- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

Has Interactive Brokers Risen Too Far After 83% Rally and Global Expansion Moves?

Reviewed by Bailey Pemberton

- Wondering if Interactive Brokers Group is a smart buy right now? You are not alone, especially with all eyes on whether the stock’s growth is matched by its valuation.

- The share price has shot up an impressive 54.9% year-to-date and a remarkable 83.5% over the last 12 months, drawing fresh attention to both its growth prospects and potential risks.

- Recent headlines have highlighted Interactive Brokers Group’s expansion into new geographies and its growing market share in digital trading platforms, fueling bullish sentiment and sparking more debate about what is already “priced in.” Major industry moves, including fintech collaborations and regulatory updates, have also kept investors watching for impacts on the company’s business model.

- Despite all that action, the stock currently scores a 0 out of 6 on our undervaluation checks. It is time to dig into which valuation methods might make sense and why there could be an even deeper way to think about its true worth that we will get to by the end of this article.

Interactive Brokers Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Interactive Brokers Group Excess Returns Analysis

The Excess Returns model evaluates a company based on how much additional profit it generates above the minimum return required by investors, known as the cost of equity. This approach focuses on how efficiently Interactive Brokers Group puts its equity capital to work and whether future growth will be value-accretive or value-destructive for shareholders.

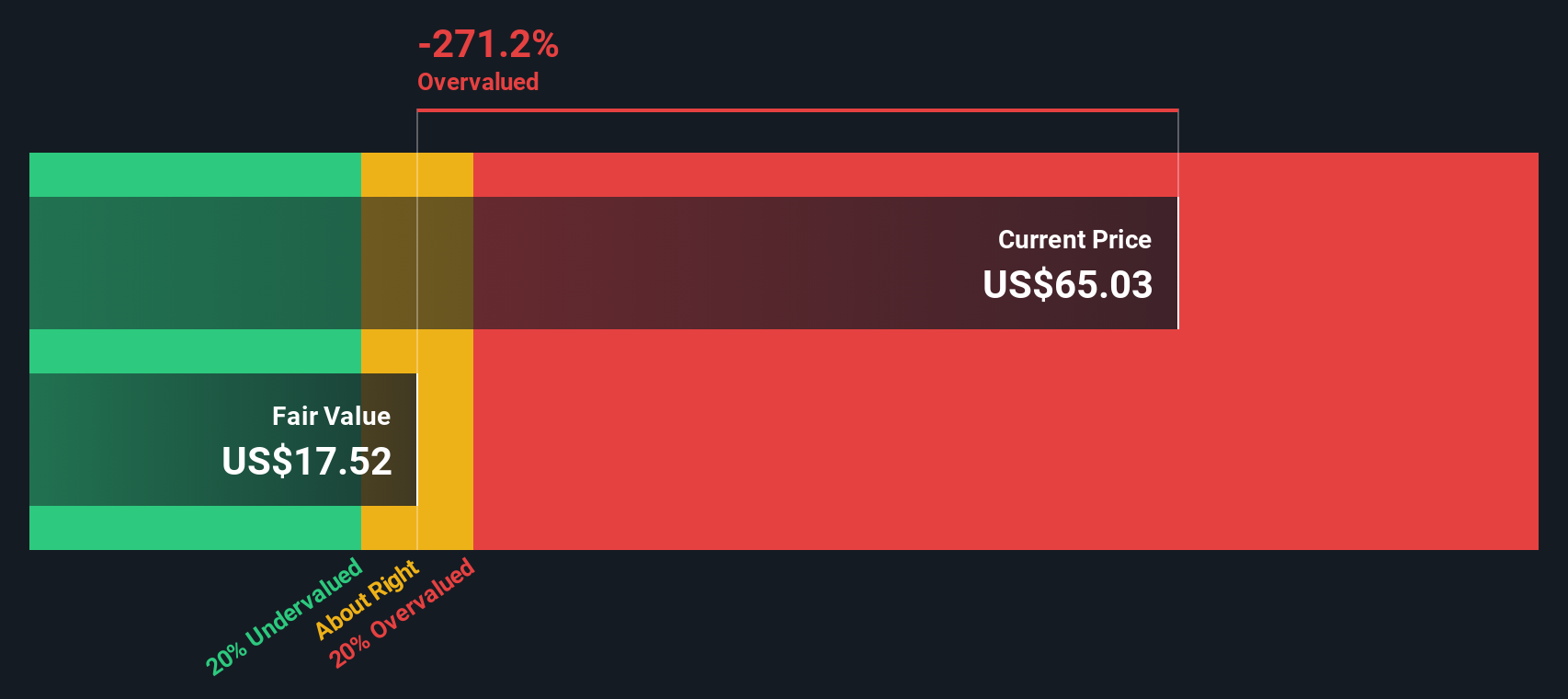

For Interactive Brokers Group, the reported book value is $11.50 per share, while the stable projected earnings per share (EPS) are $2.43. These EPS estimates are derived from averages provided by five analysts. With a cost of equity of $1.18 per share, the company’s calculated excess return comes to $1.25 per share. The average return on equity stands at a strong 17.70%, and the stable book value projection rises to $13.72 per share, based on estimates from two analysts.

Despite healthy profitability, the Excess Returns model estimates an intrinsic value of $36.33 per share. When compared to the current stock price, this implies the shares are 94.6% overvalued.

Result: OVERVALUED

Our Excess Returns analysis suggests Interactive Brokers Group may be overvalued by 94.6%. Discover 842 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Interactive Brokers Group Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used tools for valuing companies that are consistently profitable, like Interactive Brokers Group. Because the company generates steady earnings, the PE ratio helps investors understand how much they are paying for each dollar of current profits.

When thinking about what a “normal” or fair PE ratio should be, it is important to recognize that higher growth prospects or lower business risks usually justify a higher multiple. Conversely, slower expected growth or greater risks often mean investors are willing to pay a lower multiple for similar profits.

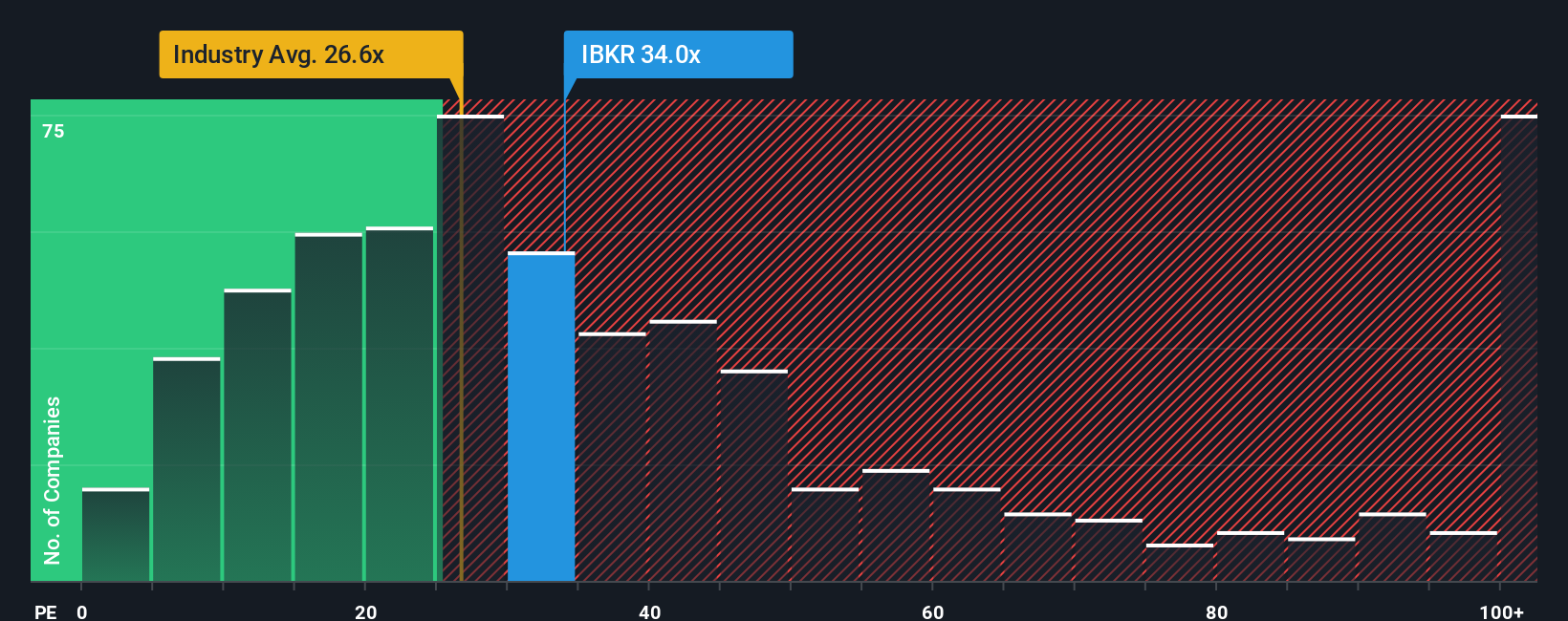

Interactive Brokers Group currently trades at a PE ratio of 34.32x, well above the Capital Markets industry average of 23.74x and the peer average of 30.60x. While these benchmarks offer some context, they do not account for important company-specific factors. That is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio for IBKR stands at 21.41x. This proprietary measure goes beyond the industry or peer averages by factoring in the company’s unique blend of earnings growth, risks, profit margins, market cap and industry.

Comparing the Fair Ratio of 21.41x with the actual PE of 34.32x shows that the shares are trading at a premium that is not justified by these fundamentals. Investors should be aware that the stock is priced well above what would usually be considered fair value when all relevant factors are taken into account.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Interactive Brokers Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple but powerful way to connect your perspective on a company’s story to what you believe about its future financial performance and ultimately its fair value.

Rather than just looking at numbers in isolation, Narratives let investors articulate the “story behind the stock” by outlining key drivers and risks, as well as their own assumptions about future revenue, earnings, and margins. This story then directly shapes a fair value estimate that you can compare to today’s share price.

On Simply Wall St’s Community page, millions of investors use Narratives because it makes the research process much more accessible and actionable. By seeing and contrasting multiple Narratives, including the logic, numbers, and fair values behind them, investors can quickly sense-check different viewpoints and decide when the market price truly presents an opportunity or a warning.

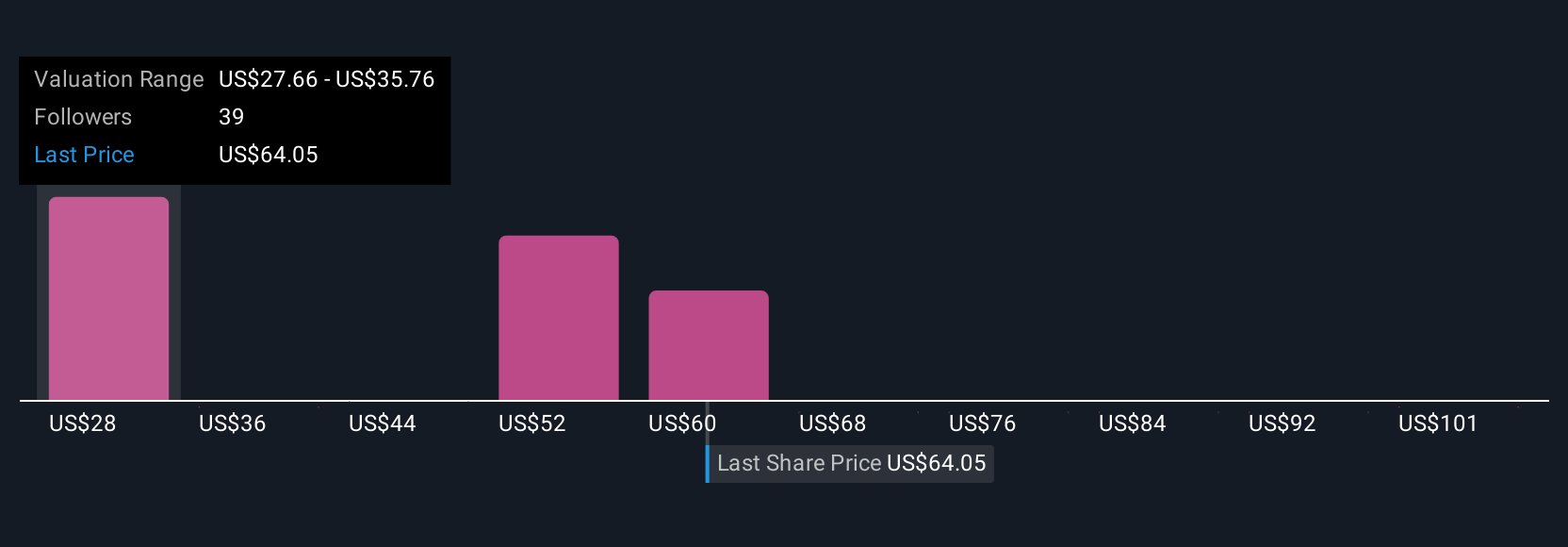

Narratives update dynamically whenever new information, like earnings or breaking news, reaches the market, ensuring you always have context for your investment decisions. For example, some investors see IBKR’s innovations and international growth pushing fair value as high as $288 per share, while others, more cautious on risks, estimate it as low as $140. This demonstrates the power of perspective in setting value.

Do you think there's more to the story for Interactive Brokers Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives