- United States

- /

- Capital Markets

- /

- NasdaqGS:MORN

How Investors May Respond To Morningstar (MORN) Surpassing Q2 Expectations With Strength in Data Platforms

Reviewed by Sasha Jovanovic

- Morningstar recently reported second quarter results that outpaced analyst expectations, with revenue and EBITDA growth led by strong performance in PitchBook, Morningstar Direct Platform, and Morningstar Credit.

- This operational momentum in key business segments stands out as the company’s Transaction-Based segment also contributed robustly to overall financial strength during the period.

- We’ll assess how continued growth in Morningstar’s data and analytics platforms shapes its broader investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Morningstar's Investment Narrative?

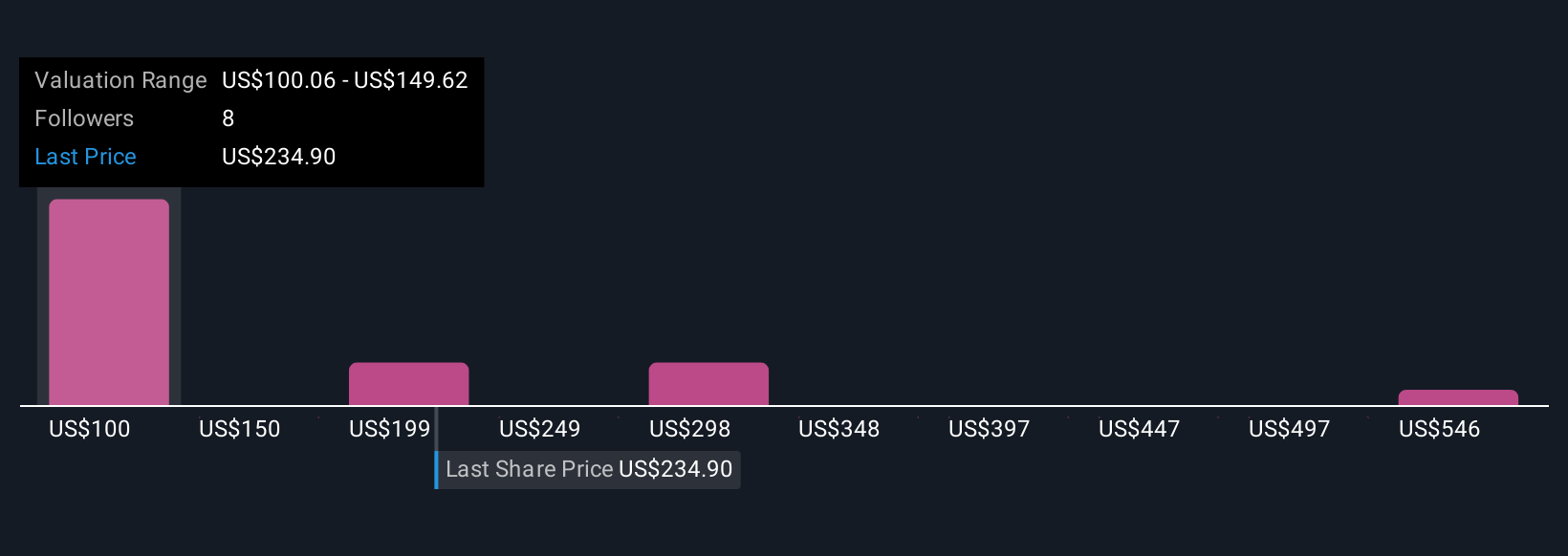

The core thesis for Morningstar centers on its ability to grow its high-margin data, analytics, and software platforms, supported by sticky, recurring revenues from institutional and advisor clients. The recent Q2 update validated parts of this story, with better-than-expected revenue and EBITDA driven by PitchBook, Direct Platform, and Credit. However, an 11% one-month decline in the share price following these results suggests near-term catalysts, such as accelerating segment growth or further tech adoption, aren’t fully convincing the broader market yet. This price move doesn’t reflect any material change from the latest company news, which affirmed positive momentum but flagged that even “beats” are not immune to profit taking or valuation scrutiny, especially after a period of rapid earnings growth. The main risk remains execution: if Morningstar’s investments in data and alternative assets platforms don’t translate to broader revenue or margin gains, shares may lag. With the next earnings catalyst just weeks away, investors will be weighing if the company’s innovation can meaningfully outpace market challenges.

Yet, Morningstar’s success still hinges on whether its diversification efforts deliver clear, sustainable upside. Morningstar's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 7 other fair value estimates on Morningstar - why the stock might be worth over 2x more than the current price!

Build Your Own Morningstar Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morningstar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Morningstar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morningstar's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MORN

Morningstar

Provides independent investment insights in the United States, Asia, Australia, Canada, Continental Europe, the United Kingdom, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives