- United States

- /

- Semiconductors

- /

- NasdaqGS:PLAB

Undiscovered Gems in United States Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the market has risen 4.1%, driven by gains in every sector, and it is up 25% over the last 12 months with earnings forecast to grow by 15% annually. In this thriving environment, identifying promising small-cap stocks can offer unique opportunities for growth and diversification.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.32% | 6.73% | ★★★★★★ |

| National Presto Industries | NA | 1.58% | -11.29% | ★★★★★★ |

| John B. Sanfilippo & Son | 12.65% | 3.66% | 8.36% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Tiptree | 68.59% | 20.55% | 20.06% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Merchants Bancorp (NasdaqCM:MBIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Merchants Bancorp operates as a diversified bank holding company in the United States with a market cap of approximately $1.99 billion.

Operations: Merchants Bancorp generates revenue primarily from Banking ($324.39 million), Mortgage Warehousing ($132.25 million), and Multi-Family Mortgage Banking ($155.67 million) segments, totaling approximately $612.31 million.

Merchants Bancorp, with total assets of US$18.2B and equity of US$1.9B, has shown impressive earnings growth of 40.6% over the past year, outpacing the Diversified Financial industry’s 12.5%. Total deposits stand at US$14.9B, while loans are US$10.9B with a net interest margin of 3.1%. Despite an appropriate level of bad loans at 1.3%, its allowance for bad loans is low at 56%. Trading at a significant discount to fair value (60%), it offers potential upside for investors seeking undervalued opportunities in the financial sector.

- Click to explore a detailed breakdown of our findings in Merchants Bancorp's health report.

Examine Merchants Bancorp's past performance report to understand how it has performed in the past.

Andersons (NasdaqGS:ANDE)

Simply Wall St Value Rating: ★★★★★★

Overview: The Andersons, Inc. operates in trade, renewables, and nutrient and industrial sectors across the United States, Canada, Mexico, Egypt, Switzerland, and internationally with a market cap of $1.70 billion.

Operations: With a market cap of $1.70 billion, Andersons generates revenue primarily from its trade ($8.50 billion), renewables ($3.01 billion), and nutrient & industrial sectors ($852.52 million).

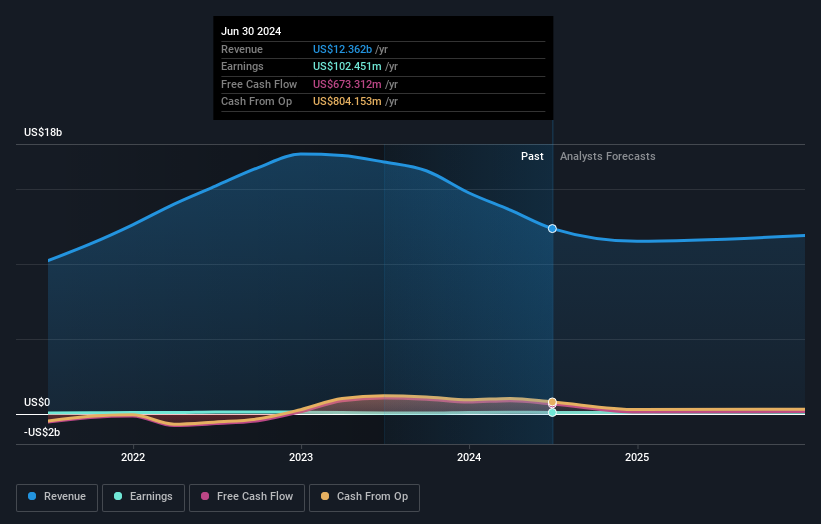

Andersons, Inc. has shown impressive earnings growth of 40.8% over the past year, significantly outpacing the Consumer Retailing industry’s 10.8%. With a debt to equity ratio reduced from 143.1% to 38.2% in five years, their financial health appears solid. Trading at a price-to-earnings ratio of 16.6x, below the US market average of 17.9x, it offers good value relative to peers and industry standards while maintaining high-quality earnings and strong EBIT coverage at 16.4x interest payments.

- Click here and access our complete health analysis report to understand the dynamics of Andersons.

Evaluate Andersons' historical performance by accessing our past performance report.

Photronics (NasdaqGS:PLAB)

Simply Wall St Value Rating: ★★★★★★

Overview: Photronics, Inc., along with its subsidiaries, manufactures and sells photomask products and services across the United States, Taiwan, China, Korea, Europe, and internationally with a market cap of approximately $1.51 billion.

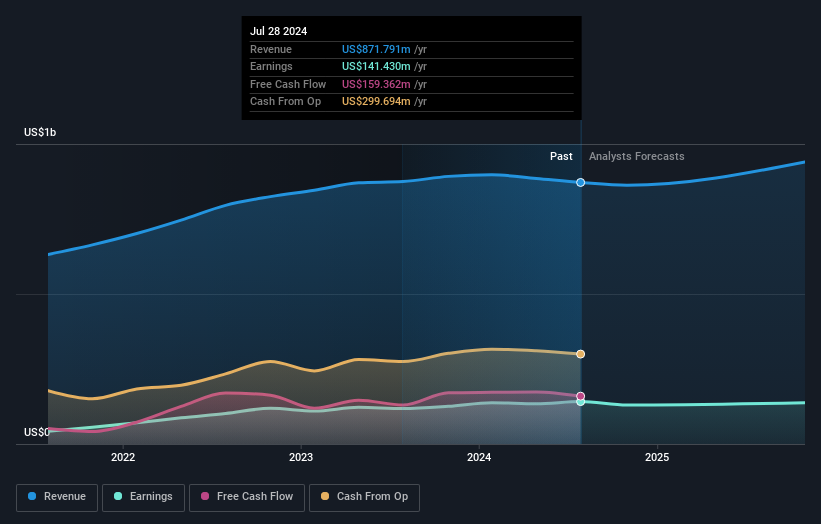

Operations: Photronics generates revenue primarily from the manufacture and sale of photomask products, totaling approximately $885.01 million. The company's market cap stands at roughly $1.51 billion.

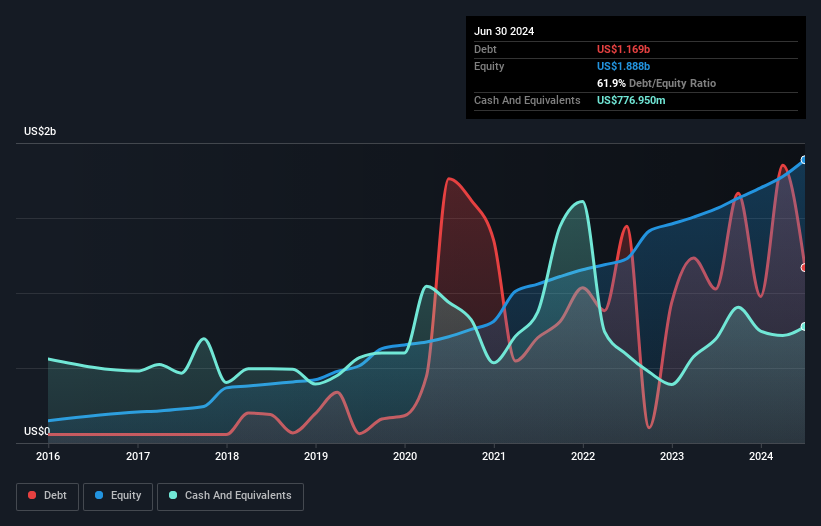

Photronics, a semiconductor photomask manufacturer, has seen its earnings grow 9.9% over the past year, significantly outpacing the industry’s -5.9%. Trading at 66.4% below fair value estimates and boasting high-quality earnings, it presents an attractive valuation compared to peers. The company is debt-free and has reduced its debt-to-equity ratio from 4.1% five years ago to zero now, eliminating concerns about interest payments coverage. Recent additions to various Russell Growth Indices further highlight its potential for future growth.

- Take a closer look at Photronics' potential here in our health report.

Gain insights into Photronics' historical performance by reviewing our past performance report.

Make It Happen

- Navigate through the entire inventory of 223 US Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLAB

Photronics

Engages in the manufacture and sale of photomask products and services in the United States, Taiwan, China, Korea, Europe, and internationally.

Flawless balance sheet and undervalued.