- United States

- /

- Consumer Finance

- /

- NasdaqCM:MATH

Metalpha Technology Holding And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed movements, with the Dow Jones Industrial Average showing slight gains despite recent declines, investors continue to seek opportunities across various sectors. Penny stocks, often representing smaller or newer companies, remain an intriguing area for those looking to uncover potential growth at a lower cost. Though the term may seem outdated, these stocks can still offer substantial returns when backed by solid financials and strategic positioning in their respective industries.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.73 | $370.75M | ✅ 4 ⚠️ 0 View Analysis > |

| ATRenew (RERE) | $4.11 | $917.81M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.59 | $575.04M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $4.065 | $684.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.885 | $246.41M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.23 | $27.72M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.39 | $569.89M | ✅ 5 ⚠️ 0 View Analysis > |

| BAB (BABB) | $0.89495 | $6.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.27 | $72.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.30 | $9.95M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 358 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Metalpha Technology Holding (MATH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metalpha Technology Holding Limited, with a market cap of $123.52 million, operates in Hong Kong offering wealth management services through its subsidiaries.

Operations: The company generates revenue of $44.57 million from trading proprietary digital assets and derivative contracts.

Market Cap: $123.52M

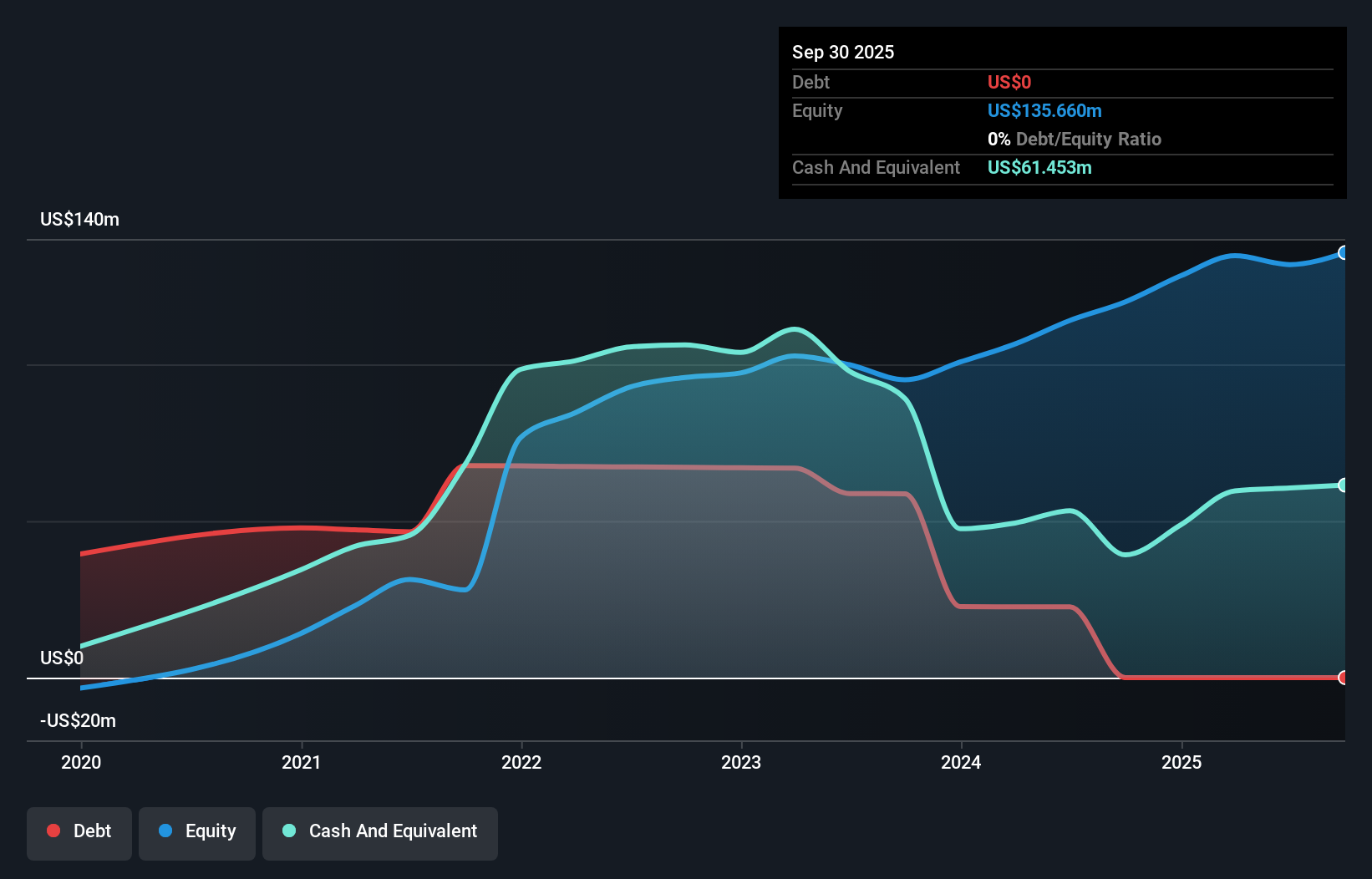

Metalpha Technology Holding Limited, with a market cap of US$123.52 million and revenue of US$44.57 million, has demonstrated strong financial metrics including an outstanding return on equity of 43.5% and no debt burden, enhancing its appeal in the penny stock sector. The company recently announced a strategic partnership with Avenir Group to advance digital asset management technologies, highlighting its leadership in innovative blockchain solutions. Additionally, Metalpha's recent private placement raised nearly US$12 million to support growth initiatives. However, changes in board composition suggest ongoing corporate restructuring efforts as it adapts to evolving market demands.

- Take a closer look at Metalpha Technology Holding's potential here in our financial health report.

- Evaluate Metalpha Technology Holding's historical performance by accessing our past performance report.

Expensify (EXFY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Expensify, Inc. offers a cloud-based expense management software platform operating both in the United States and internationally, with a market cap of approximately $141.42 million.

Operations: The company's revenue is primarily generated from its Internet Software & Services segment, amounting to $143.91 million.

Market Cap: $141.42M

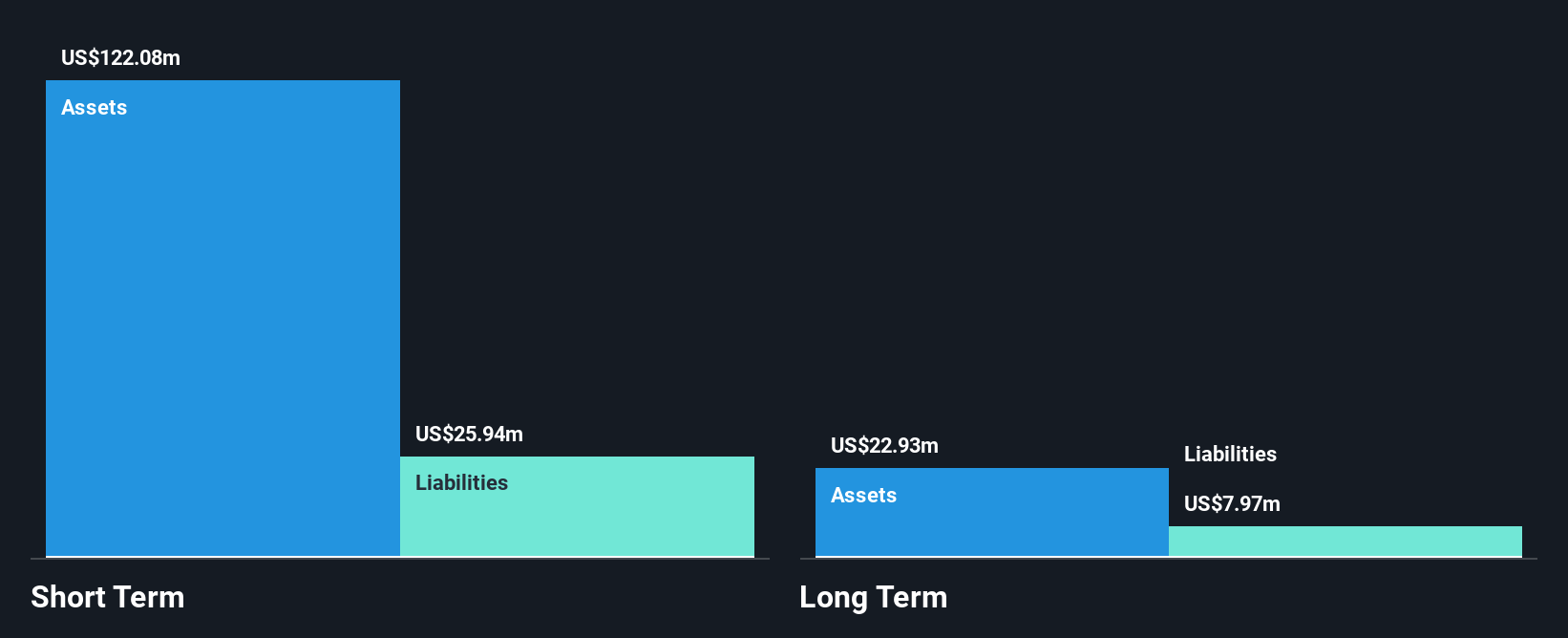

Expensify, Inc., with a market cap of US$141.42 million and revenue of US$143.91 million, presents a mixed picture in the penny stock arena. Despite being unprofitable and not expected to achieve profitability soon, Expensify has substantial short-term assets exceeding its liabilities and is debt-free, offering financial stability. Recent developments include a multi-year partnership with the Brooklyn Nets and enhancements to its Concierge service using AI technology, which may bolster its market presence. However, significant insider selling raises caution regarding internal confidence levels amidst ongoing losses that have widened over recent periods.

- Click here and access our complete financial health analysis report to understand the dynamics of Expensify.

- Examine Expensify's earnings growth report to understand how analysts expect it to perform.

TrueCar (TRUE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TrueCar, Inc. is a U.S.-based company that provides internet-based information, technology, and communication services with a market cap of approximately $204.56 million.

Operations: The company generates revenue through its Internet Information Providers segment, which accounted for $181.22 million.

Market Cap: $204.56M

TrueCar, Inc., with a market cap of US$204.56 million, is navigating the penny stock landscape with significant financial maneuvers and recent performance improvements. Despite being unprofitable and having increased losses over five years, TrueCar's short-term assets far exceed its liabilities, providing a solid cash runway for over three years. The company recently reported improved earnings results, showing progress in reducing net losses compared to the previous year. An acquisition agreement by Scott Painter is underway for approximately US$260 million, which could lead to strategic shifts and delisting from Nasdaq if completed as planned by early 2026.

- Navigate through the intricacies of TrueCar with our comprehensive balance sheet health report here.

- Understand TrueCar's earnings outlook by examining our growth report.

Next Steps

- Reveal the 358 hidden gems among our US Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MATH

Metalpha Technology Holding

Provides wealth management services in Hong Kong.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives