- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

Will IBKR's Taipei Exchange Move Reveal New Strengths in Its Global Competitive Positioning?

Reviewed by Sasha Jovanovic

- Interactive Brokers Group recently expanded its platform to include the Taipei Exchange (TPEx), allowing eligible clients to trade equities, ETFs, and Taiwan Depositary Receipts listed on TPEx.

- This enhancement broadens client access to emerging small and medium-sized Taiwanese enterprises and streamlines trading with automatic foreign exchange conversion.

- We will examine how Interactive Brokers’ broadened international market access through the TPEx addition influences its investment prospects.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Interactive Brokers Group Investment Narrative Recap

To own shares of Interactive Brokers Group, an investor typically needs to believe in the ongoing demand for international trading access and the company’s ability to attract global clients with enhanced market reach. The recently announced addition of the Taipei Exchange is a meaningful expansion, yet its near-term impact on the most pressing catalysts and risks, such as market volatility and competitive pressure in Asia, appears limited for now, as the core business remains highly dependent on broader trading volumes and investor sentiment trends.

Among the company’s recent rollouts, the launch of the Karta Visa card stands out for its global utility and embedded financial features. While not directly related to the TPEx addition, this product introduction fits into the broader theme of expanding value-added services, which could help drive account and activity growth, an important business catalyst as Interactive Brokers continues to build market share beyond its trading platform enhancements.

By contrast, it’s worth noting that an increasingly competitive brokerage environment in Asia remains a risk that investors should be aware of, especially as...

Read the full narrative on Interactive Brokers Group (it's free!)

Interactive Brokers Group is projected to reach $5.9 billion in revenue and $740.3 million in earnings by 2028. This scenario assumes annual revenue growth of 5.9% and a $42.3 million increase in earnings from the current $698.0 million level.

Uncover how Interactive Brokers Group's forecasts yield a $76.82 fair value, a 25% upside to its current price.

Exploring Other Perspectives

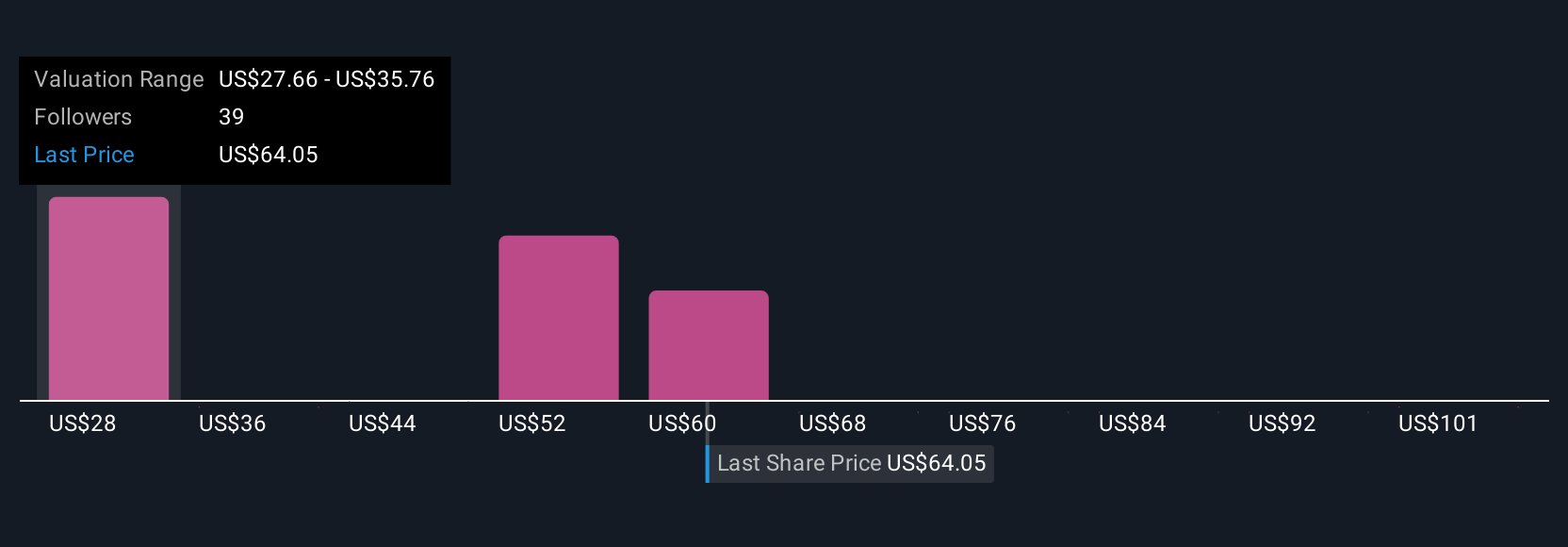

Simply Wall St Community members offer 11 distinct fair value estimates for IBKR, ranging from US$36.33 to US$76.82 per share. This breadth of opinion reflects how expansion into new international markets like Taiwan may shape future opportunities and challenges, encouraging you to consider a range of viewpoints as you assess the company’s outlook.

Explore 11 other fair value estimates on Interactive Brokers Group - why the stock might be worth 41% less than the current price!

Build Your Own Interactive Brokers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interactive Brokers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interactive Brokers Group's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives