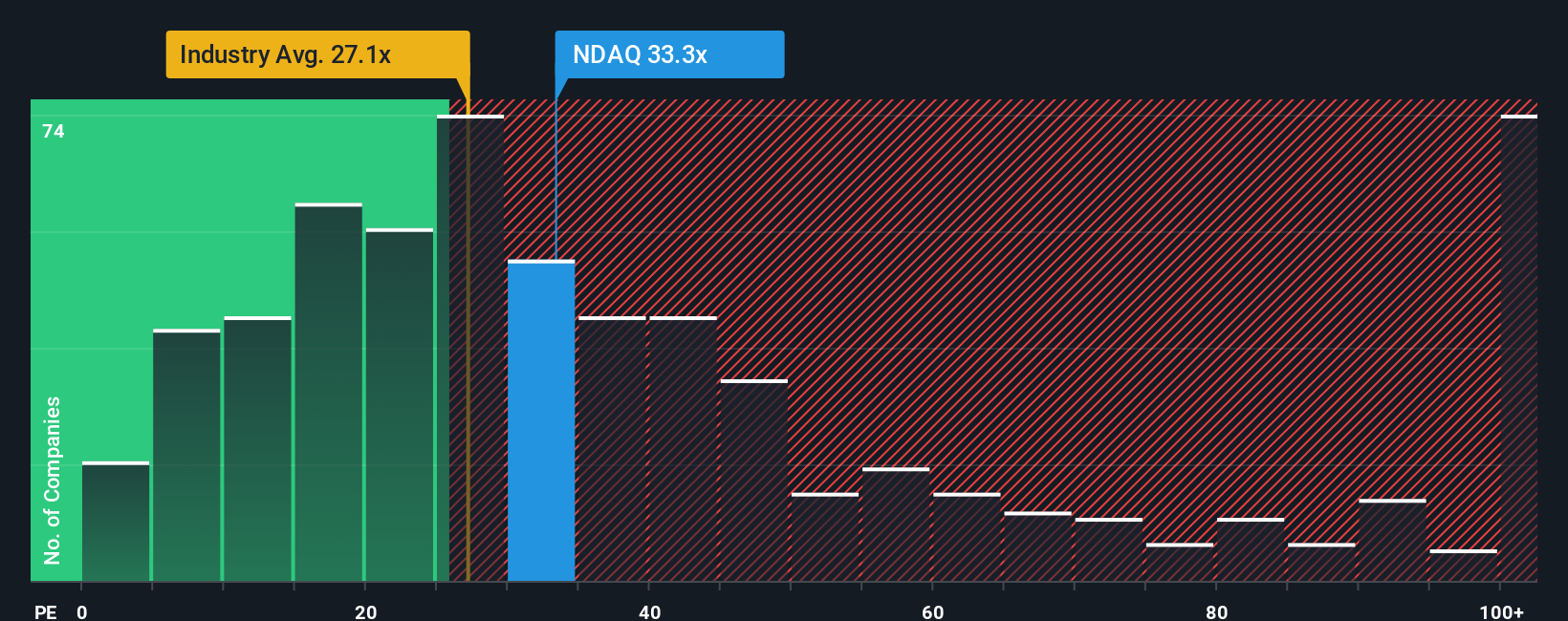

Shifting focus to valuation based on earnings ratios, Nasdaq's price-to-earnings ratio sits at 33.2x, higher than both the US Capital Markets industry average of 26.3x and the fair ratio of 17.9x that the market could move towards. This creates valuation risk if investor sentiment shifts back in line with industry norms. Are future earnings strong enough to support a premium, or could sentiment change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nasdaq Narrative

If you enjoy digging into the numbers or want to challenge the consensus, you can easily build your own perspective on Nasdaq in just minutes, starting with Do it your way

A great starting point for your Nasdaq research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while opportunities pass you by. Make your next smart move with investment ideas tailored to today’s hottest market trends.

- Tap into potential future market leaders by checking out these 23 AI penny stocks, which are at the forefront of artificial intelligence innovation and transformation.

- Start building reliable passive income streams by exploring these 19 dividend stocks with yields > 3% with attractive yields above 3% and strong financials.

- Catch the next undervalued gems by looking into these 916 undervalued stocks based on cash flows that are currently trading below their long-term cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives