- United States

- /

- Capital Markets

- /

- NasdaqGS:MORN

Will a New Chief Revenue Officer Drive a Shift in Morningstar’s (MORN) Client Engagement Strategy?

Reviewed by Sasha Jovanovic

- Morningstar announced that Chief Revenue Officer Daniel Dunn will leave the company on November 21, 2025, and will be succeeded by Julie Willoughby, who has over 25 years of experience in various client-facing and sales roles at the firm.

- This leadership transition places a long-tenured veteran at the helm of global sales, marking a pivotal moment for Morningstar's approach to client engagement and revenue growth.

- We'll examine how Willoughby’s appointment as Chief Revenue Officer may influence Morningstar's investment narrative and future sales momentum.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Morningstar's Investment Narrative?

For anyone considering Morningstar, the big picture depends on trusting the firm’s ability to deliver steady innovation in investment data and research, monetize new products, and retain its reputation for quality insight. The company’s recent growth in both revenue and net profit, ongoing technology launches, and new partnerships speak to potential catalysts in expanding digital platforms and alternative investment access. However, with the abrupt exit of Chief Revenue Officer Daniel Dunn and the elevation of longtime executive Julie Willoughby, there’s some uncertainty around near-term sales strategy. Given Willoughby’s deep experience inside Morningstar, the transition appears well-planned, and shouldn’t materially disrupt current sales momentum or alter key risks. Still, with underperformance relative to the wider market and a share price well below analyst price targets before this change, the biggest risks, such as sustaining growth in a highly competitive industry, remain in clear view for investors after this leadership shift. But keep in mind, the revenue growth outlook may not match the industry pace, and that matters.

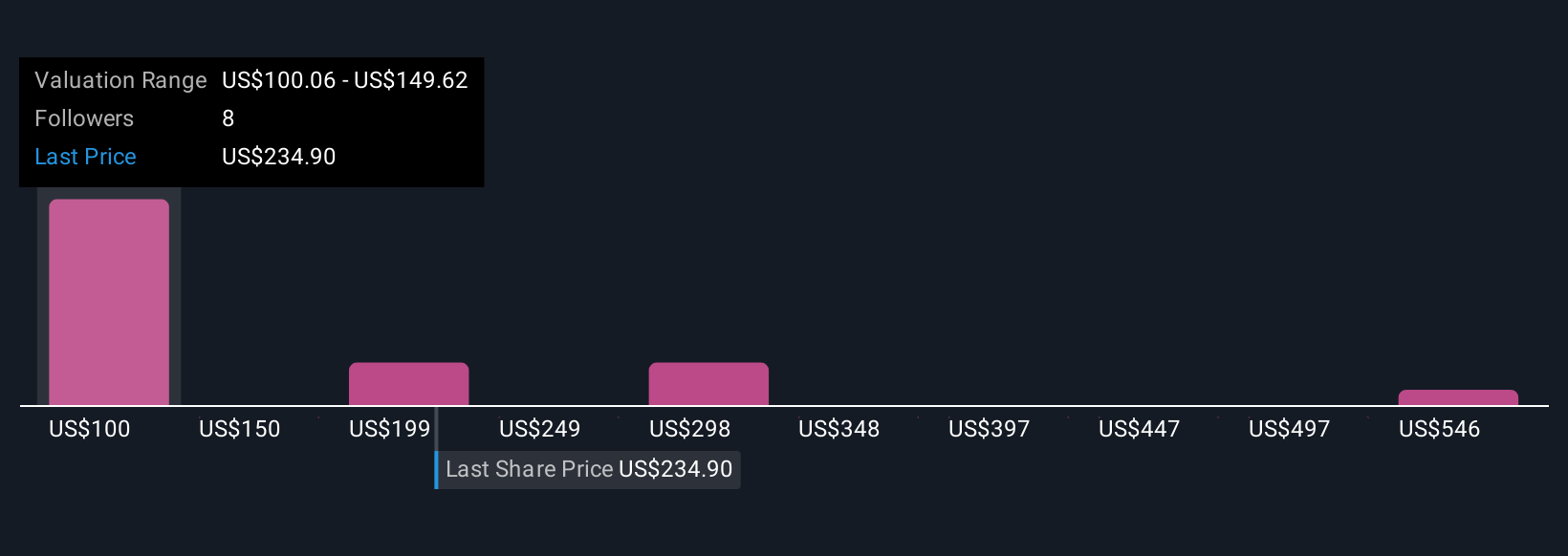

Morningstar's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 8 other fair value estimates on Morningstar - why the stock might be worth over 2x more than the current price!

Build Your Own Morningstar Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morningstar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Morningstar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morningstar's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MORN

Morningstar

Provides independent investment insights in the United States, Asia, Australia, Canada, Continental Europe, the United Kingdom, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives