- United States

- /

- Capital Markets

- /

- NasdaqGS:MKTX

MarketAxess’ Emerging‑Markets Push and ICE Bonds Integration Might Change The Case For Investing In MKTX

Reviewed by Sasha Jovanovic

- At the Barclays Financial Services Conference in September, MarketAxess CEO Chris Concannon and CFO Ilene Fiszel Bieler outlined the company’s evolving growth plan, emphasizing progress in non‑US credit revenue, stronger algorithmic and block trading activity, and plans to deepen integration with ICE Bonds while prioritizing organic growth and selective share repurchases.

- An interesting takeaway is management’s emphasis on emerging markets, where electronic bond trading remains minimal, positioning MarketAxess to potentially capture substantial new volumes as these markets modernize.

- We’ll now look at how this focus on emerging markets electronification could shape MarketAxess’s existing investment narrative and long‑term positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MarketAxess Holdings Investment Narrative Recap

To own MarketAxess, you need to believe that bond markets will keep shifting onto electronic platforms and that the company can defend and extend its network effects beyond US high grade credit. The Barclays conference comments reinforce this narrative but do not materially change the near term picture, where the key catalyst remains progress in higher margin US credit and the biggest risk is continued pressure from competitors and client preferences in large block trading.

The most relevant recent development here is management’s focus on emerging markets, where electronic penetration is still very low. If MarketAxess can translate its experience in US and European credit into scalable tools for these newer markets, it may add a fresh source of volume and gradually reduce its dependence on US high grade, which is important given the ongoing pressure on fees and market share in its core segment.

Yet while the growth story is appealing, investors should be aware that rising competition and shifting block trading behavior could...

Read the full narrative on MarketAxess Holdings (it's free!)

MarketAxess Holdings' narrative projects $1.1 billion revenue and $370.5 million earnings by 2028.

Uncover how MarketAxess Holdings' forecasts yield a $200.90 fair value, a 20% upside to its current price.

Exploring Other Perspectives

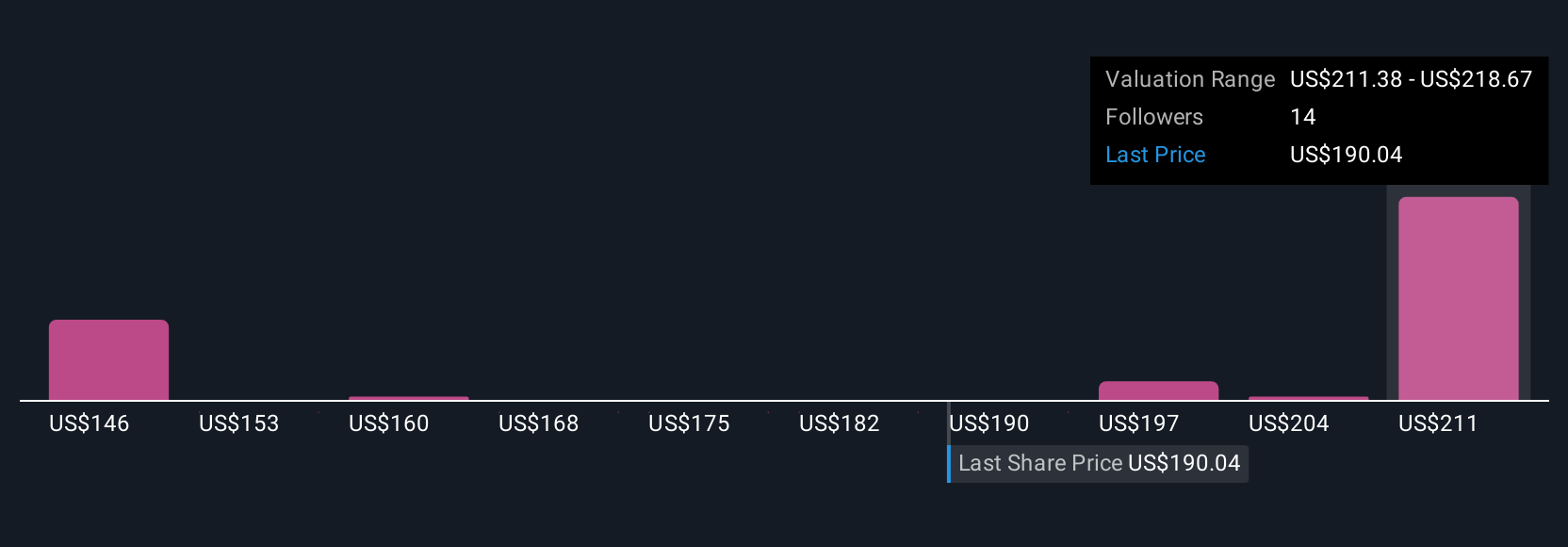

Five fair value estimates from the Simply Wall St Community span roughly US$138 to US$207 per share, showing how differently individual investors view MarketAxess. You should weigh that dispersion against the risk that competition and client preferences in block trading may further challenge its core US credit franchise and, in turn, the company’s ability to sustain attractive economics over time.

Explore 5 other fair value estimates on MarketAxess Holdings - why the stock might be worth 17% less than the current price!

Build Your Own MarketAxess Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MarketAxess Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MarketAxess Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MarketAxess Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKTX

MarketAxess Holdings

Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026