- United States

- /

- Diversified Financial

- /

- NasdaqGS:MQ

Marqeta (MQ): Assessing Valuation as Investors Weigh Growth Potential and Recent Share Price Swings

Reviewed by Kshitija Bhandaru

Marqeta (MQ) has seen its stock performance fluctuate lately, catching the attention of investors curious about shifts in the payments space. While the company navigates industry changes, recent numbers highlight both opportunities and ongoing challenges for the fintech firm.

See our latest analysis for Marqeta.

After a long stretch of volatility, Marqeta’s share price is still up nearly 22% for the year to date, despite recent selling pressure including a 20% drop in the past month. While the one-year total shareholder return is down over 12%, momentum had improved earlier this year. This suggests investors are weighing both ongoing sector risks and the company’s growth potential as the fintech landscape evolves.

If this kind of shift piques your interest, it could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets, investors are left wondering if Marqeta is poised for a rebound or if the market already reflects the company’s future growth prospects. Could this be a buying opportunity?

Most Popular Narrative: 32.3% Undervalued

At $4.55 per share, Marqeta’s market price sits noticeably below the fair value estimate set by the most widely tracked analyst-driven narrative. This sharp difference hints at high expectations for future growth and profitability that the market may not yet be pricing in.

Ongoing product innovation, including real-time decisioning, advanced fraud management using AI/ML, flexible and credit-enabled card credentials, and value-added services, is increasing customer retention, expanding wallet share, and enabling premium pricing. This supports margin expansion and growing gross profit.

Want to know what’s fueling Marqeta’s bold valuation? This narrative is built on blockbuster revenue growth, a remarkable turnaround in profit margins, and a future earnings multiple that rivals industry giants. Curious what projections push the fair value more than 30% above the market? Unlock the full story and see which aggressive assumptions are moving the needle.

Result: Fair Value of $6.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a handful of major clients or fast-changing payment technology trends could present significant challenges to Marqeta’s optimistic growth outlook.

Find out about the key risks to this Marqeta narrative.

Another View: What About the Sales Multiple?

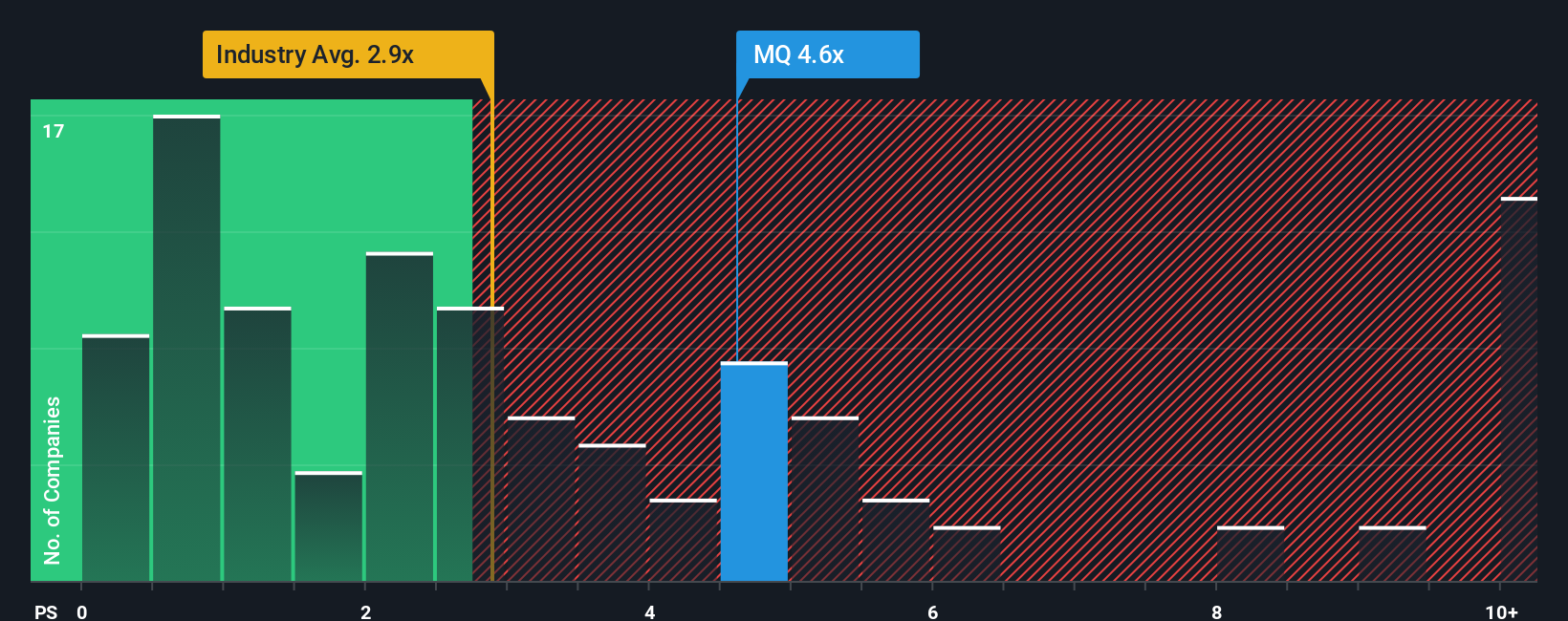

Looking beyond fair value estimates, Marqeta’s current price-to-sales ratio sits at 3.7. This is significantly higher than both the US Diversified Financial industry average of 2.5 and the peer average of just 1. This suggests the market is pricing in stronger growth than its direct competitors, but also introduces more risk if expectations fall short. The fair ratio of 2.9 is a level the market could adjust toward if sentiment shifts. Could these comparative numbers hint at overexuberance, or do they underscore a durable competitive edge?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marqeta Narrative

If you prefer to draw your own conclusions from Marqeta's numbers or want to build a story that reflects your independent research, it's never been easier. You can create an entire narrative from scratch in just a few minutes. Do it your way

A great starting point for your Marqeta research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act now and set yourself up for smarter investing. These opportunities could give your portfolio a real boost if you act before the crowd jumps in.

- Unlock higher passive income potential by tapping into these 18 dividend stocks with yields > 3%, which boasts reliable yields above 3% and a reputation for resilience.

- Ride the momentum of next-generation breakthroughs by targeting these 24 AI penny stocks, leading innovations in artificial intelligence and machine learning.

- Capture untapped value by checking out these 877 undervalued stocks based on cash flows, which smart money is watching for significant upside based on their cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MQ

Marqeta

Operates a cloud-based open API platform for card issuing and transaction processing services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives