- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Nasdaq (NasdaqGS:NDAQ) Partners With Komodo Health For Enhanced Healthcare Insights

Reviewed by Simply Wall St

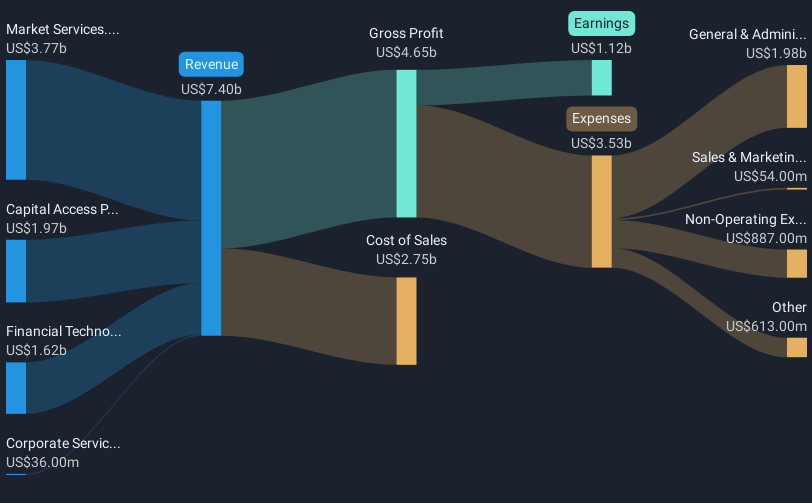

Nasdaq (NasdaqGS:NDAQ) experienced significant developments last month, including robust Q1 2025 earnings results with substantial revenue and net income growth. The company also enhanced shareholder value through increased dividends and a buyback program, reinforcing investor confidence. The partnership with Komodo Health further strengthened Nasdaq's data capabilities in the healthcare sector. Despite the wider market exhibiting mixed movements amid tariff discussions and anticipated Federal Reserve decisions, Nasdaq's strategic enhancements helped drive its stock to a 14.40% gain over the period, underscoring its positive outlook against a backdrop of broader market uncertainty.

Be aware that Nasdaq is showing 1 possible red flag in our investment analysis.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

Nasdaq's recent developments, including increased dividends and a buyback program, have bolstered investor sentiment, potentially fortifying the company's narrative focused on enhancing shareholder value and modernizing market operations. As highlighted by Nasdaq's partnership with Komodo Health, these initiatives align with their strategy to innovate within the healthcare data sector. Over the past five years, Nasdaq's total shareholder return, incorporating share price and dividends, surged to 131.72%, reflecting a robust growth trajectory. This performance is impressive against the context of last year's outperformance relative to both the US Capital Markets industry and the broader market. The company's stock gained significantly in this period, which may be indicative of sustained trust in its growth initiatives and shareholder strategies.

The positive earnings results and strategic partnerships could influence revenue and earnings forecasts by driving operational efficiencies and expanding customer engagement, particularly through Verafin's AI solutions and the AWS collaboration. Despite a 14.40% share price gain last month, Nasdaq's current share price of US$75.94 reflects a 9.3% discount to the consensus price target of US$83.72. This suggests that the market still sees potential upside in Nasdaq's valuation. Analysts anticipate earnings will grow to US$1.9 billion by 2028, making the narrative of innovation and market strength an essential consideration for investors assessing future growth opportunities amidst industry and macroeconomic challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nasdaq, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives