- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Is Now the Right Moment for Nasdaq After Its Recent 6% Drop?

Reviewed by Bailey Pemberton

Thinking about what to do with Nasdaq stock right now? You are not alone. Whether you have been watching it for a while or you already hold shares, the ups and downs lately can definitely give you something to think about. Over the past year, Nasdaq has put up a solid 25.1% gain, with returns over the past five years climbing to an impressive 122.8%. Yet, the recent month has not been so kind, down 6.3%, and it slipped 1.2% over just the past week. This kind of near-term pullback often makes investors wonder if the next move is up, down, or sideways.

Some of these moves can be traced back to broader trends in tech and financial marketplaces, as investor sentiment shifts and market developments alter risk perceptions. But when it comes to deciding your next step, valuation becomes key. According to our valuation scorecard, Nasdaq earns a score of 1 out of 6. That means, by our measures, the company looks undervalued in just one of the six major checks we use. So, does this mean it is a bargain, a trap, or something in between?

Valuation analysis is never one size fits all. Next, we will walk through the different methods analysts use to figure out if a stock like Nasdaq is attractively priced, pricey, or sitting somewhere in the middle. And, if you want to go beyond the numbers, stick around because there is an even more powerful way to judge value that we will uncover at the end.

Nasdaq scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nasdaq Excess Returns Analysis

The Excess Returns valuation model focuses on a company’s ability to generate returns above its cost of equity. This method evaluates whether Nasdaq is producing sufficient profits, after accounting for the risk and opportunity cost of capital, to justify its current share price.

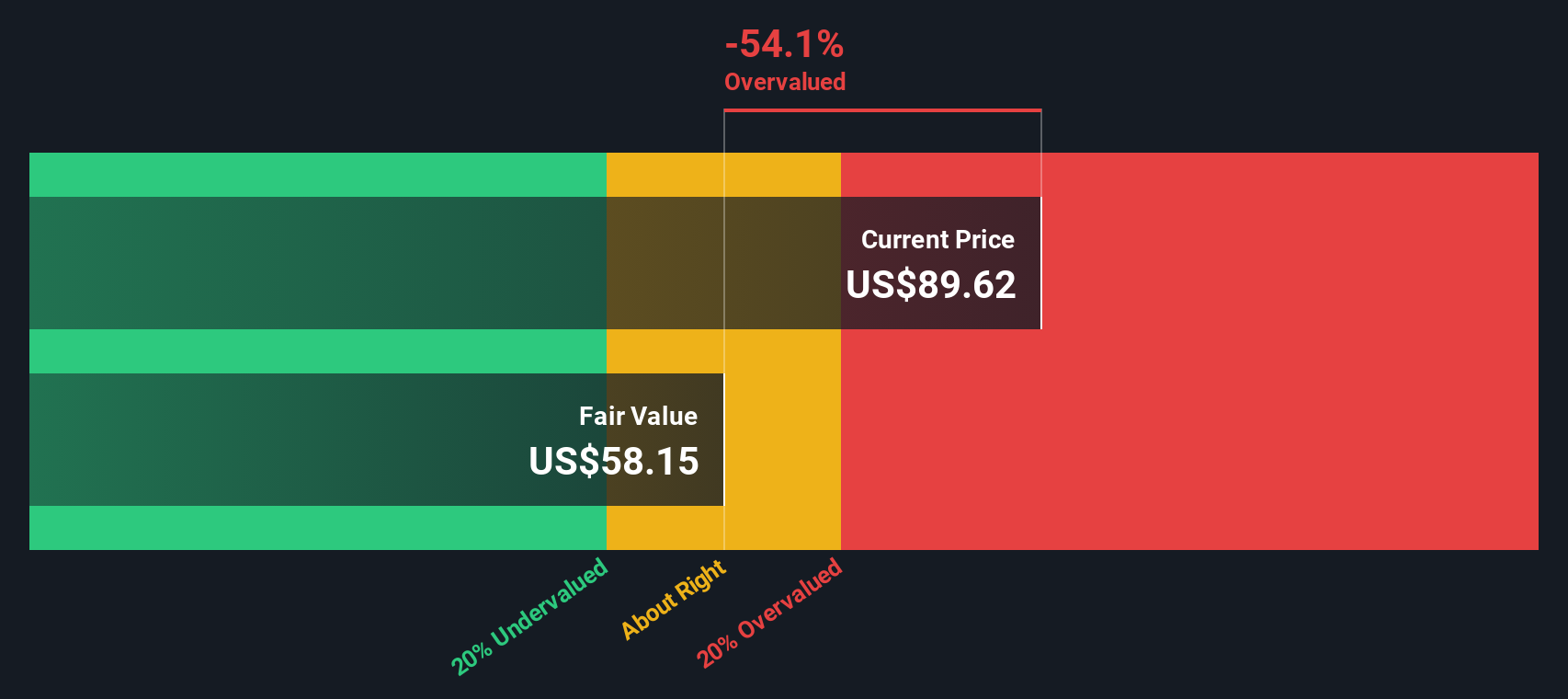

For Nasdaq, recent data highlights a Book Value of $20.58 per share and a projected Stable Book Value of $22.72 per share, based on estimates from three analysts. Its Stable Earnings Per Share (EPS) are forecast at $3.87, drawing from weighted future Return on Equity expectations from six analysts. The average Return on Equity stands at a healthy 17.04%, while the Cost of Equity per share is $1.96. After these cost considerations, the Excess Return generated is $1.92 per share, showing that Nasdaq consistently delivers a profit above its cost of capital.

However, after applying this model, Nasdaq's intrinsic value is estimated at $57.41 per share. Relative to the current price, this suggests the stock is about 52.6% overvalued. In other words, the market is demanding a much higher price than what the company’s excess returns would justify.

Result: OVERVALUED

Our Excess Returns analysis suggests Nasdaq may be overvalued by 52.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nasdaq Price vs Earnings

The Price-to-Earnings (PE) ratio is a useful metric for valuing profitable companies like Nasdaq because it ties the stock price directly to the company’s earnings. For companies with steady profits and clear growth prospects, the PE ratio offers a quick way to see how much investors are paying for every dollar of earnings today.

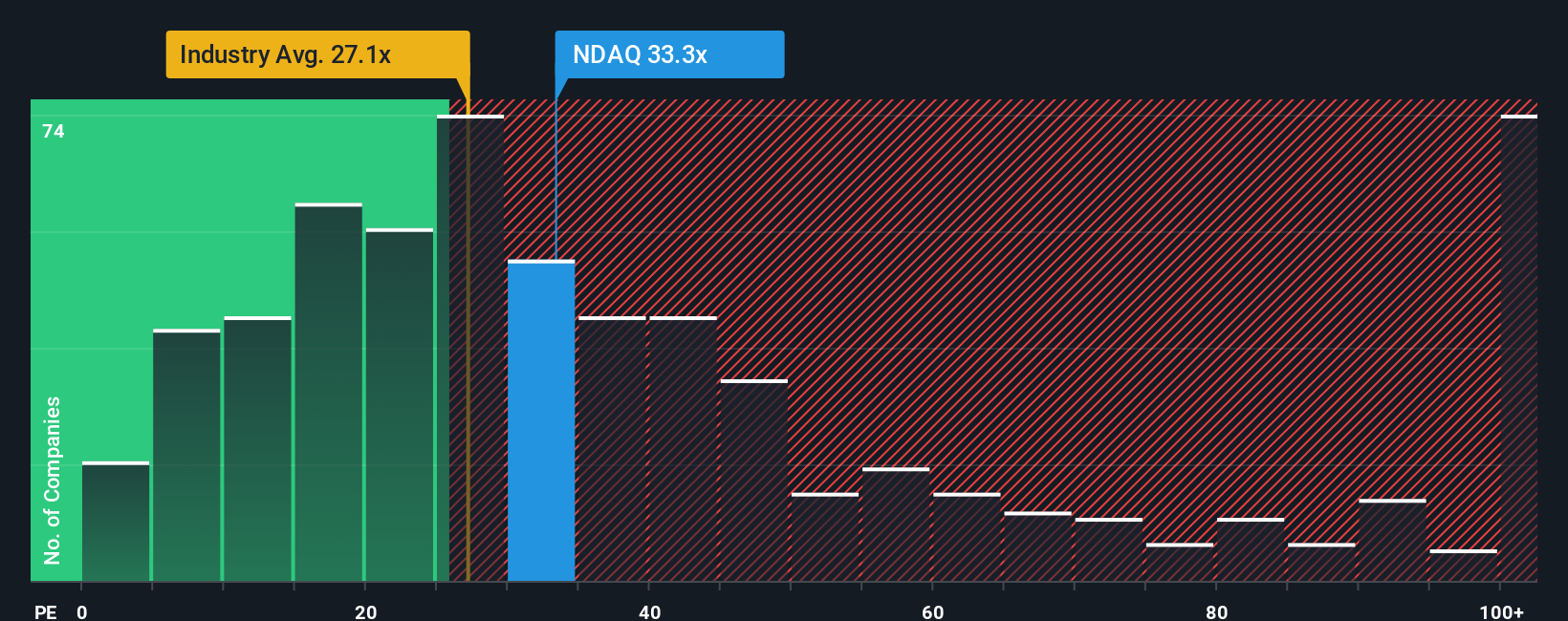

Growth expectations and perceived risk both have a big influence on what constitutes a “normal” PE. Companies with stronger expected growth or lower risk profiles tend to command higher PE multiples, while more mature or riskier companies typically see lower ratios. Currently, Nasdaq’s PE ratio sits at 33.34x, nearly matching the peer group’s average of 33.55x and notably higher than the Capital Markets industry average of 27.07x. This means investors are paying a premium compared to the industry, but aligning closely with similar peers.

The Simply Wall St "Fair Ratio" for Nasdaq is 17.94x. Unlike a simple comparison against peers or industry averages, the Fair Ratio blends in factors such as the company’s earnings growth, risk levels, profit margin, overall industry trends, and market capitalization. This makes it a more comprehensive gauge of what would be a reasonable multiple for Nasdaq right now.

Comparing the current PE ratio of 33.34x against our Fair Ratio of 17.94x, Nasdaq’s stock appears significantly overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nasdaq Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story and thesis about a company’s future, captured by your expectations for its fair value and what you believe about its potential for future revenue, earnings, and margin growth.

Rather than just crunching the numbers, Narratives connect the dots between a company’s outlook, the numbers in your forecast, and the fair value that emerges from your own assumptions. They allow you to openly lay out your reasoning, whether you are optimistic or cautious, and make your investment decision more transparent and informed.

Narratives are simple to create and easily accessible on Simply Wall St’s Community page, trusted by millions of investors. By using them, you can compare your Fair Value forecast to Nasdaq’s current price to see if it is time to buy, hold, or sell.

What makes Narratives even more powerful is that they update automatically with new information, from earnings announcements to relevant news, keeping your story current as the market changes. For example, you might see some investors forecast bright growth thanks to Nasdaq’s investments and partnerships, with fair values as high as $115, while others are much more cautious and set their targets as low as $74. This demonstrates how each Narrative provides a unique, actionable perspective.

Do you think there's more to the story for Nasdaq? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives