- United States

- /

- Capital Markets

- /

- NasdaqGS:MKTX

Assessing MarketAxess Holdings (MKTX) Valuation After Prolonged Share Price Decline

Reviewed by Simply Wall St

MarketAxess Holdings (MKTX) has seen its shares drift lower in recent weeks, with the stock trading around $171 after a stretch marked by moderate revenue and net income growth. The current valuation may invite fresh debate among investors, who are weighing recent performance against the company’s longer-term trends.

See our latest analysis for MarketAxess Holdings.

MarketAxess Holdings stock has been losing momentum this year, with a 1-year total shareholder return of -40.3% and a 5-year total return of -68.6%. This reflects increased uncertainty among investors even as the company delivered modest revenue and net income gains. The latest 30-day share price return of -4.1% signals that sentiment remains subdued in the short-term, keeping valuation front of mind for many watching the stock.

If you’re weighing your next move in today’s shifting market landscape, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether MarketAxess Holdings is trading at a bargain price after its declines, or if the market is accurately reflecting its prospects and pricing in all the expected growth ahead.

Most Popular Narrative: 19% Undervalued

MarketAxess Holdings is trading at $170.94, which is well below the most followed narrative’s fair value estimate of $212.08. This sizable gap is sharpening investor focus on whether strong future growth can power a meaningful rebound.

The company is rapidly expanding into new geographies and asset classes, particularly through its growth in emerging markets (EM) and Eurobonds. These areas saw more than 20% volume growth and double-digit commission revenue increases, suggesting the addressable market is broadening and could support higher long-term revenue and earnings.

Wondering exactly what growth assumptions justify this hefty upside? Discover the ambitious revenue path, margin projections, and bold profitability targets behind this valuation. Find out which financial levers analysts believe will change the game for MarketAxess.

Result: Fair Value of $212.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition and the continued preference for manual block trading in the U.S. could limit MarketAxess Holdings’ revenue and margin growth going forward.

Find out about the key risks to this MarketAxess Holdings narrative.

Another View: Relative Valuation Warning

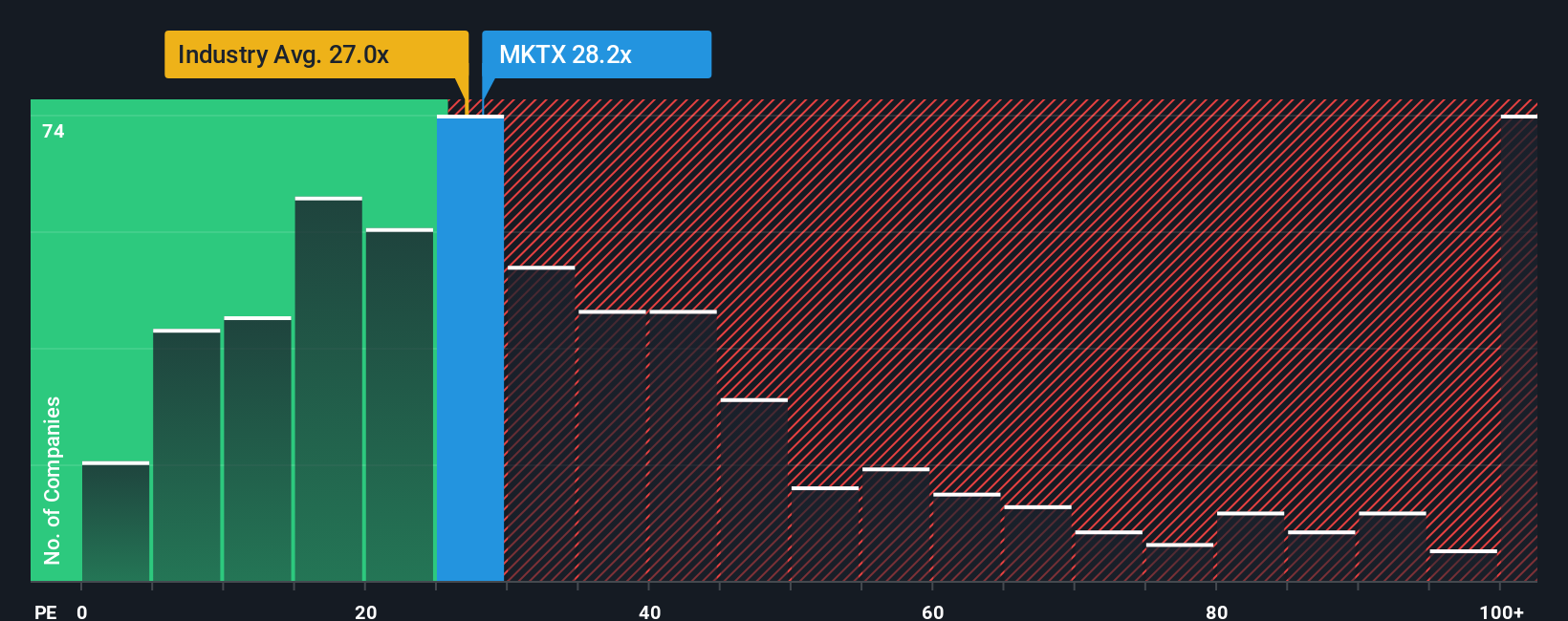

Looking at MarketAxess Holdings through the lens of its price-to-earnings ratio reveals a less optimistic story. The stock trades at 28.7 times earnings, which is more expensive than both the US Capital Markets industry average of 25.9x and the peer group average of 27.6x. Notably, it is also elevated compared to the fair ratio of 16x that the market could ultimately revert to. This premium multiple exposes investors to valuation risk if growth expectations do not materialize as hoped. Does this suggest that even after recent declines, shares could still have downside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MarketAxess Holdings Narrative

If you want to dig deeper or see things from your own perspective, you can explore the data and build a personalized narrative in just minutes, Do it your way

A great starting point for your MarketAxess Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Actionable Investment Ideas?

Stay a step ahead and expand your horizons with handpicked stock ideas proven to excite smart investors. Don’t limit your choices when big trends are unfolding right now.

- Unlock the hidden gems making waves in finance by checking out these 872 undervalued stocks based on cash flows, which stand out for robust fundamentals and attractive prices.

- Target dynamic growth in healthcare with these 33 healthcare AI stocks, set to transform patient outcomes using artificial intelligence and next-level data analytics.

- Boost your portfolio’s income stream by browsing these 17 dividend stocks with yields > 3%, offering generous yields and time-tested stability for every market condition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKTX

MarketAxess Holdings

Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives