- United States

- /

- Mortgage REITs

- /

- NasdaqCM:LOAN

Why We Think Manhattan Bridge Capital, Inc.'s (NASDAQ:LOAN) CEO Compensation Is Not Excessive At All

CEO Assaf Ran has done a decent job of delivering relatively good performance at Manhattan Bridge Capital, Inc. (NASDAQ:LOAN) recently. As shareholders go into the upcoming AGM on 21 June 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for Manhattan Bridge Capital

Comparing Manhattan Bridge Capital, Inc.'s CEO Compensation With the industry

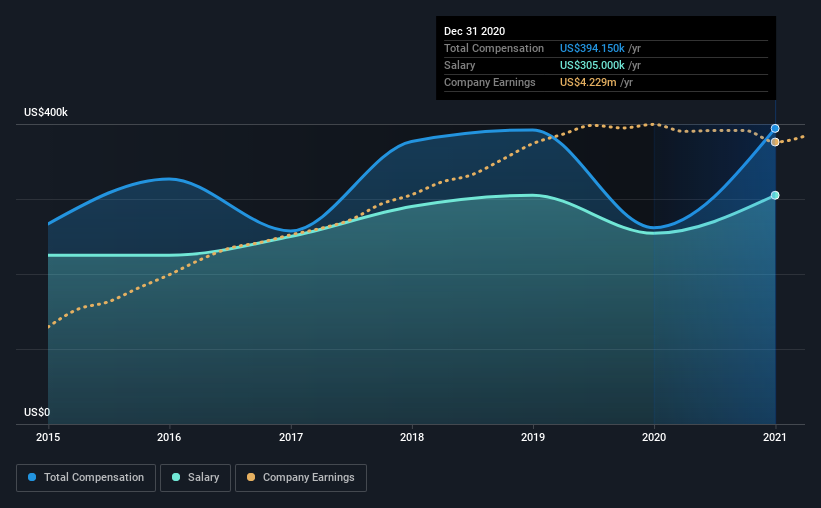

According to our data, Manhattan Bridge Capital, Inc. has a market capitalization of US$66m, and paid its CEO total annual compensation worth US$394k over the year to December 2020. We note that's an increase of 51% above last year. We note that the salary portion, which stands at US$305.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$394k. So it looks like Manhattan Bridge Capital compensates Assaf Ran in line with the median for the industry. Moreover, Assaf Ran also holds US$18m worth of Manhattan Bridge Capital stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$305k | US$254k | 77% |

| Other | US$89k | US$7.6k | 23% |

| Total Compensation | US$394k | US$262k | 100% |

Talking in terms of the industry, salary represented approximately 17% of total compensation out of all the companies we analyzed, while other remuneration made up 83% of the pie. According to our research, Manhattan Bridge Capital has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Manhattan Bridge Capital, Inc.'s Growth Numbers

Over the last three years, Manhattan Bridge Capital, Inc. has not seen its earnings per share change much, though there is a slight positive movement. The trailing twelve months of revenue was pretty much the same as the prior period.

We're not particularly impressed by the revenue growth, but we're happy with the modest EPS growth. So there are some positives here, but not enough to earn high praise. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Manhattan Bridge Capital, Inc. Been A Good Investment?

Manhattan Bridge Capital, Inc. has generated a total shareholder return of 20% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 3 warning signs for Manhattan Bridge Capital you should be aware of, and 1 of them is significant.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Manhattan Bridge Capital, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Manhattan Bridge Capital, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:LOAN

Manhattan Bridge Capital

A real estate finance company, originates, services, and manages a portfolio of first mortgage loans in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives