- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

What Interactive Brokers Group (IBKR)'s Karta Visa Card Launch Means For Shareholders

Reviewed by Sasha Jovanovic

- In late October 2025, Interactive Brokers announced that eligible clients can now access the Karta Visa card, an enhancement to its cash management suite offering global spending with no foreign transaction fees, luxury travel perks, and expanded account linkage.

- This move integrates spending directly with client brokerage accounts, reflecting the company's push to make its platform a comprehensive solution for saving, trading, investing, and everyday financial activity.

- We'll now explore how the launch of the Karta Visa card may impact Interactive Brokers' investment narrative and its appeal to global investors.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Interactive Brokers Group Investment Narrative Recap

To invest in Interactive Brokers, you need to believe in the ongoing shift toward global investing and the platform’s ability to provide comprehensive, tech-driven solutions that meet the needs of both individuals and institutions. While the Karta Visa card launch enhances the client experience by offering everyday financial utilities, it does not appear likely to materially influence the company’s most important short term catalysts, such as sustained account growth or increased trading activity, or address the core risks around trading volumes and earnings sensitivity to market conditions.

Of recent announcements, the partnership with HSBC for the HSBC WorldTrader offering stands out. Both the recent Karta card expansion and global partnerships have the shared potential to attract more international accounts, which is closely tied to ongoing catalysts like growing assets and trades, and the risk of increased competition globally.

In contrast, investors should pay close attention to the risk that heightened competition in Europe and Asia could...

Read the full narrative on Interactive Brokers Group (it's free!)

Interactive Brokers Group's narrative projects $5.9 billion in revenue and $740.3 million in earnings by 2028. This requires 5.9% annual revenue growth and an earnings increase of $42.3 million from the current $698.0 million.

Uncover how Interactive Brokers Group's forecasts yield a $76.64 fair value, a 9% upside to its current price.

Exploring Other Perspectives

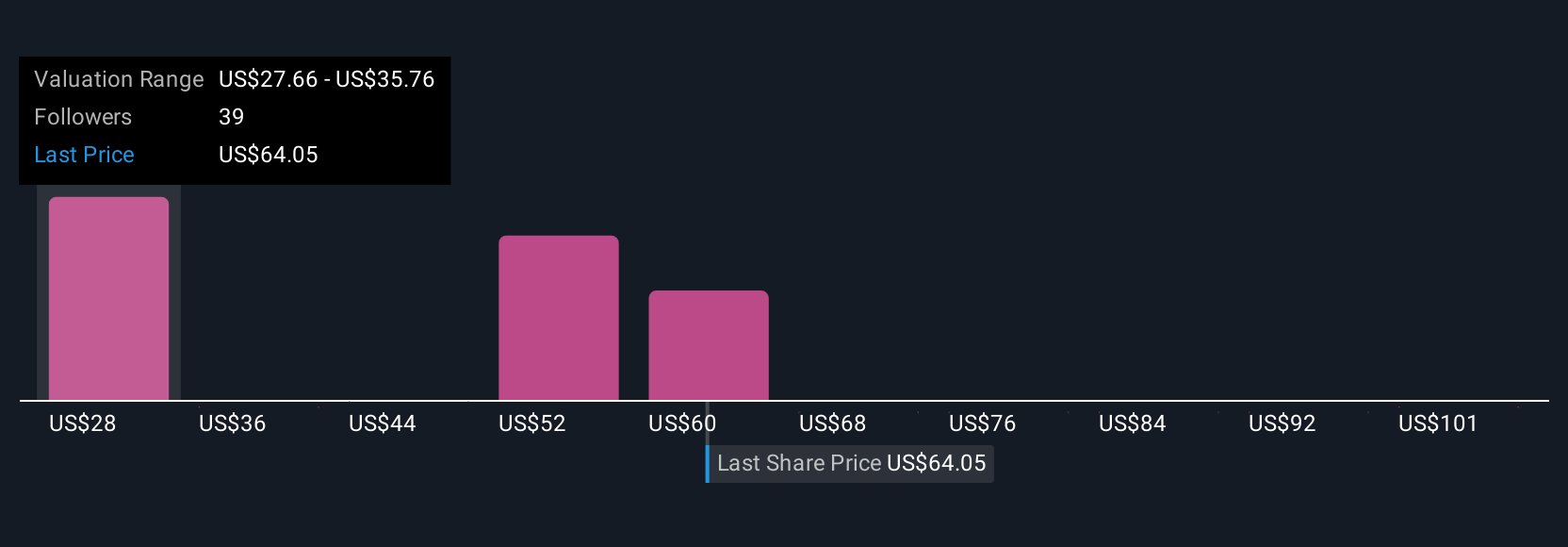

Ten private investors from the Simply Wall St Community gave fair value estimates for IBKR ranging from US$35.80 to US$76.64. These varying perspectives highlight just how much opinions can differ, especially as global expansion accelerates and the company faces intensifying competition.

Explore 10 other fair value estimates on Interactive Brokers Group - why the stock might be worth 49% less than the current price!

Build Your Own Interactive Brokers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interactive Brokers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interactive Brokers Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives