- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

Evaluating Interactive Brokers (IBKR) Valuation After a 13% Weekly Dip and 39% Yearly Climb

Reviewed by Simply Wall St

See our latest analysis for Interactive Brokers Group.

After a strong run so far this year, Interactive Brokers Group's share price has dipped 13% over the past week, reflecting some cooling momentum as investors reassess recent gains. Still, the year-to-date share price return sits at an impressive 39%, and the company’s five-year total shareholder return of nearly 395% shows long-term growth has not lost its edge.

If you’re searching for fresh opportunities beyond the usual names, now is a perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

But with such impressive long-term returns and a recent pullback, is Interactive Brokers Group trading at an attractive valuation, or is the market already factoring in future growth prospects, leaving little room for new investors to benefit?

Most Popular Narrative: 17.6% Undervalued

The consensus narrative points to a fair value for Interactive Brokers Group that is meaningfully higher than the current market price. This sets the stage for a valuation case built on technology-driven expansion and continued platform growth.

The introduction of new products and enhancements, such as the strengthened ATS with new liquidity providers and order types, enhancements to the IBKR Financial Advisor Portal, and the launch of securities lending for Swedish stocks, suggests potential for increased trading activity and higher commission revenue.

Want to see what’s powering this optimism? The narrative hints at aggressive growth targets, margin trends that differ from the industry average, and a profit multiple usually reserved for fast movers. Find out which assumptions analysts are betting on and what projections drive this impressive valuation gap.

Result: Fair Value of $76.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing geopolitical tensions and heightened competition could quickly shift market sentiment and impact Interactive Brokers Group's growth outlook.

Find out about the key risks to this Interactive Brokers Group narrative.

Another View: Multiples Analysis Raises a Caution Flag

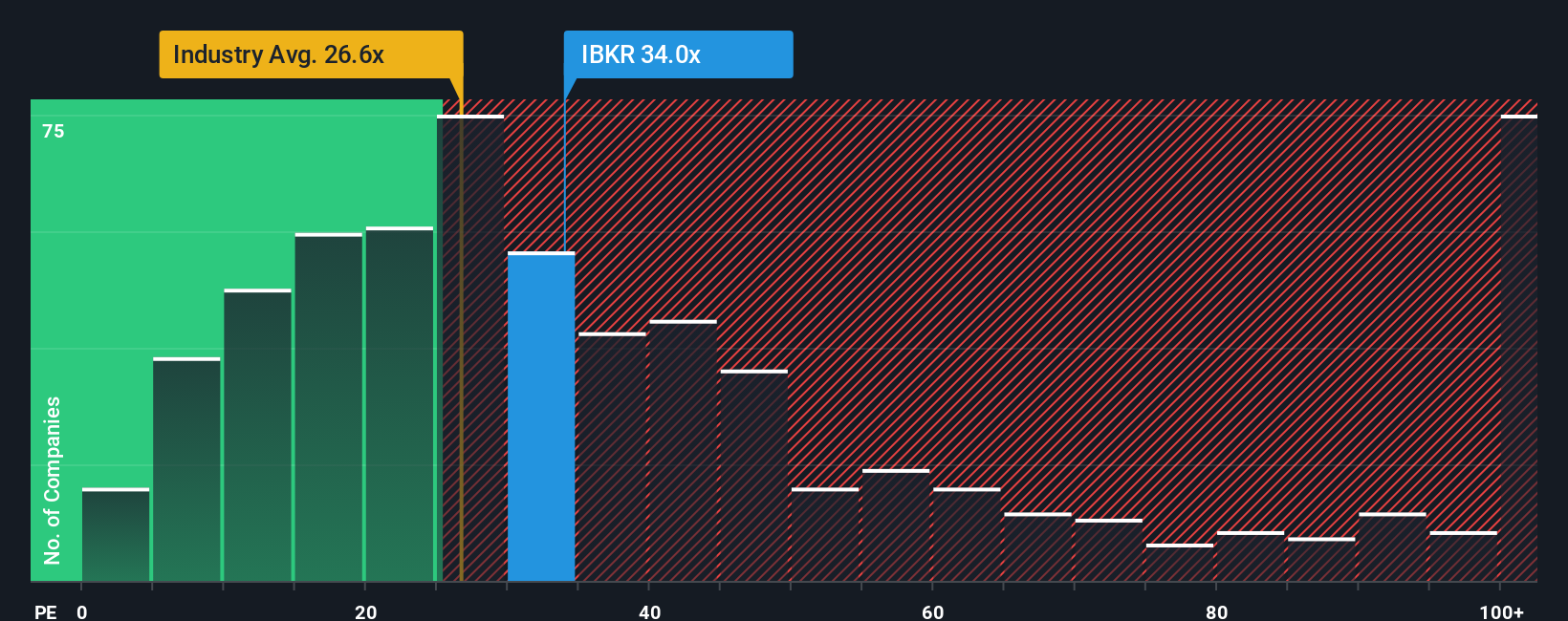

While the consensus points to significant undervaluation, an alternative look at the company’s price-to-earnings ratio tells a different story. Interactive Brokers trades at 30.7x earnings, which is substantially higher than both the industry average of 23.7x and its fair ratio of 21x. This suggests that the shares may be priced for perfection, introducing heightened downside risk if expectations falter. Could the market be overestimating future growth potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Interactive Brokers Group Narrative

If the current consensus does not align with your perspective, you can dive into the numbers yourself and craft a personal view in just a few minutes, choosing your own metrics and story. Do it your way.

A great starting point for your Interactive Brokers Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Tap into the full potential of your portfolio by checking out investment opportunities that others may overlook. Use these handpicked screens to spot compelling stocks before the crowd does.

- Accelerate your search for breakthrough technology by reviewing these 27 AI penny stocks. These companies are shaking up the artificial intelligence space with bold innovations.

- Unlock stable cash flow potential by exploring these 18 dividend stocks with yields > 3%. This screen is designed for those seeking consistent returns from proven companies paying attractive yields.

- Expand your horizons with these 3588 penny stocks with strong financials, which are poised for dynamic growth and untapped upside as hidden gems in the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives