- United States

- /

- Capital Markets

- /

- NasdaqGS:MKTX

Is MarketAxess a Smart Addition After Its Shares Fall 25% in 2025?

Reviewed by Bailey Pemberton

If you are finding yourself stuck at an investing crossroads with MarketAxess Holdings, you are definitely not alone. After all, watching the stock slip nearly 25% this year and tumble a whopping 66% over the past five years could make anyone wonder whether it is time to steer clear, double down, or simply wait and see. Even in the past week and month, shares have been sliding further, with a 5.4% drop in the last 7 days and a 6.1% drop over the past 30. There's been little in the way of dramatic market headlines to explain every leg down. Yet, it is clear risk perception around the fixed-income trading platform has shifted. Despite all this red ink, some long-term investors are starting to ask if all that pessimism has actually left the shares undervalued, especially with digital bond trading continuing to mature and the broader investment landscape evolving.

If we bring out the valuation microscope, MarketAxess scores just 1 out of 6 on common under-valuation checks. So, from that perspective, most traditional metrics do not screen the stock as a screaming bargain. But is that the full picture? In the next section, let's dig into exactly how those different valuation models measure up for MarketAxess, and stick around because there may be a smarter way to think about valuation that gets us much closer to the truth.

MarketAxess Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: MarketAxess Holdings Excess Returns Analysis

The Excess Returns valuation model measures how much profit a company generates above the minimum return required by its investors, focusing especially on its return on invested capital. Essentially, it evaluates whether MarketAxess Holdings is consistently earning more than what shareholders would expect for the risk they are taking on.

For MarketAxess, the latest data shows a Book Value of $37.05 per share and a Stable EPS (earnings per share) of $8.64, based on consensus from seven analyst forecasts for future returns on equity. The average Return on Equity across the projections is a robust 19.34%, which is notably higher than the company’s cost of equity at $3.61 per share. This translates to an Excess Return of $5.02 per share, meaning that after covering its cost of capital, MarketAxess still generates significant additional profit for shareholders. The Stable Book Value, sourced from four analysts, is projected to increase to $44.65 per share over time.

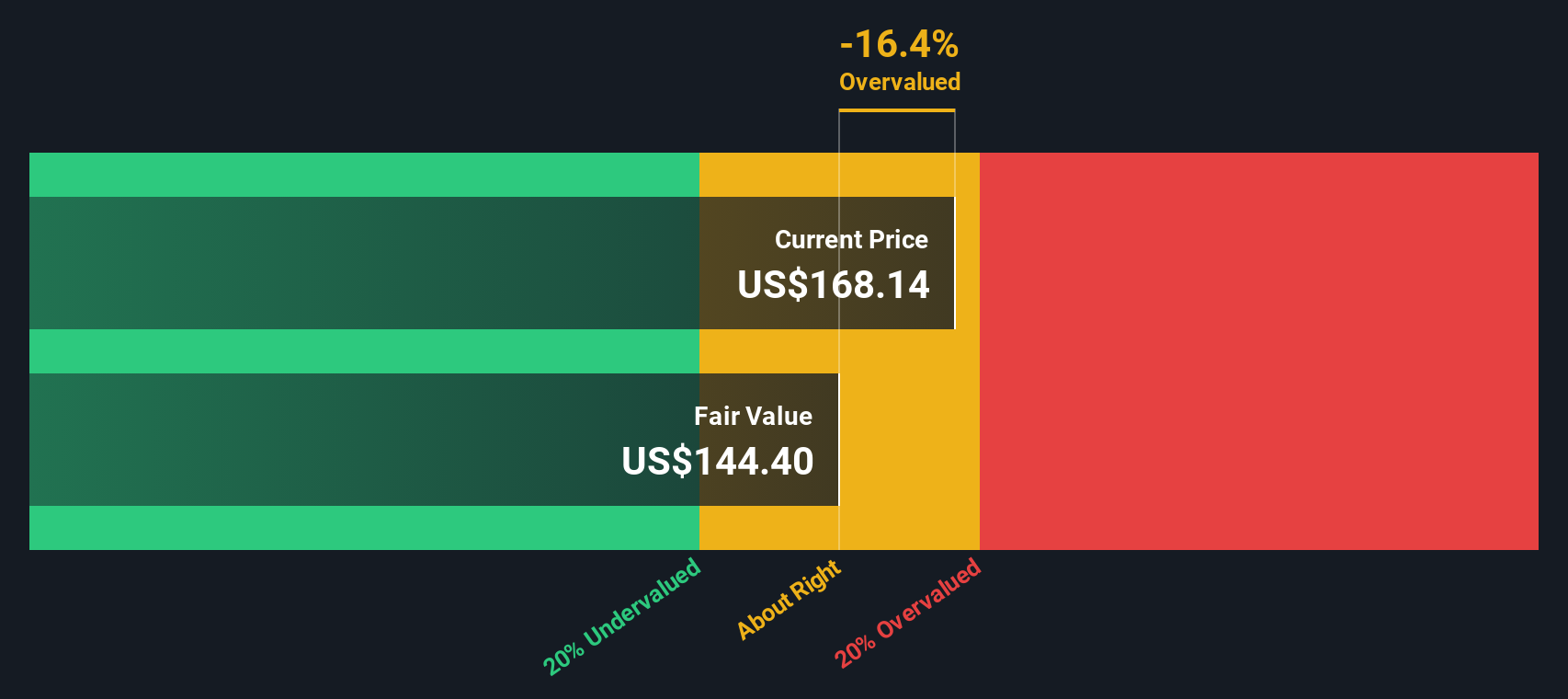

Despite these solid fundamentals, the model estimates an intrinsic value that is 17.8% below the current market price. That suggests MarketAxess stock is currently overvalued, even when accounting for its consistent profitability above the cost of capital.

Result: OVERVALUED

Our Excess Returns analysis suggests MarketAxess Holdings may be overvalued by 17.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: MarketAxess Holdings Price vs Earnings

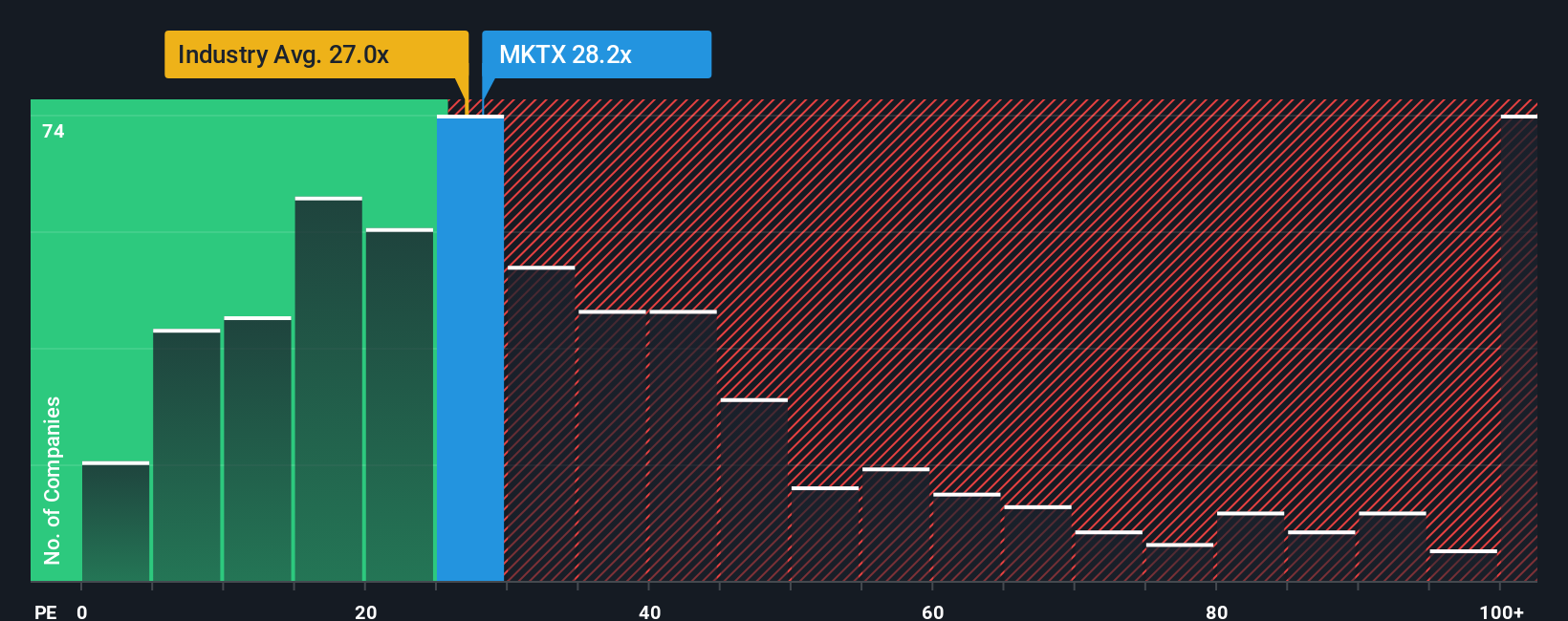

When analyzing profitable companies like MarketAxess Holdings, the Price-to-Earnings (PE) ratio is often the preferred valuation metric. This measure lets investors quickly compare what they are paying for each dollar of current earnings. Generally, a higher PE reflects expectations for stronger future growth or lower risks, while a lower PE suggests the opposite. However, what is considered "normal" can vary significantly depending on industry trends and company-specific outlooks.

MarketAxess currently trades at a PE ratio of 28.6x, slightly above the industry average of 27.1x and just over the peer average of 27.9x. On its own, this could hint at modestly elevated expectations or potentially greater perceived resilience. To get a clearer perspective, it helps to reference the Simply Wall St “Fair Ratio,” which takes into account not only industry and peer averages, but also considers MarketAxess's unique traits, including its growth profile, profit margins, risk factors, and market capitalization.

According to Simply Wall St’s analysis, the fair PE ratio for MarketAxess is estimated at 15.8x. Because this fair ratio is materially below the current multiple, it suggests the stock may be pricing in more optimism than its growth or risk profile justifies. The Fair Ratio offers a sharper, more tailored view than just comparing to broad industry benchmarks because it adjusts for subtle but meaningful differences in company fundamentals and prospects.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MarketAxess Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives let investors create their own story for a company by combining their expectations for future revenue, earnings, and profit margins, and linking them directly to a fair value estimate. Instead of relying only on static ratios or historical models, Narratives empower you to connect what you believe about MarketAxess Holdings, including their business direction, competitive strengths, and changing industry trends, to your investment decision.

This storytelling framework is available to everyone through the Simply Wall St platform’s Community page, used by millions of investors. With Narratives, you can compare your estimated fair value to the current share price, decide if it makes sense to buy or sell, and see how the story evolves as new earnings, news, or market shifts are reported, keeping your view up to date.

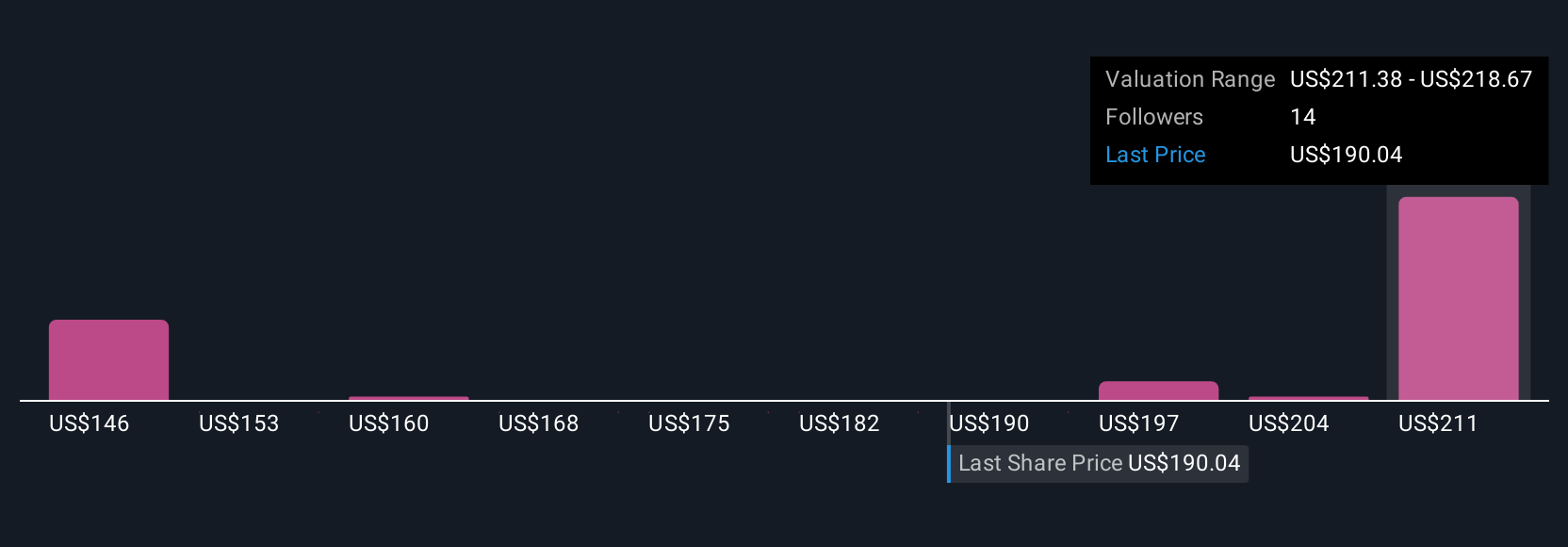

For MarketAxess Holdings, some investors are optimistic, building on catalysts like expansion into new markets and digital trading, and estimate a fair value over $270 per share. On the other hand, more cautious investors highlight growing competition and changing trading protocols, suggesting fair value could be as low as $168. Narratives reveal your assumptions and expectations, helping you invest with confidence by making the numbers truly personal.

Do you think there's more to the story for MarketAxess Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKTX

MarketAxess Holdings

Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives